🗞 Weekly Market Newsletter | Edition No. 27

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, January 22nd, 2023

Hello Friends,

What an absolutely jam-packed week of price action in the global markets and headlines in the news - we have a lot to cover in a short amount of attention span time.

For those in-a-hurry, let me give you my jot notes;

Bitcoin soared 35% and the total crypto market cap reclaimed $1 trillion.

The World Economic Forum hosted Davos 23’ as the world’s elites gathered to discuss and plan for a rapidly shifting world order.

Tech layoffs surge as hundreds of thousands of workers are let go due to

artificial intelligence being cheaper and more efficientlooming recession fears.The U.S Debt ceiling of $31 trillion was breached; officially it will take over 725,000 years to pay off.

The financial markets are broken.

So in a nut-shell since nothing makes any sense, let me tell you what I really think is happening - something big is on the horizon.

As many of you know it’s my gospel rule that when the headlines lack logic, I take a deep breath and look outside.

I try my best to disconnect from the madness of the purposefully spread misinformation and splash my face with a dose of reality.

In the reality that I feel, this is what I’m noticing;

Food prices are absolutely soaring worldwide; specifically meat and fresh produce.

It’s of my opinion that we are on the horizon of not a food shortage, but much of the world being priced out of the food market.

I’m honestly expecting a global hunger surge within 1-2 years.

The class of useless citizens is forming, fast.

Unemployment rates are surging and companies are firing their workforce under the guise of a pending recession, but we all can sense that this is a lie. Rather, we are experiencing a technological revolution that is slowing the demand for human labour at an exponential rate.

With large percentages of the global population becoming effectively useless (and let’s face it, the rising generation of young adults do not want to work, they want to browse the internet and consume content) it presents the opportunity I’ve speculated on for a long time that this will usher in a wave of socialist agenda’s on the backs of a new financial system that will provide handouts for the basic needs of many citizens.

There’s too much debt and not enough income and no one cares anymore about their credit score, paying taxes or authority.

The entire fiat monetary system was built off of financial derivatives and lending of unbacked currencies, in other words, make-believe money.

The entire world believes that the *adults* in the room (the government) know exactly what they’re doing and really smart people with fancy calculations and policies have everything under control - sadly this is hopium, they don’t.

I’m first expecting a global housing crisis followed by pension funds of our seniors to go poof.

At best we have a mental health epidemic, at worst we have civil war.

You can feel the social tension when you walk into a public space, share an opinion online or watch the news - the state of mental health is at an all-time low.

We have socially-accepted mass looting, social media plagued with bots, homelessness surging and drug/substance abuse (including antidepressants and ADHD medication) skyrocketing - it’s clear we have a struggling society.

While I have many more observations, these are amongst my most notable.

Now why do I bring this up as a part of a newsletter oriented mainly towards capital markets and economics?

Because the world as we know it is changing drastically and if these observations if scaled out, they have the potential to send shockwaves through the social, political and economic structures to which our capital markets are built atop.

The financial markets are broken because the world as we know it is transforming and on the frontlines of this battle for a new world order are multiple generations of humans fighting to preserve their way of life amidst a century that bowed down to globalization as their pseudo god.

In conclusion, we’re not even one month into 2023 and already you can feel the energy in the air is particle-charged with speculation on the direction that liquidity will flow as changes take place.

Let’s celebrate while the markets are green and the immediate horizon appears rosy, but do not forget that reality as we know it is slowly unraveling a new way of life for us on earth.

Until next week, enjoy this week’s edition below.

- MBF

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 Crypto Market Surges, leads global indices.

💭 Matthew’s Thoughts…

Inverse Cramer strikes again.

Just 12 Days after Jim Cramer, the media puppet of the elites host of CNBC’s Mad Money warned all crypto investors to “sell their Bitcoin and exit the market while they can…” Bitcoin surged 35% forming a local top at the time of writing this newsletter just shy of $23K per coin.

Meanwhile, the total crypto market cap surpassed $1 trillion with many leading altcoins drawing in liquidity as their market caps increased 20-30%.

It’s important to remember that capital markets are no different than your local grocery store - wholesalers want to purchase low and sell high.

During the recent lows of crypto the mainstream media outlets were paid billions to feature articles on how crypto is “dead”, “going to zero” and was a “flat out ponzi scheme”.

Yet looking at the charts, it’s evident this was a ploy for large market actors to accumulate at bargain prices while the uneducated retail investor was scared into capitulation.

All the world’s a stage, And all the men and women merely players; They have their exits and their entrances. - W. Shakespeare

All the world’s a stage, and when it comes to money and investments it’s best you learn fast who the main characters are and the scripts they are paid big money to shill.

Blockchain technology will become the value networks of the future world, we’re still early.

🗞 Swift Cutting Off Crypto Exchanges

💭 Matthew’s Thoughts…

The fear, uncertainty and doubt is endless.

This headline spread faster than a wild fire over the weekend and is largely misunderstood.

The truth is that a single bank providing liquidity solutions to Binance is the root of the issue, not the entire SWIFT system as a whole.

The reporters need to learn how to report.

Moving on…

🗞 U.S Economic Data lay ahead

💭 Matthew’s Thoughts…

On the cusp of the January to February transition lay the first FOMC meeting of 2023’ and the Federal Reserve will be reviewing important economic data releases such as core CPI, unemployment and GDP when deciding on the potential for continued interest rate hikes to start the year.

Already in January we’ve seen one CPI release come in lower than expected yet still considerably much higher than the 2% target set by the FED.

Market players rushed to put their gambling shoes on and began buying up assets as they speculate on a dovish FED pivot ending in a 25 basis point hike (most likely) worst case scenario or at best a pause / reversal of rates (unlikely imo).

Yet, it’s the week ahead that in my opinion will set the tone for the entire financial year.

We have superbowl-esque hyped up earnings releases from the top corporations in the U.S starting on Monday, which may create enough momentum to send the S&P500 into bull market territory, or send the markets directly to hell if they miss the mark terribly. No pressure tho’.

A plethora of U.S Economic Data releases begin to publish starting Tuesday.

All eyes on the U.S Dollar (DXY) chart this week and heading into the FOMC end of month.

🗞 World Economic Forum Host’s Davos23’

💭 Matthew’s Thoughts…

I could write an entire newsletter outlining my thoughts and conspiracies regarding this year’s Davos23’, but it’s not the time and place.

Rather, this headline will suffice.

Put the world’s richest 1% most powerful elites in a small room and just try to tell me that cryptocurrencies are not amongst the main topics discussed behind closed doors.

In fact, the doors need not even be closed as bankers and regulators made public their perspectives on blockchain as a disruptive tech meanwhile demanding that global governments begin the process of urgent regulation.

Is 2023’ the year for mass adoption?

Could the Ripple (XRP) lawsuit become precedent of law for cryptocurrencies in the world’s most powerful economic nation?

Will cryptocurrencies be deemed securities or commodities, and how will they be taxed?

These are some of the questions facing headwinds as the year unfolds - but you can bet your bottom Bitcoin that as Davos23’ concludes, these individuals will leave with direction on how they want to approach regulating this technology.

🗞 Ripple CEO Comments on Lawsuit @ Davos 23’

💭 Matthew’s Thoughts…

Conveniently, Brad Garlinghouse the CEO of Ripple is attending Davos23’ meeting with global regulators and shared his thoughts on the pending resolution of the Ripple vs. SEC lawsuit - it’s truly worth a listen.

🗞 Tech Layoffs - a sign of a pending recession or A.I takeover?

💭 Matthew’s Thoughts…

As I mentioned in my opening remarks, it appears fishy to me that tens of thousands of workers in the tech sector are being let go at the same time that A.I is making a push for adoption worldwide.

Why pay an engineer a $100,000+ salary when ChatGPT is $43 per month and can solve every possible question known to mankind - including coding.

It’s only a matter of time before we walk into a local electronics store and talk to an A.I customer service rep’ who can easily explain to us the difference between every product’s features and benefits, meanwhile matching our wants and needs with the perfect product.

…and then we’ll pay with crypto and be happily on our way.

Remember, pay attention to reality.

Look closely as you shop for groceries, watch the body language of the cashiers, bank tellers and customer service reps - do we truly believe that these jobs will be in existence in just a few short years from now?

🗞 U.S Debt Ceiling

💭 Matthew’s Thoughts…

In my first episode of ‘A Journey from Barter to Bits” I shared with you how for thousands of years the concept of money has been a cycle that repeats and evolves with the invention of new technologies.

We just happen to be living at a time of one of those important transitions - lucky us.

The previous system, the fiat currency system, has been the de-facto ponzi scheme since the U.S cheated their way to the peaks of capitalist power in the 1970’s as their bribes partnerships with the middle east over Oil priced in USD gave their currency world reserve status.

Now, $31 trillion dollars of make-believe-money-created-out-of-thin-air-later, the U.S Government has once again reached their debt ceiling and is facing default of their debt.

Not to worry though, my good friend Sven came through with a deep analysis on the most likely outcome that will occur in the coming weeks.

The ceiling will simply be moved higher.

A mid-newsletter note for the reader

Of course my expectations throughout this newsletter are for you to recognize my sarcasm and wit as I sort of laugh at the concept of our global markets being quasi-broken.

As we cover most of the headlines from this week, each one of them sort of have this undertone of controlled chaos to them.

A sort of narrative-like dream state becoming awakened as the citizens of the world begin to chat amongst one another and begin asking questions that have never been made public forum as social media has granted us the privilege once and for all in the modern day.

Heck, even the richest man in the world Elon Musk is reciting the same points I’m making here today with as much cause for concern that behind the veil of our globalized society is a serious catastrophe waiting to occur if we do not find a baseline democracy to stand on and seek for some form of unified truth to the world.

and continuing on…let’s finally look at the charts as they are beautiful this week.

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

FOREX

📉 DXY(U.S Dollar) + 📈 CAD

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

My expectations remain intact from last week’s analysis with only a slight refurbishing of the path I feel the DXY will travel.

On the daily timeframe (chart below) we are very close to reaching the 400MA and I do believe this may mark a short term support, lined up perfectly with the first FOMC event of 2023.

I’m expecting mild volatility at the turnover of the month with the DXY potentially bouncing to the 104 region as interest rate decisions will likely spook speculators out of their appetite for risk and they’ll hedge short on stocks and crypto.

It’s of my opinion that the public expectation this year is a FED pivot and no matter if the first event of the year strikes a 25 basis point hike or not, I believe investors sense the beginning of the end of QT (quantitative tightening) and I’m expecting the downtrend for the DXY to continue lower into the end of Q1.

Featured Chart DXY 1D (click to enlarge photo)

Which brings us to the weekly higher timeframe DXY chart which is important as you’ll note the weekly 100, 200 and 400 MA are just below the monthly fair-value-gap region of 96-98.

By the time I’m expecting the DXY to break down into this region it should be late February to mid March and a touchdown on these MA’s would certainly give me sufficient confluence that a bottom is in for the DXY and that a rally should begin to form.

Remember the phrase, “Sell in May and Go Away.” as I believe come May month we will have experienced short term tops on both equities and crypto and it will be profit taking time as the DXY attempts a surge upwards into the yearly open or lifetime median line ~105-107.

From there, we will reassess the macroeconomic conditions and make a strategy based on the overall appetite for risk at that time.

Featured Chart DXY 1W (click to enlarge photo)

Supporting my thesis behind a weakening DXY through Q1 is the strength of the maple leaf coin charted below.

Recently the Canadian Dollar has broken above and retested the daily 100MA with sights on the 200 and 400 respectively.

The path I’ve drawn expects a Q1 target of .775 with only a slight pullback after rejecting from the 200MA lined up perfectly with the first FOMC event of the year which should see the DXY spike upwards.

Featured Chart CAD 1D (click to enlarge photo)

Equities

📈 S&P500 + 📈 TSX

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

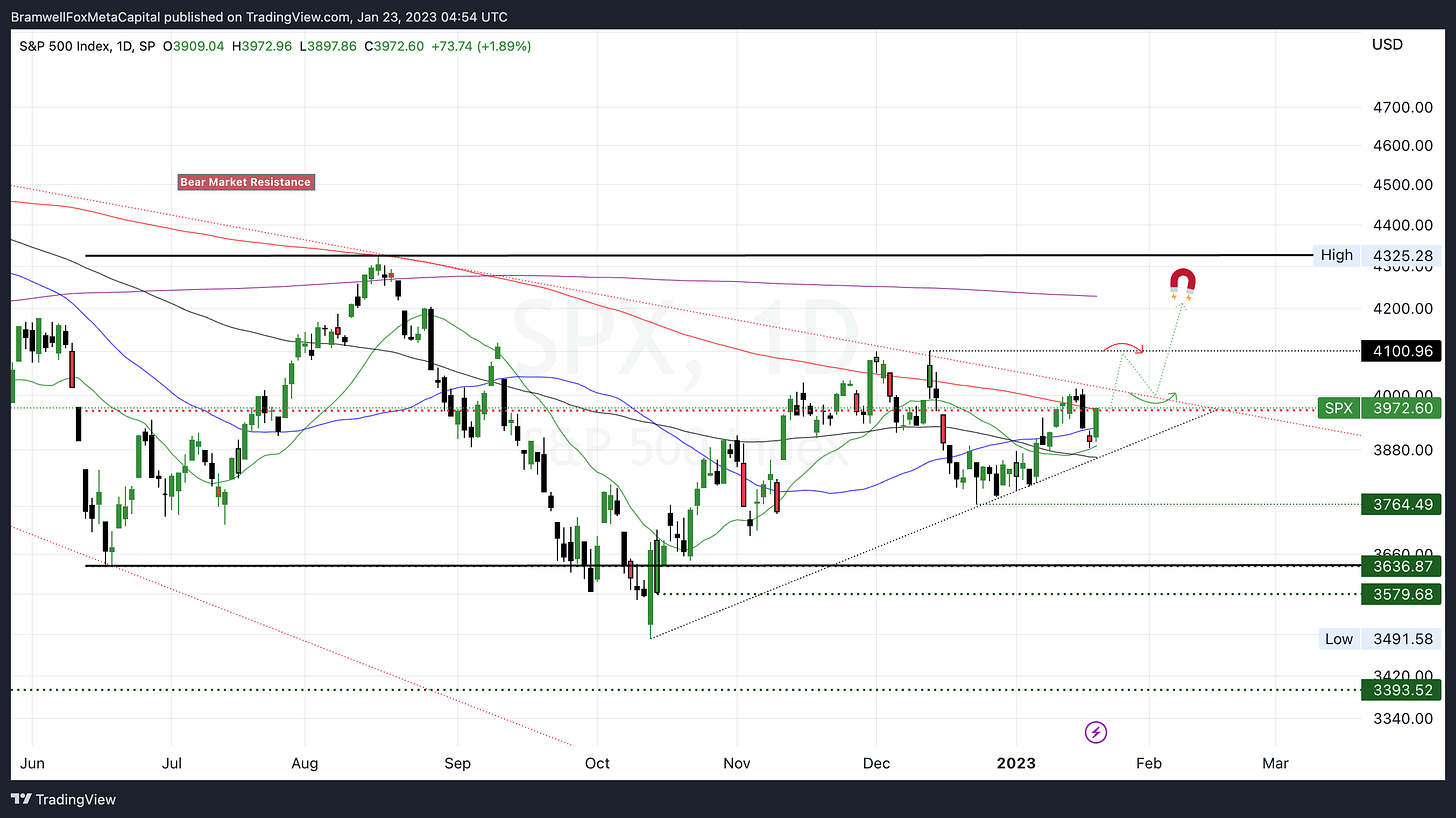

My most unpopular opinion is that this week corporate earnings are stronger than expected and that the S&P500 breaks bear market structure targeting 4100 in the short term.

Certainly if I’m wrong the entire markets could go south very quickly as the trendline support depicted below would see the S&P fall into the 3750 region and the bulls would have a very challenging fight to save the structure.

Featured Chart S&P500 1D (click to enlarge photo)

Yet again, I find myself comparing multiple global indices to gather evidence behind the global sentiment for risk.

The TSX provides a clear cut case for continued bullish momentum as I have targets for the Canadian equity exchange in the short term of ~21.2K and Q1/Q2 as high as 22.2K

Featured Chart TSX 2D (click to enlarge photo)

Remember, the VIX is the volatility indicator of the S&P500.

Should we be expecting such a possible collapse as a break in trendline on the S&P may unfold, I would have expected by now a far more bullish VIX to already have made its move.

It hasn’t.

In fact, I believe the VIX is headed lower into the 16-17 range which ultimately tells me there may be room for the S&P to break out of its bear market.

Big week of earnings ahead and I cannot stress that enough.

Featured Chart VIX 3D (click to enlarge photo)

Treasuries

📉 US2YR & 📉 US10YR

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

Much of the online debate I’m reading is a back and forth over whether we’re about to be ransacked by the recession of a lifetime.

You’d assume with hundreds of thousands of workers being fired that a meteor was about to smash into the economy, but I simply do not see it.

Here we see the 2&10YR treasury yields looking weak.

In fact, the 2YR rate of change is looking steeper than the 10yr which may slowly fix the inverted yield curve to avoid the recession signal altogether.

We are looking to see the 2yr fall below the 10yr in the coming weeks and months.

All eyes on the demand for bonds in the short to medium term.

(Bond prices up means yields down)

Featured Chart US2YR 12HR (click to enlarge photo)

Featured Chart US10YR 12HR (click to enlarge photo)

Cryptocurrencies

📈 Bitcoin & 📉 BTC.D + 📈 XRP & + 📈 Total Crypto Market Cap 📈 Total Altcoin Market Cap

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

Bitcoin hasn’t given any grace on the surge to the bears calling for 10K-13K pullbacks.

In fact, Bitcoin hasn’t even experienced a true pullback since breaking out of its accumulation zone (yellow).

At the time of writing, we have recently broken upwards from our demand cluster and I’m targeting 25K within 7-10 days leading into the FOMC before my expectations are for investors to hedge short in advance of monetary policy decisions.

I’m expecting a pullback into the low 20K at the monthly open of February, liquidity to fill up the engines and for a continuation for Bitcoin into 28.5K by the end of the quarter.

Featured Chart BTC 1D (click to enlarge photo)

It’s important that as we analyze Bitcoin, we take note of Bitcoin dominance as a total percentage of the entire crypto market cap.

Currently, BTC.D has broken above its 3D 200MA and is approaching the median line of the 3D range.

Anytime that BTC.D falls, two scenarios are possible.

Altcoins make their run.

Crypto Market Falls

It’s of my opinion that in the short term as BTC.D has a slight pullback, it will represent further altcoin market cap surges to the upside as shown below in the TOTAL2 analysis after we look at XRP and TOTAL.

Featured Chart BTC.D 3D (click to enlarge photo)

XRP has officially exited its bear market and there is plenty of energy surrounding the asset as record volume is pouring into the XRPL ahead of a lawsuit resolution.

My targets in the short term for XRP are ~50 cents before a pullback recharges liquidity and a further upside move sets sail for the weekly fair value gap just shy of .75 cents.

From this move, I would expect consolidation above .55 cents to occur as we await fundamental news surrounding the lawsuit and the clarity XRP deserves as a digital asset.

Featured Chart XRP 1D (click to enlarge photo)

After months of crypto dipping below the high timeframe range into its accumulation region (yellow), the total market cap has broken bear market structure and has reclaimed the psychological $1 trillion support.

From here there isn’t much resistance to the upside until the $1.25T region, conveniently located by the daily 400MA (purple).

This will be my short term Q1 target for TOTAL.

Featured Chart TOTAL 1D (click to enlarge photo)

As I mentioned with Bitcoin dominance, we can use TOTAL2 when analyzing the possible trajectory of altcoins as Bitcoin dominance falls.

When TOTAL2 is bullish and BTC.D is bearish, altcoins make their move.

I’m expecting the total altcoin market cap to surge upwards towards 700-750B in the coming weeks.

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

📈 Oil + ⚖️📉 Gold & ⚖️📉 Silver

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

I think this next move from Oil will fool many into hedging bullish on Oil, when in fact I believe a rejection at $85 is next followed by a continuation to the downside in the coming months dropping the price of Oil to $65.

It could be political or economic, or a mix of both, but I’ll be following the headlines very closely to see what narrative unfolds to give further clues and evidence to support this thesis.

Big week ahead for Oil….and more importantly for the price of gas!

Featured Chart Oil 1D (click to enlarge photo)

Gold has had an incredible run up from its accumulation zone in mid 2022.

I called 2K per oz last July and believe by the end of 2023 Gold will have set all time highs in price as my expectations are a collapse of fiat currency value.

In the short term, I expect Gold to reject from $1,950 per oz and retest the median line to gather liquidity in the $1,850 region.

Featured Chart Gold 1D (click to enlarge photo)

I’m expecting the same thesis for Silver as it attempts a breakout of its own en route to $25.

A short pullback is expected into the mid 22’s before Silver makes its next leg upwards and a breakout occurs setting sail for $25-30 per oz by end of year.

Featured Chart Silver 3D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 027

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!