🗞 Weekly Market Newsletter | Edition No. 16

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, October 23rd

Hello Everyone,

For those in a hurry, let me update you on exactly what’s happening in global markets:

The U.S Federal Reserve is the puppet master now, and all eyes are on their every move. The most important FOMC meeting of the year occurs on November 2nd where it’s expected that they’ll raise interest rates by 75 basis points - everyone should be bracing for market volatility in either direction.

It’s due to the soaring U.S Dollar strength that we are all waiting for something to break. What do I mean by break? I mean that it’s very possible financial system actors (both governments and central banks) lose any and all control of keeping inflation in check, currencies from devaluing, labor markets from plummeting and global wealth destroyed in an all-of-a-sudden moment.

When interest rates rise, the U.S Dollar becomes attractive relative to other assets. The bond market becomes worthless as nothing can match the Federal Reserve’s higher interest rate given on the U.S Dollar creating a panic for pension funds globally who are seeing their equity positions collapse in addition to their safe haven bond positions. And if pensions fail, uh-oh.

The call has been given by major global organizations such as the World Economic Forum and the IMF to cease rate hikes before something breaks - but the FED is dead set on lowering price inflation in the U.S to 2% (it’s currently above 8%).

This is the vicious cycle the financial markets find themselves in.

As interest rates continue to rise the cost of operating our very lives or any businesses rise with it - lowering the consumer and corporate cash flow due to higher debt payments.

As inflation rises costs rise with it, employers must cut back on expenses including labor - creating rising unemployment.

As consumers scramble for cash, they liquidate their savings and investments to double down on simple living - this creates selling pressure in the market and a liquidity shortage.

With less employment income for consumers facing lower cash flow, consumers spend less and this creates an economic contraction. Business revenues suffer and performance expectations fall, creating selling pressure on their stock value.

It’s the most vicious hamster wheel we find ourselves running on as investors as Q4 2022 trudges on.

*For an even deeper understanding of everything I just wrote it’s well worth your time to listen to the Dollar Milkshake Theory.

I hope to outline for all of you when we transition into the charts section of today’s edition the various paths that assets could travel, both bullish and bearish based on whichever narrative that unfolds.

Enjoy my thoughts, scribbles and predictions.

- Bramwell

ps. How am I approaching the markets? I have a cash position equal to <10% of my portfolio value that I’m actively building. I have not sold any of my positions and I am watching for any signs that the bearish predictions may be gaining momentum in order to set price targets below to accumulate more digital assets.

Should the markets reverse into the green and we look back as this was the bottom, I’m completely satisfied with deploying this capital once a confirmation or trend reversal has occurred.

📰 BramwellFox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 XRP News [XRP Sidechains, NFT’s + Hinman E-Mails]

💭 Bramwell’s Thoughts…

I want each of you to think of blockchain networks like you would think of legos - that the value is derived from what you can build atop of them.

Bitcoin was the original peer-peer payments network, whereas Ethereum was the first to enable smart contracts built into their network capability - ie. the ability to build on top of a blockchain.

Fast forward years later the XRP blockchain is now experimenting with (2) major technology stack upgrades.

Federated Sidechains

NFT Integration

To understand federated side chains, use this visual.

When on a road-trip are the restaurants and gas stations directly on the highway, or via an off-ramp off to the side? Typically, they’re off to the side so that the flow of traffic does not get congested on the main highway.

This is the upgrade that XRP is making to the traditional smart contract model which slowed down the network and faced soaring gas fees to use the smart contract d’apps.

In short, it’s big.

What’s bigger? NFT integration which is expected to go live on October 31st (what a treat!) should there be no more

tricksdelays in the upgrade.Remember, a network’s value is proportional to network utility and these two network upgrades dramatically upgrade the usage of the XRP blockchain.

The XRP network also hit a home-run last week with breaking news that affects the Ripple vs. SEC lawsuit. The SEC finally handed over the infamous Hinman e-mails which are rumoured to have contained

corruptionconflict of interest dialogue between Ethereum Founders & the SEC in a collusion to give ETH a free pass on securities violations in exchange for a fee.Stuart Alderoty’s tweet sounded bullish af.

🗞 Messy Macro is Right [Bank of Japan Intervention, China Consolidating Power, Bank of America Warning UST Market Unstable as 10YR Yield Soars

💭 Bramwell’s Thoughts…

It’s obvious when a sink pipe is broken because water pours out onto the floor, what a mess.

It’s similar when a financial system is broken because liquidity evaporates into thin air, what a mess.

So it was fitting I include the following tweet by Jordi Alexander as it was right on the money - the global macro is a mess.

The Japanese Yen last week collapsed to new lows vs. the U.S Dollar and the Bank of Japan tried to step in and save the day by purchasing billions worth of government debt - but sadly it didn’t work and they ultimately wasted billions of capital in the process.

This is the effect that soaring interest rates are having as the turmoil travels nation to nation.

Next up, China.

In a power move, China granted Xi Jinping a third term as President and this is big as rumours circulated that the economic plan voted on during last week’s CCP convention involves the consolidation of the Taiwan region into Chinese control.

It’s also worth speculating on why Hu Jintao, the former president of China and second in command, was escorted from the CPP convention prior to party voting on Xi’s grand motions for the future of China.

Power moves are taking place in Asia that should be followed closely.

🗞 Robert Kiyosaki issues warning for the U.S Dollar as Saudi Arabia may join BRICS+

💭 Bramwell’s Thoughts…

Furthering the speculation of a power war between the democratic nations and BRICS+ (Brazil, Russia, India, China & South Africa) nations was this tweet by Robert Kiyosaki covering the news that Saudi Arabia may become the newest member of BRICS.

If this follows through it may certainly be the demise of the U.S Dollar as the global reserve currency as the BRICS nations will have dominant control over the flow of energy & manufacturing exports globally.

I will be keeping my eyes on this headline and watching the U.S Dollar technicals to show weakness correlated with any further breaking news.

🗞 Liz Truss Steps Down, UK Inflation 10%+

💭 Bramwell’s Thoughts…

Perhaps weeks ago when I wrote about the various crises we were facing I should have added a leadership crisis to the list.

After just 44 days in office Liz Truss, the conservative leader of the UK, formally excused herself from public responsibility after making a series of public policy blunders that catapulted the UK inflation rate to over 10%.

It appears politicians will be next on the chopping block if central banks lose control of the global financial system, and my eyes are dead set on the U.S midterm elections and tensions rising in the Canadian parliament.

🗞 FTX CEO Outlines Adoption Framework

💭 Bramwell’s Thoughts…

Sam Bankman-Fried, the CEO and Founder of FTX, one of the leading global cryptocurrency exchanges took to Twitter this week outlining his perspectives on what regulation and oversight would look like to increase adoption of blockchain technology.

I personally thought it was value adding dialogue; however, many fellow crypto-twitter OG’s did not share the sentiment including crypto personality BitBoy whose attack on SBF went viral.

How do I feel about it?

Well to be honest I’m impartial to crypto-twitter politics.

I’m not part of the bitcoin-maxi movement who wishes that the government burns in hell and banks die with them.

I’m also not part of the movement who believes the government and banks are filled with kind-hearted warm and fuzzy smart people who just want the world to be happy and have our best interests in mind.

I’m more so like Neo from the Matrix who is capable of playing both sides and understands that technology is at the forefront of evolution - therefore I’m just focused on riding the wave while the others argue on the beach.

🗞 Markets ‘100%’ confident in a 75 basis point hike + 5% next year

💭 Bramwell’s Thoughts…

All eyes on November 2nd.

You’ll notice as we progress into technical analysis for this week that I’ll have an orange vertical line on many charts, this marks the November 2nd FOMC meeting.

Market participants are near 100% positive of a 75 basis point hike.

And for certain should Jay Powell come out and announce a 1% hike I’m just going to hide in the corner as the world collapses beneath our very feet 😅

The most important part of this meeting will be his press conference remarks alongside the question & answer period. All eyes and ears will be trying to dissect his body language and tone of voice to get hints on if & when a FED pivot may occur.

BramwellFox MetaCapital’s Weekly Market Review & Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative

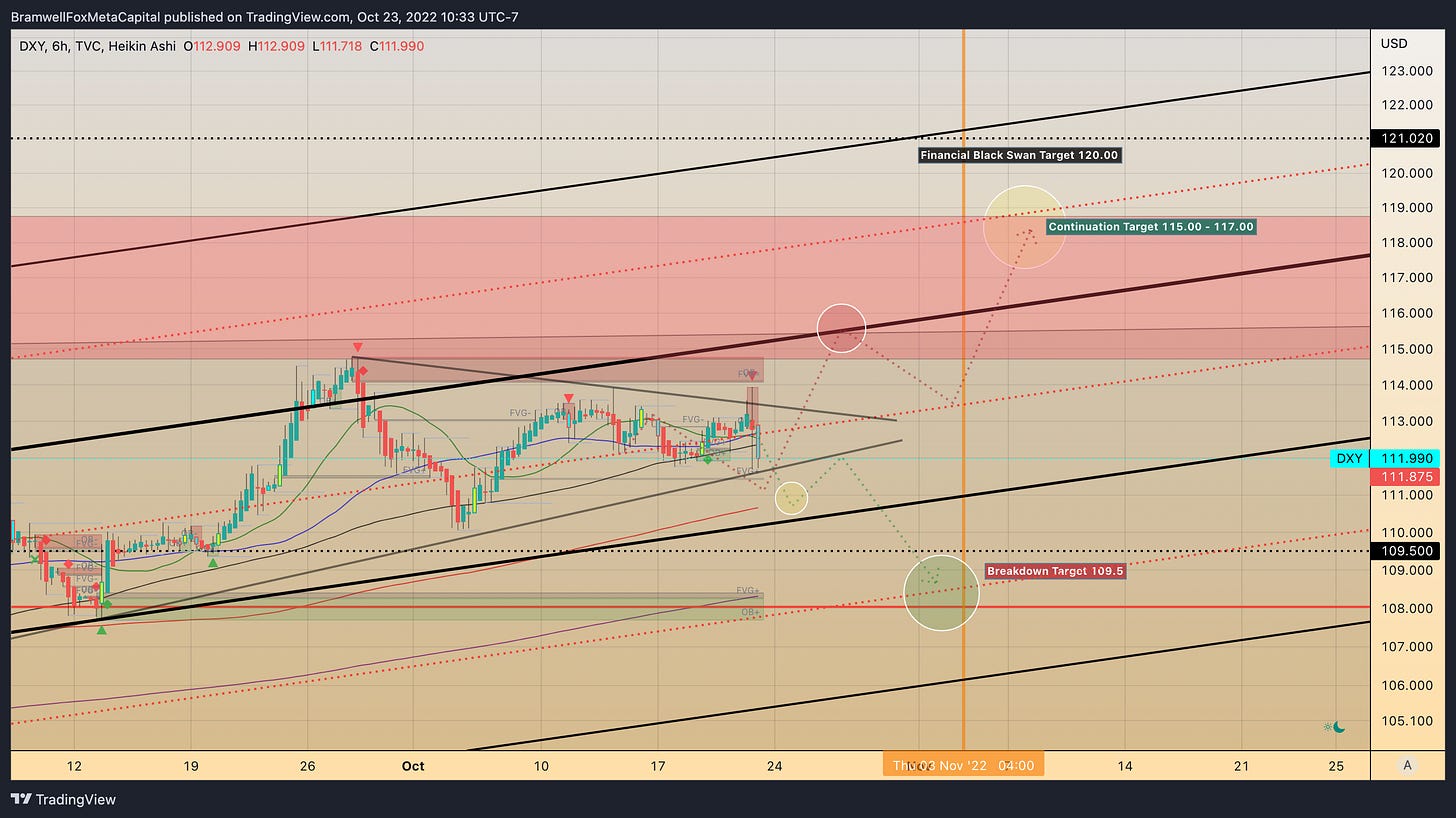

📉 DXY(U.S Dollar)

💬 📉🧸 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The DXY fell sharply on Friday reacting to Bank of Japan intervention alongside a short rally on equities before the weekly close.

You’ll notice the DXY is forming a wedge that can break either way.

A break to the downside is what my intuition is telling me as treasury yields are overextended and requiring a pullback meanwhile the majority of equity indices are oversold and seeking a relief rally.

While a break to the downside would potentially target the 109.5 region, all is NOT in the clear as the slight pullback may only add fuel to the fire for the FOMC meeting on November 2nd to which the DXY may skyrocket upwards into the 116-120 region which would surely created havoc globally.

Should this week break bearish for equities in anticipation of further rate hikes, it’s also on the table that the DXY extends upwards in fear only to ultimately crash downwards once rate hikes are announced.

This would ultimately mean the markets would have already priced in the pain and possibly create upwards pressure on risk assets once we all realize we’re okay after all.

Featured Chart DXY 6HR (click to enlarge)

Featured Chart DXY 1D (click to enlarge)

📈 Canadian Dollar

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

As expected from last week’s analysis, $CAD broke out of its falling wedge and is showing strength headed into this week.

I’m cautious to allow too much room for upside as I do expect the week of 02/11 to be volatile.

Therefore, a short rise to the .74 region before a pullback into support during rate hike week followed by a continuation to the upside as the inverse head and shoulders completes its price pattern.

I’m long into .75 $CAD for the short term.

Featured Chart DXY 1D (click to enlarge)

📈 Bitcoin

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I’m still (along with the rest of the world) waiting on Bitcoin to make its move.

As a rule, periods of low volatility are followed by HIGH volatility.

Bitcoin is either about to break upwards like a racehorse, or absolutely collapse.

This is a no-trade zone for the majority of traders as the slow price chop of a few hundred dollars up and down will deplete capital fast.

Bitcoin is sitting on a rising support line ~18.1K and a breakout upwards of 20.1 - 20.5K would be bullish in the short term for crypto.

The bullish path would be a breakout above the diagonal resistance and a re-claim of the green support region before a further continuation upwards.

The orange line marks the FOMC meeting and I can’t see any upside moving past 21.5K in any case until more data is released.

On the bearish side I’m open to selling pressure occurring in the second half of the week as fearful retail cashes out at any local highs. Perhaps this scenario has BTC breaking below 18.1K by the weekly close and traders short hedged into FOMC - but I doubt it.

I believe we will chase upside liquidity this week and the biggest move will occur next week.

Please leave any questions on these chart analysis below and i’ll help you understand the indicators, lines and paths better.

Featured Chart BTC 6HR (click to enlarge)

📈 XRP

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

My fellow analysts would roll over in their grave at the amount of mess I have on this XRP chart, but let me explain.

What you’re seeing in the impulse move upwards that started in mid September reaching the highs of .55 cents just a week and a half ago.

This impulse had a (5) wave structure on a lower timeframe, which could be the beginning of a larger high timeframe impulse that has XRP take the stage for a bull-run to end 2022.

Each structure has 5 upwards waves numbered (1,3,5) and two corrective waves (2,4).

Thus, should my bullish bias be correct, we are on the corrective wave 2 of a 5 wave structure.

I’ve used a tool called a Fibonacci retracement to calculate the levels that XRP could fall to after reaching the highs of .55, and the bearish red path could take us as low as .35-37 cents should bad news come from the macro situation.

Otherwise, you’re seeing that XRP recently broke out of its downtrend and could be possibly starting the rise onto the green path upwards to .75 cents in the short term.

Behind the price patterns you’ll see horizontal regions marked by a red dotted midline and this is simply for me to see the highs and lows of trading range over time. Typically it’s useful to assume should the price break up or down from these regions that a similar range will remain intact, hence the pasted regions above and below which we use as possibly support and resistance lines along the path.

In short, I’m bullish on XRP and expect Q4 to be generous for the price action and market cap of XRP. Any dips are for accumulating.

Please leave any questions on these chart analysis below and i’ll help you understand the indicators, lines and paths better.

Featured Chart XRP 12HR (click to enlarge)

📈 S&P500 & TSX

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

My sentiment on the S&P500 remains the same as all risk-assets across the board this week.

I’m bullish to take out upside liquidity until the FOMC meeting unravels hints for what’s next for the FED’s monetary policy.

I’m expecting equities to rally up and into the 3850-3900 region led by tech and retail sectors on the backs of strong earnings releases last week.

Featured Chart S&P500 1D (click to enlarge)

📈 TSX

I’m not as bullish on the TSX this week as I am U.S equities.

I’m expecting the TSX to range between 18.5K and 19K.

Certainly a short term rally could see the TSX test the 19.2 region; however until we see CPI releases for October unravel and we hear from the Bank of Canada on their next move, I don’t believe the TSX will experience any major strength.

Featured Chart TSX 1D (click to enlarge)

📈 GOLD

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I know you’ve heard of Gold, but have you heard of, Gold on steroids?

I’ve been using the price action of Gold as a lie detector test on the global economy all year.

Gold has had a few fake-outs to the downside but with supply drying up globally, I’m anticipating a bull-run like no other once the DXY tops out.

I’m targeting a Q4 price of $1800/oz.

Featured Chart Gold 12HR (click to enlarge)

📉 OIL

💬 📉🧸 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The tug of war for Oil prices is more climactic than any Netflix drama.

OPEC producers have been slashing production but have faced their demise against Biden’s releasing of the unlimited U.S strategic oil reserves month over month.

Wait a second, you mean their supply isn’t unlimited?

Uh…

No, it’s not.

But to keep gas prices down and consumers happy heading into elections, Biden has been selling the U.S short of their leverage against global exporters in order to bribe U.S citizens to vote for him stay true to his promise of lowering inflation.

The goal here would be for the U.S to push prices down into the $65/barrel region meanwhile OPEC is determined to hit the green target of $95/100 per barrel.

Fight.

Featured Chart Oil 1D (click to enlarge)

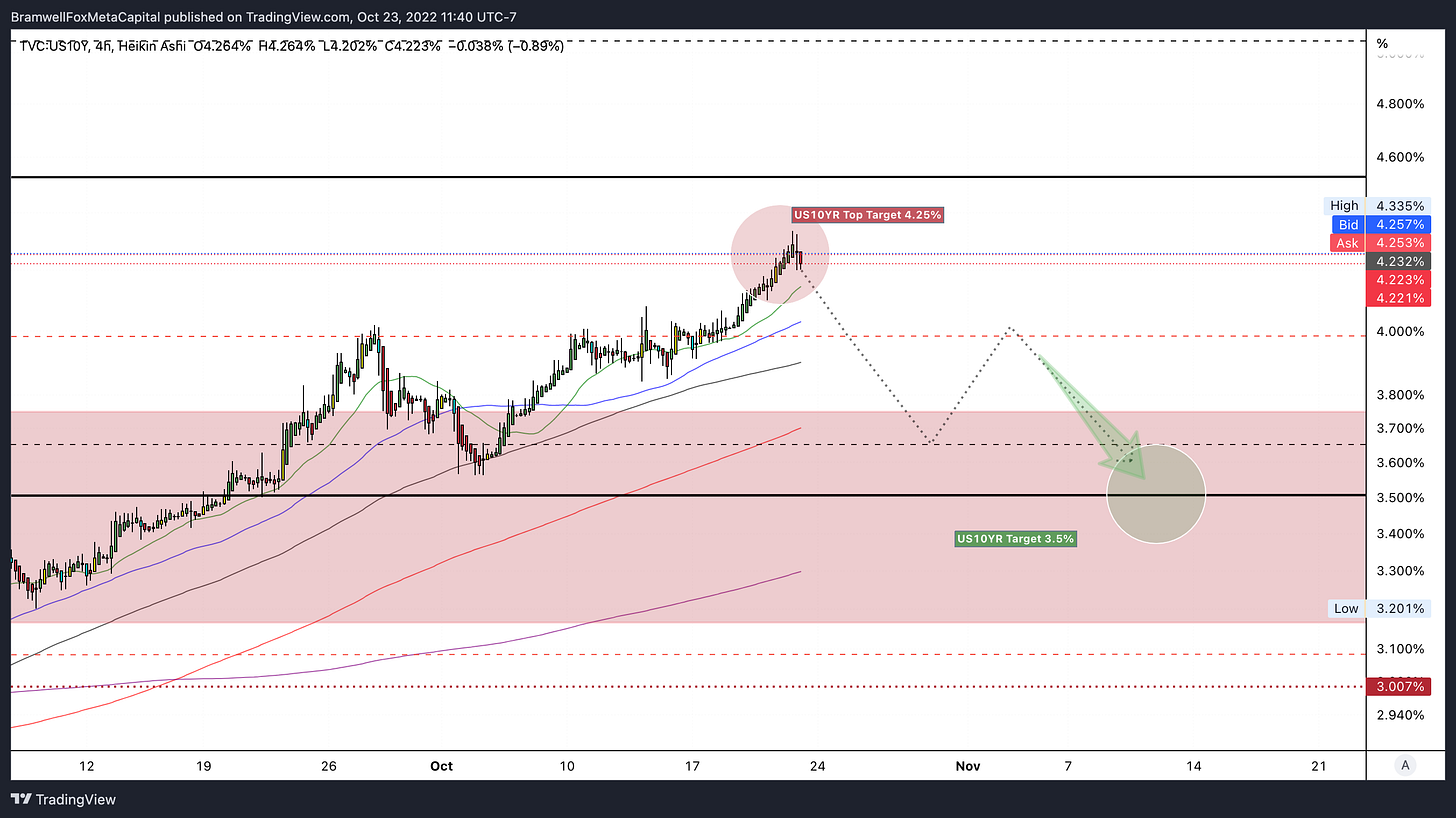

📉 U.S Treasuries

💬 📉🧸 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

All I can think of is the poor housing market. Rest in Peace anyone who was forced into locking in a 7%+ fixed rate in 2022, may the lottery gods be with you.

To read more into the correlation between the housing market and treasury rates click here.

Treasury yields continued their flight last week as the 2YR eclipsed nearly 4.75% and the 10YR 4.35% respectively.

These were my topside targets and I’m fully expecting a bumping road downwards as they both correct into my green targets by end of Q4 2022.

I will now search for hints and narratives to unfold in the coming weeks to confirm a DXY top and a reversal of UST yields - as I fully expect this to be the end of the max pain for the bond market.

Featured Chart US 2YR 6HR (click to enlarge)

Featured Chart US 10YR 4HR (click to enlarge)

📉 THE VIX (Volatility Index)

💬 📉🧸 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I’ve saved the best for last.

Remember that the VIX is an index for volatility in the stock market, and the VIX has fallen out of its ascending channel that began in late August.

Are equities in for some upside breathing room? Have we bottomed already? It’s possible.

However as you’ll notice in my charts, a possibility is that the VIX traps eager bulls into deploying capital before it shoots back up into the channel and heads for the 40 range which has ultimately signaled the end of all bear markets in the worst of ways via capitulation and margin calls.

We want for the VIX to slowly grind downwards and never look back outside of a possible short spike during the FOMC meetings in November and December.

The VIX collapse is the closest hint we have to a return to risk assets.

Featured Chart VIX 12HR (click to enlarge)

👋🏼 Hey!

Thanks for reading this week's Market Update Edition No. 016

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!