🗞 Weekly Market Newsletter | Edition No. 02

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

A Message from the Author

Hello #FMC Community and welcome to the market update newsletter for July 2022’.

🔴 For those-in-a-hurry, head to the tl:dr section of the newsletter for everything need to know covered in my scribble™ format.

In this edition i’m going to highlight the main macroeconomic events and breaking news that occurred over the past month and provide my interpretation in the #BigPictureDeepDive section below.

We’ll transition smoothly into our #CryptoMarketSnapshot and i’ll weigh-in on Bitcoin and whether we should be bracing for a continued ‘crypto winter’, or whether a market bottom and reversal is near. I’ve added featured charts including the total crypto market cap, total defi market cap and xrp/usd with my thoughts on the short term price action.

Lastly, i’ll open up the #CEOJournal and share my final thoughts, how i’m feeling and what I'm watching as we head into the second half of a turbulent twenty-twenty-two.

Whether you’re reading this newsletter as a complete newbie to the world of finance or a seasoned investor seeking an interesting take on global markets, I hope you find value and enjoy reading the information I've gathered and presented for this newsletter edition.

Please take part in our community poll below and don’t miss out on this edition's bonus content featuring my highlighted Featured Digital Asset + The $1 Portfolio Breakdown.

I truly appreciate your subscription to our newsletter and grateful for each and everyone of you.

-BramwellFox, Founder #BFMC

Community Poll 📊

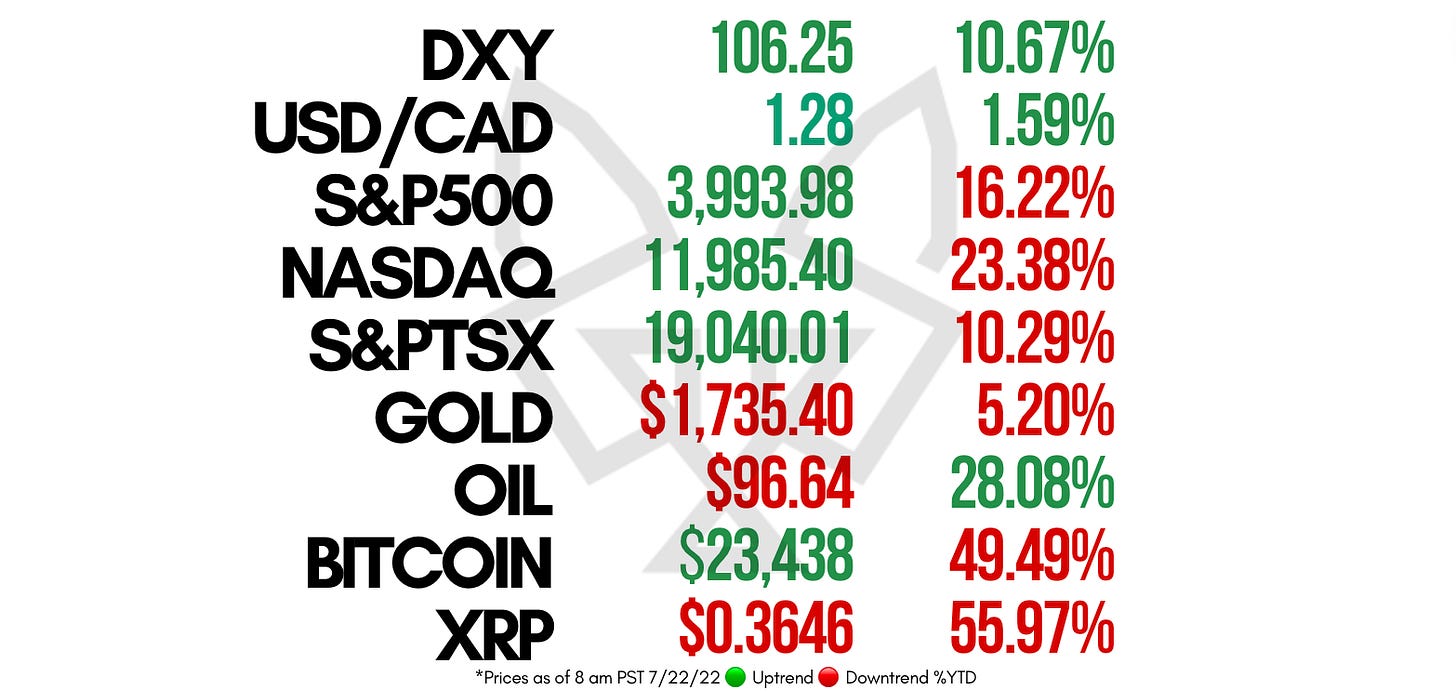

Tickers 📈

🔴 TL;DR (In a hurry? Read this only.)

Global Inflation Is Soaring - but has it peaked?

June CPI (Consumer Price Index); Annual Inflation Rate for the U.S rose to 9.1% & Canada 8.1% respectively - the highest inflation both countries have experienced in ~40 years.

Interest Rates Grind Upwards - is a recession on the horizon?

The U.S Federal Reserve increased the funds rate by 75bps to 1.5%-1.75% during its June 2022 meeting, instead of 50bps initially expected. The Bank of Canada surprised markets by hiking rates a full 100bps. Further hikes are expected throughout the remainder of 2022.

U.S Dollar Flexing Strength as Bond Yields Soar - has the DXY topped?

The DXY (U.S Dollar Currency Index) reached a 20-year high of 109.29 in Q2 as the yield curve on the 2YR / 10YR bonds inverted causing fears of a recession.

Oil & Gas Prices Falling - are commodities digging their own grave?

Crude Oil falls under $100 per barrel, down from a Q1 high of $130.50 in March.

Major Crypto Players Go Bankrupt - was this the market bottom signal?

Cryptocurrency lender Celsius Network files for Chapter 11 Bankruptcy and halts all consumer withdrawals following market volatility and downturn in the first half of 2022.

3AC (Three Arrows Capital) Hedge Fund files Bankruptcy owing an estimated $3.5B in debt to creditors.

Judge Netburn Stares Down SEC

LiarsLawyers - is a settlement near?The drama continues in the Ripple vs. Securities & Exchange Commission lawsuit saga as Judge Netburn forces the production of critical conflict of interest emails from former SEC Finance Director William Hinman.

🟢 #BigPictureDeepDive

🗞 Macroeconomic Event #1 | Global Inflation Is Soaring - but has it peaked?

In June CPI (Consumer Price Index); Annual Inflation Rate for the U.S rose to 9.1% & Canada 8.1% respectively - the highest inflation both countries have experienced in ~40 years.

💬 Interpretation, Analysis & Discussion

Let’s agree that the common consensus en masse when discussing inflation is defaulted to complaining of rising prices of ‘stuff’ + a higher cost-of-living, resulting in the misery index (actually a real index) skyrocketing. While this definition is kinda correct, in reality inflation should be correctly understood as the purchasing power of a currency declining due to shifting monetary policy by Central Banks and Governments.

The results of the CPI data annualized for June were released and they weren’t pretty - a near 40-year high for both U.S & Canadian inflation rates, yikes!

You may be asking, what does this mean and how do we fix it?

Rising Inflation rates are countered by central banks raising interest rates to slow down economic activity by making credit (borrowing & debt) more expensive. This monetary policy tool (and weapon of wealth destruction) coincides with the Central Banks embarking on their continued efforts of reducing balance sheets, also known as quantitative tightening, where they begin to sell off assets they accumulated to float the economy during the global pandemic.

When interest rates go up a few things happen;

Cost(s) to produce goods & services increase as supply chains & manufacturing. costs react to more expensive operating costs leading to price increase.

Consumer spending decreases as a reaction to higher costs of living and lower disposable income.

Unemployment Rates increase as corporations tighten labor costs and decrease workforce.

Corporate balance sheets shrink due to lower than anticipated gross earnings meanwhile profit margins decrease due to higher operating & financing costs.

Investors decrease exposure to stocks due to poor performance expectations, creating a build up of sell pressure for risk-on assets, and increase their appetite for lower risk yielding instruments such as bonds.

These economic downturns (contractions) are a very normal part of what’s referred to as the business cycle. Typically, economic contractions may lead to recession-states or depression-states depending on how severely deep the financial wound has been cut open.

The big question on every investor's mind - has inflation peaked? To answer that, let’s jump into the next macroeconomic event on our plate to discuss, keep reading.

🗞 Macroeconomic Event #2 | Interest Rates Grind Upwards - is a recession on the horizon?

The U.S Federal Reserve increased the funds rate by 75bps to 1.5%-1.75% during its June 2022 meeting, instead of 50bps initially expected. The Bank of Canada surprised markets by hiking rates a full 100bps. Further hikes are expected throughout the remainder of 2022.

💬 Interpretation, Analysis & Discussion

Has inflation peaked? Are prices going to fall from the sky and back down to earth with a soft landing for the economy? The markets are unsure.

For two years Central Banks (both the Federal Reserve & Bank of Canada) alongside Government Treasury Officials have been telling us that inflation was transitory and that they anticipated a return to the targeted ~2% annualized rate which would symbolize the beginning stages of economic growth activity - but it turns out they were lying hadn’t expected the adverse effects of geopolitical tensions in Ukraine, Supply Chain back-ups due to a resurgence of pandemic related shut-downs in China alongside a commodity price surge leading to food shortages and fuel price hikes.

Due to out-of-control-inflation burning like a wild fire in the pocket books of citizens globally, the largest manufacturer of U.S Dollars, the Federal Reserve, announced their pledge of hiking interest rates in consecutive meetings in an attempt to reestablish homeostasis between inflation vs. growth. The northern counterpart Bank of Canada surprised investors with a more aggressive July rate hike of 100bps in an attempt to cool off Canada’s scorching hot real estate market which has grown exponentially and out-priced the majority of Canadians from home ownership. (see graphic below)

With such aggressive monetary policy measures taking place, are future rate hikes priced into the market? We’ll discuss this as we move into our next macroeconomic event.

🗞 Macroeconomic Event #3 | U.S Dollar Flexing Strength as Bond Yields Soar - has the DXY topped?

The DXY (U.S Dollar Currency Index) reached a 20-year high of 109.29 in Q2 as the yield curve on the 2YR / 10YR bonds inverted causing fears of a recession.

💬 Interpretation, Analysis & Discussion

The U.S Dollar is represented by the DXY ‘Dixie’ index, which is a basket of leading global economic currencies (Euro 57.6%, Japanese Yen 13.6%, Pound Sterling 11.9%, Canadian Dollar 9.1%, Swedish Krona 4.2%, Swiss Franc 3.6%) weighted against the strength of the U.S Dollar.

The U.S Dollar is considered to be the Global Reserve Currency, a privilege bestowed upon the United States since the collapse of the Bretton Woods agreement by President Nixon in 1971. A large majority of international trade settlements occur using the USD and are trusted by many nations worldwide due to the historical strength of the U.S economy.

The strength of the Dollar peaked in 1985 and has been in a multi-decade decline reaching its lowest point during the financial crisis of 2008/09’. From 2008 onwards the dollar has been slowly ascending in strength marked by a 20-year high reached this year when it peaked at 109.25 last quarter.

In the chart above I'd like for you to observe the inverse correlation between the U.S Dollar and Cryptocurrencies - or what is referred to as ‘risk-on’ assets. During the pandemic crisis of 2020, the DXY began its correction into the green weekly demand zone before reacting with a bounce in April 2021. This happens to perfectly correlate with the end of the crypto Bull Market and the topping of Bitcoins ATH price of $69K in 2021.

To make matters worse for risk-on investors, the strength of the dollar is paired with soaring short-term (2YR) government bond yields and an inversion of the yield curve vs. the 10YR U.S government bond. This simply means that investors are fearing a short-term recession and hedging upon things looking worse before they get better. Since U.S Bonds are paying well in the short term, and these U.S Bonds are paid out in U.S Dollars, the demand for the Dollar has been very high throughout 2022.

But how high can the dollar go? Is there ultimately a risk of the Dollar becoming too strong? Yes, there is.

This year's demand for the dollar isn’t an event isolated in time and space - it’s aggressively attributed to the near economic collapse of other nations that have been crippled by the reverberation of the 2020 global pause.

Since March of 2020, the world has watched as countless civil tensions have risen against pseudo-democratically elected government institutions that have failed to serve their people, supply chain shortages exacerbating hunger and poverty crises in the world's poorest nations, a Russia v. Ukraine War which has driven the cost of Oil and other commodities to all time high prices - all contributing factors to a loss of trust in many currencies further accelerating the demand for the Dollar. What’s the ultimate risk if this demand continues to drive the DXY to new highs?

War.

With over 8+ billion human beings on planet earth spread across over 200 countries, resource sharing is an absolute necessity for peace. In an inflationary environment such as what we are witnessing in 2022 paired with a soaring single dominant reserve currency, it’s a perfect recipe for other nations to want to even the playing field of economic power - and we’ve already witnessed the early signs of these tensions when Russia* invaded Ukraine earlier this year in the name of power.

*It’s worth noting that Russia well understood it’s strength as a leading exporter of Oil and flexed it’s ignorance to U.S sanctions, which temporarily tanked the purchasing power of the Russian Ruble in February before a strong bounce sent the Ruble to new high’s against the Dollar as the War continues into Fall of 2022.

War can unfortunately restore economic equilibrium when all else fails - meaning the peace and prosperity of the world as we know it is walking a tightrope. We will need to be patient and monitor the geopolitical landscape closely and hope to see a reversal in the demand for the U.S Dollar towards the end of this year.

🗞 Macroeconomic Event #4 | Oil & Gas Prices Falling - are commodities digging their own grave?

Crude Oil falls under $100 per barrel, down from a Q1 high of $130.50 in March.

💬 Interpretation, Analysis & Discussion

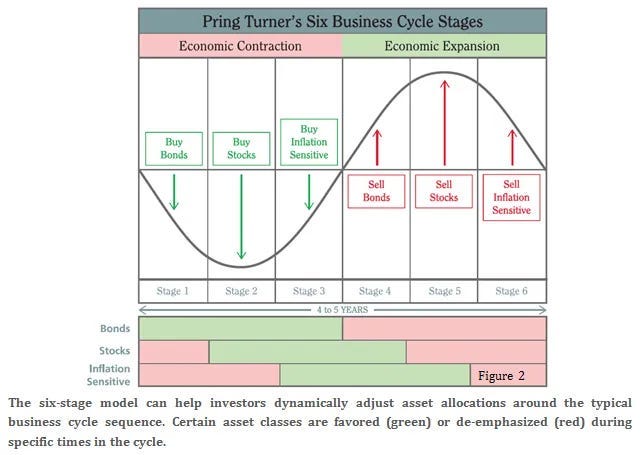

There is much to be learned by studying the macroeconomic holy grail, Pring Turner’s Six Phase Business Cycle as the global economy operates in a very cyclical nature.

Money perpetually flows between various sectors of the economy throughout these six phases and it’s important as an investor to find the ‘You Are Here!’ point to avoid incurring avoidable systematic risk to your portfolio.

We are currently hovering around Stage 2 of the business cycle and experiencing the early stages of the economic contraction phase.

The economic contraction stages are generally marked by;

Rising Interest Rates ✅

Peaking Commodity Prices ✅

Decline in Corporate Sales & Revenue ✅

Risk-on investment assets such as stocks have experienced large drawdowns meanwhile bond yields are peaking and commodity prices such as Corn, Oil & Wheat have reached new highs.

This is the financial environment of maximum value on many assets due to decade low prices - yet paradoxically maximum investor fear at the same time.

Is the worst behind us, or ahead? The markets are unsure, but there is an elephant in the room I'll discuss with you that I'm paying attention to, stemming from a sharp reversal of commodity prices in July.

Crude Oil peaked in early June at $130.50 per barrel and has since been in free fall to now trading under $100 per barrel. Similar declines in Wheat, Corn & Copper have occurred. Commodities falling can be an early indicator to a market reversal of growth based investments, yet at the same time are also strong indicators of a recession or even worse, a depression looming.

So which one is it?

The speculative contrarian in me has a hypothesis. Typically in a financial landscape leading to a recession we would expect to see inflation hedged investments such a Gold & Silver rise in value, however the demand has remained uncharacteristically low. I speculate that the price of Gold has remained flat due to many investors pontificating that the Federal Reserve will need to reverse its anticipated rate hikes to keep the peace of the people and combat the rising demand of the dollar.

Time will tell.

If we are amidst the turning point of the markets, we should look out for obvious signs of large scale capitulation, be that retail investors or possibly hedge funds or financial institutions failing to deleverage their exposure to risk-on assets and meet the fate of margin calls on the outstanding debt.

🗞 Macroeconomic Event #5 | Major Crypto Players Go Bankrupt - was this the market bottom signal?

Cryptocurrency lender Celsius Network files for Chapter 11 Bankruptcy and halts all consumer withdrawals following market volatility and downturn in the first half of 2022.

3AC (Three Arrows Capital) Hedge Fund files Bankruptcy owing an estimated $3.5B in debt to creditors.

💬 Interpretation, Analysis & Discussion

As we pivot our attention back to the emerging and disruptive cryptocurrency markets we may have the bottom signal we’ve been looking for following the death spiral $LUNA and their algorithmic stablecoin ‘UST’ which de-pegged in May tanking the price of $Bitcoin to under 20K and taking the entire market with it.

Due to the rapid decline of the once ~$20B combined market cap of LUNA + UST in May, many too-big-to-fail crypto lenders and hedge funds such as Celsius Network & 3AC were forced to suspend client asset withdrawals pending their bankruptcy proceedings, capital restructuring and liquidation of remaining assets to creditors.

Was this the cascade of liquidations, marked by large selling volume spikes in May & June, that we were looking for to mark the bottom and restore financial homeostasis to the historically acclaimed inflation hedge asset class?

I’m not convinced.

As we progress through Q3/Q4 2022 I'll be monitoring the developments of these publicly insolvent exchanges, lenders and hedge funds and treading carefully in the event of any black swan events to catch over enthusiastic relief rally investors off guard.

The bittersweet positive karma that may blossom from this bear market we’ve been experiencing may be a sweep of crypto regulations. The markets have the full attention of lawmakers and central banks worldwide and the acceleration of Web 3.0 and blockchain seems inevitable.

Speaking of lie law makers…

🗞 Macroeconomic Event #6 | Judge Netburn Stares Down SEC Liars Lawyers - is a settlement near?

The drama continues in the Ripple vs. Securities & Exchange Commission lawsuit saga as Judge Netburn forces the production of critical conflict of interest emails from former SEC Finance Director William Hinman.

💬 Interpretation, Analysis & Discussion

Dubbed the ‘Case of the Century’, CEO of U.S FinTech unicorn Ripple, Brad Garlinghouse stated his company has spent in excess of $100M on legal fees fighting the Securities & Exchange Commission since the litigation began circa December 2020.

The entire case has been an edge-of-your-seat thriller watched closely by hundreds of thousands of crypto enthusiasts and investors. The bullish outcome of this case has the potential to set the precedent of much needed clarity for digital assets to be recognized as non-securities by the U.S government. The bearish outcome would be if $XRP, the native token utilized by Ripple, was deemed to have been offered to the public as a security further opening the floodgates for endless litigation by the SEC to seek damages and impose further violations across the board to fin tech developers who may not have the cash to defend themselves in court.

From the beginning, clarity (a simple legal framework to operate within) has been what the market participants; investors and developers alike, have been seeking from the financial watchdogs of the United States.

In a famed 2018 speech by SEC director William Hinman, he offered the first version of a legal framework gave his ‘personal opinion’ of what digital assets needed to accomplish in terms of decentralization in order to be considered non-securities by the SEC.

So it came as a surprise to the industry when the SEC launched a $1.3B claim against Ripple in 2020 as they had been operating under what they had believed to be the legal boundaries discussed by Director Hinman in his speech and created a suite of products designed for cross-border payments utilizing the XRP network.

What didn’t come as a surprise was the degree of corruption uncovered during the discovery stages of the lawsuit as it was made public that Director Hinman and other SEC officials had large scale conflicts of interest in litigating Ripple and therefore slowing the mass adoption of the XRP technology.

As it turns out, Director Hinman’s speech may not have been his personal opinion (as argued by the SEC only after Ripple requested emails under the Freedom of Information Act) as a lengthy e-mail exchange was submitted into case discovery which included multiple agency officials and outside partners pertaining to policy surrounding digital assets (and possibly XRP specifically) years prior to the lawsuit announcement.

The SEC has been doing everything in their power to keep these emails hidden from the public and from Ripple; however, the tides turned in June as Judge Netburn, the judge overseeing the case delivered a blow to the SEC by forcing the production and delivery of the e-mails to Ripple. These emails are speculated to contain information that may support Ripples Fair Notice Defense and crush the odds of the SEC pursuing future litigation(s) against other market participants should this information surface publicly.

It may be in the best interest of both parties to begin serious settlement discussions, and Q3/Q4 I fully expect a resolution or tipping point to the case-of-the-century.

📸 CryptoMarketSnapshot

Bitcoin

Featured Chart: $BTC / USD

📈 Technical Analysis & Discussion

Has Bitcoin reached the end of its correction? It’s possible.

Bitcoin spent most of early July ranging in the 20K range as accumulation volume soared in a post-mortem capitulation event.

🐂 Bullish Trigger: a re-claim of the Weekly Supply Zone ~28K

🧸 Bearish Trigger: a breakdown below the $18.6K low.

A ranging price between $18.6K - $28K would mean to me that the supreme leader of the crypto markets is awaiting developments in the macro-environment before continuing a trend.

XRP

Featured Chart: $XRP / USD

📈 Technical Analysis & Discussion

In my opinion the most exciting chart in crypto to watch in Q3/Q4 will be the $XRP price action for many reasons;

The Flare Network has officially launched bringing smart contract capability and interoperability to the XRP blockchain, a much needed utility boost for token holders.

The Ripple vs. SEC lawsuit ending in a settlement would give XRP the legal clarity it needs to become the de-facto payments system and liquidity hub for central banks and institutions globally.

The XRP blockchain will be upgraded to enable NFT capability + a rumored automatic market maker operating within the XRPL integrated decentralized exchange.

All three events create a surge in on-chain activity, increasing demand and therefore a higher price per token.

🐂 Bullish Trigger: a re-claim of the Weekly Supply Zone ~$0.50 cents

🧸 Bearish Trigger: a breakdown below the Weekly Demand Zone ~$0.285 cents

Altcoins Market Cap

Featured Chart: $TOTAL2 (Total Crypto Market Cap - BTC Market Cap) / USD

📈 Technical Analysis & Discussion

The total altcoin market cap is showing room to expand in price on the 5-Day timeframe as much of the evidence is showing oversold territories highlighted by the eclipse placed over the RSI, MACD, Money Flow and On Balance Volume indicators.

The weekly supply region of ~$400B was touched and now TOTAL2 is ranging between $500B - $750B. The fibonacci zones of 0.5 ($250B) and the 0.618 ($150B) typically have a magnetic appeal for price during a correction; however, I would save this possibility only for a black swan event such as further insolvency liquidations or a regulatory sweep of new laws.

For now, the indicators look healthy for a relief rally and possibly a reversal should the dollar break down.

DeFi Market Cap

Featured Chart: $TOTALDEFI / USD

📈 Technical Analysis & Discussion

The total DeFi market cap is looking bearish to be in the short term with price having fallen below the 400MA (red) and approaching simultaneously a weekly supply region of $50-55B.

With many market participants on edge due to network hacks and custodian risk over crypto, it doesn’t surprise me that the total DeFi market cap appears weaker than TOTAL2.

The stochastic RSI is approaching an over extended zone as well as the accelerator oscillator both marked by highlighted eclipses. I’ll be looking for a potential small leg down and an inverse head & shoulders pattern to form in Q3/Q4 with profits flowing into DeFi from a potentially relief rally or market reversal in the fall as sentiment improves and new DeFi platform security and bridges are engineered.

NFT’s

💬 Analysis & Discussion

NFT marketplace(s) have seen low trading volume and large drawdowns on the floor price of the industry leading projects. While the macro future for NFT’s is extremely bullish, investors should be seeking projects that offer ownership utility for their NFT’s or potential passive income opportunities.

I’ve got my eyes on The Fat Cats Club, an up and coming NFT project that has seen tremendous success since their launch on the Songbird Network earlier in 2022.

Which NFT projects are you excited about?

💭 CEOJournal + Final Thoughts

7:46am July 22nd

…as I come to the end of writing the first market update newsletter for BramwellFox MetaCapital from my home here in Kelowna, British Columbia, all I hear are the birds chirping wildly outside my balcony door and all I can feel is the heat of the morning sun beaming down on my back - it’s going to be another hot day here in the Okanagan.

I feel compelled to laugh at the symbolism and contrast of such an uplifting present moment I'm experiencing this morning relative to the thousands of words I've written above summarizing where we find ourselves as investors in the most turbulent, volatile (and at times quite scary) financial markets of 2022.

It’s symbolic because no matter what the markets do; up, down, sideways, turn inside out - it doesn’t matter to the birds, to the sun. If the markets tank in an hour from now, the sun will not care, the birds will not care.

It’s important to always keep a firm grasp on the fact that money & investments are part of the game of life, but have nothing to do with life itself. Having wealth can produce the possibility of a unique life situation should one use it in ways to foster moments of joy, however a true moment of joy can also be experienced with no wealth at all if you close your eyes, breathe and take in what life has to offer all around us.

July has brought the warmth of the sun and with it a sentiment boost to the markets which is a pleasant relief for all of us. The macroeconomic events i’ve discussed in this edition that occurred from June to July are important to watch closely as further developments unravel and i’ll admit i’m still sitting patiently on the fence, not rushing to ride a bull or run from the bears, just sitting patiently listening to the birds for a moment and letting time solve all arguments at it’s own pace.

In other words, for the financial junkies out there, I'm sitting flat and have not entered any new spot long positions nor trading the chop until I see confirmation of a new trend or news breaks that I can forecast to be of significant meaning.

I’ll wrap this edition up here and hope you’ve enjoyed reading this edition as much as I've enjoyed writing it. If you’ve learned something, I'd love for you to share your comments below and would appreciate you sharing my substack with your network.

Cheers,

-Bramwell

🥳 Bonus Content

+ Featured Digital Asset of the Month

Flare Network | $FLR | @FlareNetworks

The Flare Network is the number one crypto asset I've had on my radar since reading its whitepaper in Fall of 2020. I’ve followed their team very closely and i’ve been impressed by their professionalism, intelligence and commitment to building the world’s first truly interoperable layer one bridge using ethereum’s virtual machine technology to unlock the value of multiple bluechip layer one digital assets with smart contact capability has my speculation senses that this may be a future top 10 crypto in years to come.

📚 Flare Network Report Card

- Proprietary Technology & Vision 9.5 / 10

- High Utility Global Use Case 9.5 / 10

- Development Talent & Skill 8.5 / 10

- Business Leadership & Partnerships 8.5 / 10

- Community Scale & Sentiment 7.5 / 10

Overall Score 87%

+ The Perfect $1 Dollar Portfolio

If I had one dollar to invest today, given everything we’ve discussed in our first edition of $BFMC’s Market Update, this would be my breakdown*

30 % Crypto

50% Bluechip Layer Ones

35% Layer Twos (Non-Proof of Work, AI, Gaming, Smart Contracts, Payments)

10% DeFi Sector (Designed for Institutional Treasury, Compliant)

2.5% Tokenized Precious Metals

2.5% Utility Based NFT’s

30% Stocks

Energy Sector

AI Technology

Psychedelic

15 % Precious Metals

65% Gold

35% Silver

15 % Cash

75% USD

15% EURO

10% CAD

10 % Bonds

Short Term < 5-Year Maturation

Did you enjoy this newsletter? Become a paid subscriber today and join our community or share BramwellFox MetaCapital with your network below.

*Disclaimer; we are passionate and educated investors with a large network of technical & fundamental analysts who understand and have experience triangulating the micro and macroeconomic investment landscape into easy to digest algorithmic thought patterns and interpretation, however it must be said and understood that our perspectives and opinions written on substack are our own and do not constitute financial advice.

All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. Day trading does involve risk, so caution must always be utilized. We cannot guarantee profits or freedom from loss. You assume the entire cost and risk of any trading you choose to undertake. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the British Columbia Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.

Thanks for your comments everyone. You can tag BramwellFox MetaCapital on Twitter @BFMCTweets or tag my personal Twitter @iambramwellfox with any feedback or questions on this edition. I'll respond to all feedback left here in the comments section.