🗞 Weekly Market Newsletter | Edition No. 14

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, October 9th

Hello Everyone,

I’m somewhat relieved to report that it wasn’t a groundbreaking news headline week for the world markets, yet what did occur lay important clues to what’s on the horizon.

The game right now is patient positioning.

My intuition says that the worst is possibly over and that sunny skies are on the horizon for our portfolios; however, the devil on my shoulders understands that the energy in the air is still charged with fear and uncertainty thus a little more patience may be needed.

We find ourselves today midway between September’s Federal Reserve interest rate hikes that shook the markets and the next FOMC meeting scheduled for November 2nd - which markets are currently pricing in an additional 75 basis point hike on interest rates at the bare minimum.

I’ll take a moment to remind you that important economic data releases such as Unemployment Rate (aka. monthly ‘Jobs Report’ ) alongside the Consumer Price Index (aka. inflation temperature reading) are what Central Banks use to make monetary policy decisions.

The irony in this paradox is that we are hoping for higher Unemployment and lower consumer demand to prove to the economic

puppet mastersdecision makers that our economies are stabilizing and cooling off.

Rather, this week there was a notable shift in headlines saturated with geopolitical news from the United Nations & World Trade Organization calling on central banks to ease off interest rate hikes to prevent a global recession and also an important OPEC+ meeting (The Organization of the Petroleum Exporting Countries) that led to a decision to reduce production by 2M barrels per day - much to the displeasure of the U.S government as lower supply equates to higher prices.

If you recall last week’s market update, my headline stated:

🚨 Currency Crisis, Credit Crisis, Energy Crisis - which crisis will break the financial system first?

I wanted to update you that the Jenga tower of World Economics ain’t looking any prettier this week - but all is not doom and gloom, especially if you’ve been dollar cost averaging assets at these prices - let’s look at where we’re standing in early October.

Update Re: Currency Crisis

The DXY (U.S Dollar Index) has cooled off since reaching its highs of 114.7x in September, likely due to the Euro & Pound rebounding from their devastating collapse recent falls.

I’ve mapped out a few trajectories (chart below) that are possible for the Dollar ‘s path as key economic data reports are released towards the end of October including the FOMC (11.02.22) meeting.

Featured Chart DXY 6HR (click to enlarge)

Above you’ll see that should the dollar continue its strength on the backs of unfavourable economic data or further deteriorating conditions across the globe for other currencies, we may experience a heightened DXY reaching upwards of 117-120 in Q4 - bad for equities and risk assets, but likely the last hurrah for the dollar.

On the contrary, should investors speculate that all bad conditions are already priced in, the news headlines may be a nothing burger less volatile and merely acting to keep fear in the market as smart money creeps back into equities and growth assets as the DXY trickles back down to support*

*bullish

Truth be told, regardless of which exact path the Dollar takes I’m unsure that the monetary policy decisions being taken will be effective enough to achieve the magical 2% target set by the Federal Reserve without pulling out the last Jenga block, but time will tell how this crumbles unfolds.

I fully believe the financial system is broken in its current capacity and that a new standard for inflation will help usher in central bank digital currencies.

But hey, that’s the conspiracy theorist in me talking.

Update Re: Credit Crisis

If and when big banks fail, the bottom will 100% be in.

🥹🤞🏼

Credit Suisse is one of the world’s largest investment banks and rumours have been circulating for weeks that they may be facing insolvency.

This is reminiscent of the 2008 collapse of the Lehman Brothers that triggered turmoil across the markets

Not good.

Adding to the credit crisis fire we might as burn up personal savings rates…

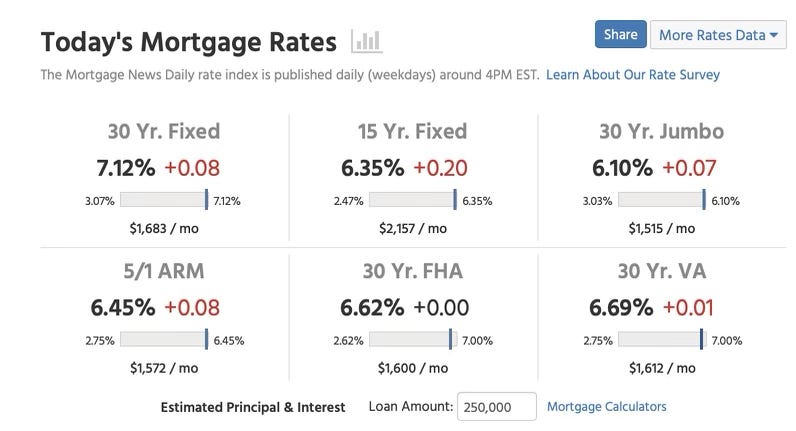

…and sure, lets add gasoline to the mix with a 30yr fixed mortgage rate soaring over 7%

…and at that we have a full blown recipe for a tasty liquidity crisis at any moment.

Once the first domino falls it may cascade the others right behind it.

So, as far as this week went in the news there wasn’t a main headline that stole the show as much a continuation of events unfolding as part of a much larger narrative.

I highly encourage you all to follow me on twitter for a prolific aggregation of up-to-the minute news and information pertaining to the world through re-shares and comments I add.

Next week we’ll dive into the smaller headlines that are specific to unfolding events in the crypto-sphere, but for the rest of today I want to highlight the technical charts for the S&P500, Bitcoin, XRP & Gold with some brief comments on what I’m seeing in the movements before I reveal my #BFMC Crypto Portfolio as the highlight of today’s edition.

- Bramwell

📊 Poll of the Week

📈 BramwellFox MetaCapital’s Technical Analysis

📈 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative

S&P500 (U.S Equities)

💬 📉 🐻 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

If I were an institutional investment bank with plenty of cash sitting ready to deploy, I would be closely holding the trigger going into the next 2-3 weeks.

The S&P500 is oversold across the board and many of the worlds best companies already facing 50% drawdown on share price.

One of the best indicators of true value in the stock market is known as a P/E ratio, or price to earnings ratio. As share prices fall in a bear market, the price part of the formula makes accumulating stocks more attractive. The bottom of a market will truly be in when the earnings side picks up from a contracted economy and makes the stock an irresistible steal.

Let’s quickly cover something obvious.

As I mentioned above, FED Chairman J.Powell stated that Unemployment had NOT yet reached a high enough number to warrant a contracted economy.

You’ve read that right, he wants you to lose your job before we can get back to normal.

So we are looking for headlines of workforce cuts and layoffs to confirm this data as with layoffs companies cut costs and with costs down, profits go back up.

Signs that corporate profit margins are reversing, costs are going down meanwhile share price is forming a technical bottom are hints and clues to predicting a reversal in a bear market.

Are we there yet? Maybe.

The S&P 500 is sitting perfectly above its weekly 200MA (red) in the chart below.

Technically speaking, a short whipsaw below the black horizontal range into the October 2020 highs may produce the reversal strength we need to follow the path in green.

Does the DXY or macroeconomic outlook support this - not really.

As a contrarian it’s easy to sit here and type that outcome, but if I had $1M dollars on the line would I go all-in right now - yikes I don’t think so - I’d also be holding the trigger waiting for confirmation.

If the 200MA does NOT hold, this would be the confirmation that bad things are about to happen as the next logical region for support will be the February 2020 highs followed by the weekly 400MA.

If such a collapse were to occur, worse-case scenarios for Bitcoin and the rest of Crypto would likely unfold as well as a lot of pain for household wealth, an explosion on the credit market scene and the onslaught of a housing market turndown.

All in perfect timing of U.S mid-term elections - how convenient.

Featured Chart S&P500 1W (click to enlarge)

Featured Chart S&P500 12HR (click to enlarge)

Bitcoin (Crypto)

💬 📉 🐻 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

Bitcoin has been following the S&P tightly over the past few weeks and is consolidating on relatively low volume around support which isn’t a great sign.

We’ve seen a number of altcoins showing strength against the BTC pairing and with the macroeconomic landscape looking bleek in the short term it appears BTC may experience another flush to the downside soon.

In the chart below I’ve given two scenarios, one bullish and one bearish.

There is a decision point coming in less than a few days if not hours for Bitcoin to either break above its downward sloping resistance or break below and retest the 18.5 region for support.

If these supports fail, Bitcoin may fall into the 17.5 demand zone which is a glass floor not known for much support. This zone likely will fail causing a free fall into 15K, or much worse the 13K lower region.

My question is, will it drag the market with it? Or will strong altcoins hold their own and de-couple from the king of crypto.

Featured Chart BTC 12HR (click to enlarge)

XRP (Crypto)

💬 📉 🐻 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

XRP has been on an absolute tear surging almost 100% since its September lows.

But what is driving the volume?

XRP has been de-listed for two years from many exchanges and is not available for many US citizens all while being litigated vs. the SEC.

Yet still, XRP has remained a Top 10 cryptocurrency and is leading the market over the last few weeks.

We’ve seen the XRP dominance chart surge to near 3.25% as well as the XRP / BTC chart break out of multi-year resistances.

In saying this, I’m going to show a bullish bias for my XRP analysis given the current fundamentals that could lead to an explosion in its price if the lawsuit were to end in any given day or week.

On a high timeframe, XRP can be seen to be possibly breaking out of a two year long text book bull-flag formation. Should we assume we’re completing Wave 1 of 5 at the .55 cent region, we should expect a possible pullback into the .39-40 cent region (green support) followed by a bullish catalyst that sends XRP into the $1.25 region by early 2023.

In the short term, the volume on this recent wave is diminishing at the same time that we have possible headwinds from the macroeconomic events I’ve discussed above.

Should the worst case scenario unfold, XRP could possibly bottom out in the .25 cent region but its highly unlikely in my opinion.

I’m targeting a short pullback which matches well with other charts and a follow through of strength in mid-late November.

Featured Chart XRP 1W (click to enlarge)

Featured Chart XRP 6HR (click to enlarge)

Gold (Metals)

💬📈🐂Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I’ve been using the price movements of Gold as a revealing indicator of the underlying economic direction.

For two years Gold ranged within a horizontal region before a failed breakdown in October.

This is called a ‘whipsaw’ in the charts and can be followed by an aggressive countermove.

Remember that Gold is an inflation hedged asset and the rumour on the streets is that the available global supply is low.

You would assume given the obvious factors that the Federal Reserve is doing their best to ‘combat’ inflation, that Gold would be a sinking ship in these headwind conditions - yet funny enough, it’s still swimming above support.

This tells me that something is off as with a suspicious rising U.S dollar, we should not be seeing strength return to Gold - but it is.

Perhaps inflation may be here to stay, fiat currencies may have had their last days and a return to Gold back money is looming?

This is my hedging concept and projection for shiny objects into 2023.

Featured Chart Gold 3D (click to enlarge)

💰 BramwellFox MetaCapital’s Cryptocurrency & Digital Asset Portfolio

The following cryptocurrencies & NFT’s make up the #BFMC Digital Asset Portfolio.

A further breakdown of percentage allocation and asset deep dives will be revealed in coming weeks alongside a list of assets on my pending accumulation radar.

Major Positions & Long Term Holds

XRP | Cross Border Payments

FLR / SGB | Smart Contracts & Interoperability

QNT | Interoperability Global Finance

CSPR | Proof of Stake Smart Contracts

HBAR | Hashgraph Consensus Smart Contracts

XLM | Retail Payments

ALBT | Institutional Grade Liquidity & DeFi

XDC | Global Finance & Trade Network

DAG | Directed Acyclic Graph Data Structure

PRO | Tokenized Real Estate

ASK | Web3 Digital Ad Technology

BTC | Proof of Work Payments Network

CSC | Micropayments & Settlements for Casinos

POLY | Tokenized Securities Platform

GLMR | Cross-Chain Smart Contract Platform

ALGO | Institutional Grade Finance Platform

DOGE | Micropayments & Trust Based Culture Network

ETH | Smart Contracts & DeFi Hub

POWR | Renewable Energy Smart Platform

VXV | Artificial Intelligence & Scientific Data Engineering

AKT | Open Source Cloud Blockchain

FIL | Decentralized Data Storage

API3 | API’s for Web3 D’apps

CRO | Native Token for Crypto.com

ELS | NFT Marketplace on the XRP Ledger

SLP | Gaming Token

Songbird NFT’S

Fat Cats Project

Baby Songbirds

Flare Oracle Series

sToadz

Sparkles Genesis Series

Songbird Punks

Canary Punks

CYBR’s

Bored Apes Songbird

Rare Pepe Club

👋🏼 Hey!

Thanks for reading this week's Market Update Edition No. 014

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!