🗞 Weekly Market Newsletter | Edition No. 28

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, January 29th, 2023

Hello Friends,

Let me give you a great metaphor of where I believe we are in the markets heading into this week.

Imagine that it’s 2:00am and we’re all together having a great time at our favourite club on a Friday night. The club closes soon, but there’s still under an hour left of fun on the horizon. You’re faced with a decision;

Wave goodbye and get ahead of the busy crowd by leaving a little early and grabbing a cab home, it’s been a great night.

Buy another round and close down the club until the lights come on and party on until the early morning.

There’s four different outcomes that occur with those two scenarios;

You leave early and unfortunately miss out on a great time and afterparty that everyone enjoyed.

You leave early and luckily miss out on the end of night bar fight and no available cabs for hours due to the crowd.

You luckily stick around and hit the afterparty and have the night of your life.

You unfortunately stick around and get punched in the face, lose your phone and wallet and walk home.

As the capital markets wake up on Monday they’ll be bracing for a jam-packed week of news releases featuring:

U.S Economic Data: Jobless Claims, Non-Farm Payrolls, Consumer Confidence and Unemployment Rate

FOMC Interest Rate Decision

Earnings Releases from big Tech; Meta, Google, Apple, Snap.

Returning to my metaphor, investors (you) have a decision to make.

Take profits now (leave the party early) to avoid a possible bloodbath should earnings miss, U.S data print too hot for the FED and interest rates continue their rise on the back of continued hawkish monetary policy - or have the complete opposite set of events occur where FED pivots, earnings hit and you miss out on the continued green candles because you cut positions too premature.

Or, stay locked in positions (stick around) and get punched in the face wishing you had taken profits if all hell breaks loose - or to the contrary face the FED and earnings releases with bravery and call bluff on the market *fud* while having the best portfolio start to the year ever.

Where do I stand?

Well, my bias on the charts is a continued bullish Q1 - but that doesn’t mean there will not be volatility.

We’ve had two weeks straight of short coverings and bullish speculation on a FED pause driving the buying momentum on risk (equities and crypto) sky high and we could certainly use a healthy pullback to refresh liquidity and gather some support across the charts.

I personally believe that big tech is in trouble on earnings and do believe that the charts will pullback due to their earnings print.

I also believe that Chairman J.Powell of the FED will raise rates 25 basis points and continue his stern position on returning inflation to target 2% while he recites his copy pasta from every statement declaring “we’re not there yet” - like an annoyed parent would at hyper children in the back seat.

So to conclude my notes heading into this week’s newsletter - if it was me at the club I’m going to order a round for the rest of you, have one last shot and Uber home ahead of the chaos - because it’s only Friday night and we have a long weekend of fun to be had in 2023’.

Enjoy the read,

- Matthew

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 The Week Ahead: Federal Reserve FOMC Interest Rate Decision + Key Economic Data

💭 Matthew’s Thoughts…

Last week I said to my wife “…what’s stopping those in charge of publishing these key data releases from somewhat manipulating the data just slightly to favor what they want to occur in the economy?”

Is that too much of a conspiracy claim?

Because I just find it too fitting that over the past two week’s we’ve seen Core CPI print come in exactly as expected (6.5% vs. 6.5% expected) as well as consumer spending just 0.1% lower YoY.

It’s the perfect data release that doesn’t give any edge to either side of the market, it’s not really bullish, yet not really that bad either.

Perhaps I’m wrong and perhaps the smartest minds in charge of all of this data stuff have precise reports and it’s 100% accurate and I’m just being paranoid, who knows, either way it’s an entertaining thought to debate.

But nevertheless, we have another jam packed week ahead and I do expect volatility to hit the market on Wednesday with the first interest rate decision of the year.

🗞 Bitcoin the best performing asset of 2023’ so far - but is it a bull trap?

💭 Matthew’s Thoughts…

Don’t look yet, but Satoshi’s digital gold is crushing the markets to start the year.

Of all the major indices it’s Bitcoin that at the time of writing is up 40% on the year.

This does bide well with my original theory that blockchain and web3 assets are crucial to the future of the global economy as the trust layer of the internet.

Furthermore, I speculate that the price and media manipulation over the recent years has been allowing wholesale actors to gobble up these valuable data network packets at pennies on the dollar relative to the retail mark-up they’ll sell them back for in years to come.

Let’s see if this theory ages well.

🗞 Sleepy Joe isn’t Sleeping on Crypto Regulation

💭 Matthew’s Thoughts…

I generally take official press releases on crypto by the Whitehouse with a grain of salt as they have only proven to have a bipolar stance on blockchain since its inception in 2008; however, if we analyze their tone with a top down perspective it’s obvious that adoption is approaching a watershed moment.

Remember, blockchain is to cryptocurrencies what iPhone is to App’s, the underlying hardware of sorts that supports innovative software solutions.

It’s inevitable that blockchain is here to stay for life, much like we never assume bluetooth will be banned or we ditch vehicles for horse and buggy like the good ol’ days.

Once a technology proves itself to be useful, it only gains traction.

What most people confuse is interchanging the word blockchain with Bitcoin, this is where the debate begins.

Bitcoin was simply the first use of blockchain, but has no business being considered the one-and-only application for payments and store of value just like MySpace had no business being considered the one-and-only application for social sharing and media.

Thus my point in saying all of this is that the Whitehouse is saying under their breath “Yes, we give thumbs up to innovation and technology” which is likely due to the speculation that Central Bank Digital Currencies will become the de-facto financial system of the 21st century.

The problem in the short term is that as a global society you can’t just megaphone the whole world with a public service announcement to make this digital leap.

It requires planning, shutting down the world under a false pretense to create an economic disaster, international cooperation and regulation, capital market development, taxation legislature and a massive subliminal warning to banks to begin laying the ground to service this new asset class to society.

In my opinion, the government(s) of the world are simply buying time to make these changes before giving blockchain the green light, but it’s coming and PR releases like this show the cracks in the posturing demeanor.

🗞 U.S Democrats Vote to Legalize Making their Citizens Poor

💭 Matthew’s Thoughts…

I won’t spend any more time on this point than it needs as in last weeks newsletter I made my point clear;

Now, $31 trillion dollars of make-believe-money-created-out-of-thin-air-later, the U.S Government has once again reached their debt ceiling and is facing default of their debt…and it will take over 725,000 years to pay off.

The system is broken.

Again, my speculation is that a new financial asset system will be introduced alongside global progressive taxation on wealth (& inheritance) and consumption which in some way shape or form renders the old fiat system antiquated and pays off the debts in a 2:1 fashion, if not clearing them completely.

I like to think about it as a software update of sorts on the database we call money.

(more on this stance can be read in my first episode of A Journey from Barter to Bits)

Let’s see how this unfolds with the U.S Government moving forward.

🗞 U.S Congressman calls for the end of Income Tax

💭 Matthew’s Thoughts…

I can’t take full credit for my bias on the direction of our future capital society as many of my perspectives are built upon the knowledge I’ve gained from Thomas Piketty in his published books “Capital in the 21st Century” as well as “Capital & Ideology”.

In those reads, he suggests that capitalism in its current form is nearing its final days and that a blended capitalist/socialist approach will be needed in the 21st century alongside a new legislature surrounding taxation.

I find it interesting that at the same time Artificial Intelligence is on the verge of forcing hundreds of millions out of the labor market and ultimately rendering humans somewhat useless in productivity terms, that we begin having the conversation of transitioning out of income tax at a time when it’s likely governments will need to subsidize the basic needs of an overwhelming majority of their populations.

It’s far too fitting for my liking.

But I’m into it; all because the data presented by Thomas Piketty suggests that without a wealthy inheritance in the 21st century it’s unlikely that future generations will have sufficient resources to survive due to the rich becoming far richer and the poor and middle classes becoming all but extinct should the current capitalist system remain unchanged.

🗞 Microsoft Finalizes Open A.I Deal

💭 Matthew’s Thoughts…

I shamefully admit that this headline has haunted me all week.

Not necessarily the investment by Microsoft (good on them!) but because the deal officially inks this moment as A.I’s watershed.

I’m acutely aware that we are alive in the moment that will be remembered forever as the dawn of human intelligence labor becoming extinct.

I can’t help but triangulate that the recent waves of tech layoffs is in preparation of big tech investment into A.I.

I can’t help but triangulate the millions of workers who will be replaced by software code from customer service reps to bankers, lawyers and scientists.

More on this later will be shared via a personal monologue from me here on substack, but for now we must watch how this technology begins to shapeshift the attitude of market participants and how much capital begins flowing into this sector.

🗞 Global CBDC Development (Saudi Arabia, British Pound)

💭 Matthew’s Thoughts…

Just a quick hit on this.

We must pay attention to Central Banks around the world as it’s very possible we experience an ‘all-at-once’ moment that they go online with CBDC’s.

*remember that Ripple & XRP are positioned to be global leaders in supporting Central Bank digital ledgers.

🗞 Flare Network FIP.01 Proposal Passed

💭 Matthew’s Thoughts…

In my opinion Flare will be amongst the top 10-25 blockchains by market cap within 3-5 years (if not sooner) and the opportunity to become an owner of this network couldn’t be more dire.

Just weeks ago, Flare executed a flawless initial token airdrop to launch their network and opened a voting proposal to change the distribution scheme that would affect the remaining 85% of the token claims of snapshot participants from back in 2020 - it passed with an overwhelming majority.

Which means that over the next (3) years Flare represents one of the most rewarding network ownership (and passive income) opportunities available in the entire crypto ecosystem.

In short, every 1 FLR token purchased now has the potential to 6-10x over three years via monthly distributions airdrops to participants who help decentralize the network by delegating their votes to FTSO’s.

It’s worth learning more about this network by visiting their website as their technology has exceptional promise to change how the entire crypto ecosystem connects together.

*I’ll be writing a full Digital Asset Deep Dive on the Flare Networks in February for Fox MetaCapital subscribers.

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

FOREX

🌪 DXY(U.S Dollar) + ⚖️ CAD

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

While I’m not convinced that the DXY is ready for a bear market rally of its own this early in the year, we must be aware that the conditions are being met for a perfect storm of volatility to create a little chaos.

The DXY is resting on high timeframe support.

The yearly open has not been retested.

Macroeconomic conditions show that the recent appetite for risk is overbought on the lower time frames meanwhile central bank interest rate decisions are lining up on deck one after another that could shatter this rally.

I’m expecting key earnings releases to spook the market early in the week giving the DXY momentum to the upside in advance of the FED raising rates 25 basis points mid week.

What happens next I speculate will be that investors begin fading the news and front running equities on the premise that a FED pivot is officially closer than ever before.

Later down the charts you’ll see my short term bearish bias on Gold and wiggle room for 2 and 10 year treasury yields to rise in the short term.

Upside Target 103.25

Downside Target 98.75 (by March 1st)

These targets should allow breathing room for the S&P500 to exit its bear market structure and begin consolidating in a range meanwhile Bitcoin should see upside targets of 28.5K and the total crypto market to exceed $1.25T

Featured Chart DXY 1D (click to enlarge photo)

I’m not expecting too much from the Maple Leaf coin this week as the DXY should take full control of the forex market.

I still expect the daily 400 MA (purple) to be tapped and the bearish order block resistance to be met by early March ultimately leading the $CAD to the mid .77’s.

Featured Chart CAD 1D (click to enlarge photo)

Equities

📈 S&P500 + 📈 TSX

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

There’s an echo chamber of bearish puts and tweets coming from all angles as many believe this last leg up is a bull trap and the S&P is setting up for a catastrophic fall into the low 3000’s due to the impending recession and former cycles of post FED-pivot market movements.

I’m not dismissing their insight as it’s certainly possible; however my take is that the S&P will not crash further, but only experience mild volatility this week before continuing up to the local highs of 4200 and pulling back ever so slightly before taking aim on the daily 400MA.

I’m expecting this move to take 3-4 weeks and re-evaluate my bullish thesis come March 1st when I expect the DXY may be primed for a bounce.

Featured Chart S&P500 1D (click to enlarge photo)

The TSX has shown excellent strength and I’m expecting more bullish upside for Canadian equities.

My upside targets for the TSX in Q2 are 22.2K.

The path to get there may differ from the one drawn below but I’m expecting the TSX to reach the median of the upper range with little resistance before making another upside move driven by strong banking and energy sectors as the year unravels.

Featured Chart Toronto Stock Exchange 2D (click to enlarge photo)

If the VIX had shown a stronger hand leading into this week my bias on the DXY may have been altered.

But I’m expecting the VIX to show continued weakness until tapping the 16-17 region before some consolidation and a breakout in March.

This move down would confirm my speculation that risk appetite will overshadow the FED’s policy decisions this week allowing equities and crypto to move up.

Featured Chart Volatility Index 1D (click to enlarge photo)

Treasuries

📉 US2YR & 📉 US10YR

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

I’m still bearish on yields and carefully watching the rate of change of the 2-year vs. the 10-year in order to hedge short on all of the recession *fud* being put out there calling for an economic apocalypse.

I do expect a little confusion and fear in the markets this week which may lead to volatility in stocks and crypto which may give the 2 year room to push up into the 4.3% and 10-year just shy of 3.5%

The sell-off in bonds should be short lived though as investors may fade the mild possible 25 bps hike and continue to front run higher yielding instruments - including growth.

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

📈 Bitcoin + 📈 XRP + 📈 Total Crypto Market Cap + 📈 Altcoin Market Cap

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

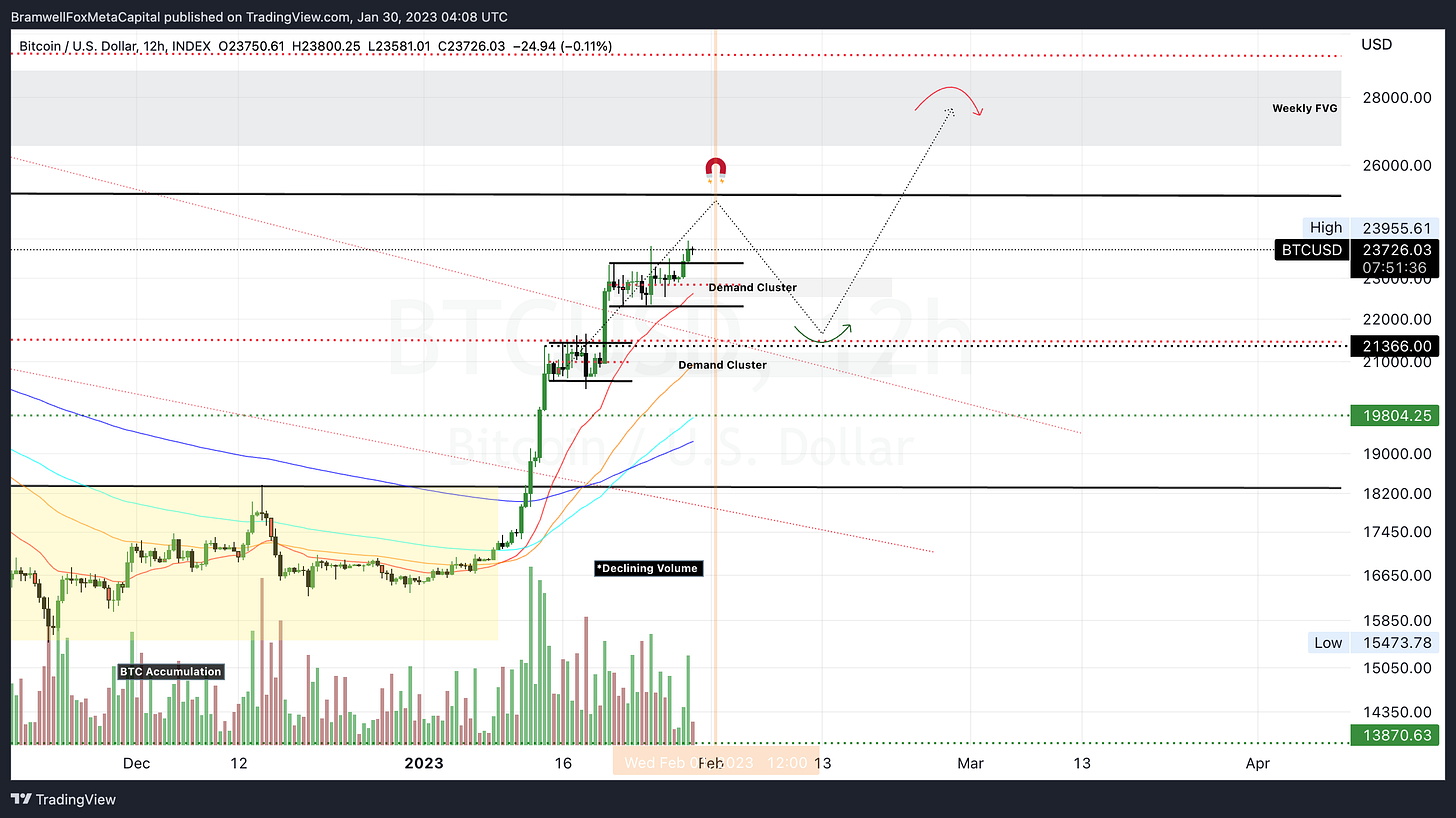

Bitcoin has been dismantling short positions by liquidating millions upon millions over the past two weeks as each time traders speculate a reversal or pullback is on the horizon, Bitcoin’s price fails to break range support swinging back to range highs aggressively.

We have two clusters of demand below the market price at the time of writing this newsletter (23.7K) and I do expect for Bitcoin to make one final push up leading into FOMC.

I’d love to see a wick into the mid 25K region followed by an aggressive engulfing candle back down into the high timeframe median (low 21’s, high 20’s) before printing a bullish reversal en route to tapping the Weekly FVG in the 28.5K region into early March.

Featured Chart BTC 12HR (click to enlarge photo)

While I do expect for Bitcoin to lead the market, it’s worth noting that XRP has recently broken out of its 3D bear market resistance and is consolidating in a range just above the line.

The region also represents the median of the weekly horizontal range which I expect to act as a weaker magnet for the price until Bitcoin claims a direction.

In the short term I’m expecting XRP to make a run for 50 cents, breaking into the weekly bearish order block before pulling back to the low 40’s to gather liquidity for its next wave which will likely be triggered by the resolution of the litigation vs. Ripple.

Featured Chart XRP 3D (click to enlarge photo)

Crypto has been a hot commodity to start 23’ with the total market cap reclaiming $1T and its sights on $1.20-1.25T target marked by the daily 400MA and range high’s.

Featured Chart Total Crypto Market Cap 1D (click to enlarge photo)

Likewise, Altcoins have been chugging along as expected yet they could experience an aggressive pushup into the $700B range should capital rotation occur out of Bitcoin once $25-$28.5K price targets have been met.

All eyes on Bitcoin dominance in February if you’re an altcoin investor.

Featured Chart Altcoin Total Market Cap 1D (click to enlarge photo)

Commodities

📉 Oil + 📉 Gold & ⚖️ Silver

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

I was expecting Oil to take one final fake-out to the upside and target the $85 per barrel range last week but instead the price was rejected and now forming a lower timeframe range just shy of $80.00.

I still expect a bull-trap to the upside within a week or two with my ultimate targets still aiming for $65 per barrel by the Spring.

Featured Chart Oil 1D (click to enlarge photo)

Gold moved as I expected last week forming a swing failure pattern at the range highs and now I expect Gold to retest the median of the higher timeframe range with my price targets $1860-$1900 per oz.

Gold will be an important asset to watch as its correlation should be somewhat inverse to the direction of the DXY.

Featured Chart Gold 12HR (click to enlarge photo)

Silver has been ranging for weeks at resistance and it’s only a matter of time before we see a volume oriented price movement. I’m bullish on metals this year and expecting Silver to target $25 by mid-late Spring.

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 028

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!

Loved this episode, so informative and well written!