🗞 Weekly Market Newsletter | Edition No. 13

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, October 2nd

Hello Everyone,

It’s interesting to close your eyes and ponder about our global financial system while asking yourself “…does any of this make any sense?”.

Well I did one day, and my conclusion was - '“I don’t think it does.”

I mean in simple terms, we have governments that are in trillions upon trillions of dollars in debt to other nations while at the same time those same nations have derivatives contracts of foreign debt obligations of other nations hedged against fixed income and over-leveraged (semi-backed) baskets of unbacked hard money of those same nations wish paper currency wishy washy backflip flip-flop fall upwards uh-oh what are we doing and how did I get here and what was I talking about again?

…that’s how I feel when I think about our financial system.

Just lost in confusing words and numbers that I’m supposed to believe people smarter than me know what they’re doing.

The problem is, I’m unsure they are.

I’m more confident that our financial system is a byproduct of an antiquated way of doing business human-human and nation-nation and that for the most part, no generation wishes to pull the last Jenga block.

Will we be the generation to topple it?

Thoughts to consider as we move into this week's edition.

- Bramwell

🗞 BramwellFox MetaCapital’s Weekly News Recap

Major News Headlines

🗞 Currency Crisis Unfolds - GBP & Euro at multi-decade lows.1

💭 Bramwell’s Long-Winded Thought

Currencies for the most part are debt obligations unbacked by Gold (or any true hard form of money anymore) meaning a collapse in the global currency system (or at the very least an orchestrated re-structuring of global finance) will be required to save major economies from a liquidity disaster should further currency devaluations continue.

🗞 Dow Jones & NASDAQ in a Bear Market - Worst Quarterly Streak since 08’2

💭 Bramwell’s Long-Winded Thought

The rumour is true, the equity markets look terrible at the moment.

In such a macroeconomic environment like we’re experiencing where investors are seeking refuge in cash (U.S Dollar) and selling risk assets at a frantic pace, no doubt that pressure isn’t typical of the last 10-15 years.

But as my friend Mark once told me to which I’ve slightly changed the wording, “…history doesn’t repeat itself, but often travels in cycles.”

With all of this cash on the table in record amounts, there will come a trigger price for institutions and retail to begin re-entering into the market.

Smart money will go gobble up the lowest prices first meanwhile retail will fend for the scraps at higher prices.

So, when I hear that a market index is in its “worst streak since”, all I’ve trained myself to hear is that a bottom is close - pay attention to the headlines in Uptober.

🗞 Yield’s continue to soar, 30YR Fixed Mortgage Rate 6.86% - is a credit crisis looming?

💭 Bramwell’s Long-Winded Thought

I feel for those locking in a 30YR 6.86 % mortgage today - that’s a lot of interest to pay stacked into a monthly payment.

Furthermore, I keep hearing the voices in the back declare ‘but housing prices will only go up from here, lock in a property while you can!’ however I can’t seem to find logic in that statement as the laws of supply and demand appear to be in favour of lower home prices in the future, not higher.

*unless we’re adjusting for inflation, but in nominal terms not a chance.

My thought process is that the new generation of humans do not possess the same want-to-settle behaviour of previous generations.

They wish to be free of physical anchors from their workplace to their home location - and last time I checked no one is taking their mortgage with them on the road.

With this changing ideology of life itself, alongside improvements in work-from-anywhere technology, we may very well experience a decrease in demand for home mortgages in the long term and a reset of financial contracts for living arrangements similar to how AirBNB disrupted the market over the past 10 years.

(sorry, slightly longer ramble than required up there)

Ah yes, returning to the news headline about unaffordable rates and a credit crisis.

Something is going to break.

When consumers are short on cash and over leveraged on their largest asset with no where to hide from inflation and a stagnant wage, no doubt we’re about to experience a cascade of credit defaults.

I’m looking for the first domino to fall.

🗞 Nord Stream Gas Leak + Putins' warning to the West, is an energy crisis looming?3

💭 Bramwell’s Long-Winded Thought

I read a perfect translation of a speech Putin gave last week to his country referring to the West as (i’ll paraphrase by memory) “power hungry capitalists seeking to colonize the remaining nations of the world under one American umbrella of labour and control” thus needless to say, he’s quite upset.

Coincidently this week, the Nord Stream Pipeline was apparently sabotaged with the West pointing fingers at Putin, and Putin pointing fingers back.

So we’re now down to an old fashioned game of who dunnit?

Likely the blame game will continue in the short term between leaders but this seriously means trouble for the global energy supply and not a good sign for my prediction on a cold winter for the world.

I’ll be paying attention to the energy sectors globally and and reversal in commodity price strength.

🗞 FED Chairman Jerome Powell discusses Crypto4

💭 Bramwell’s Long-Winded Thought

The week started off on Tuesday with FED Reserve Chairman Jerome Powell discussing the role that blockchain may play with CBDC’s (Central Bank Digital Currencies) and also touched on the regulation of stable coins.

I believe it’s very bullish that we’re at a place in time where crypto is being discussed amongst the leaders of central banks as a superior technology to our legacy systems.

Although given the current state of the global financial marketplace, we cannot expect too much attention to be publicly discussed in the open that may give us hints of when & what exactly their plans may be to integrate blockchain or which networks may lead the path forward.

Although one more, I have an idea.

🗞 Ripple vs. XRP Lawsuit Update5

💭 Bramwell’s Long-Winded Thought

This week didn’t disappoint in the ongoing saga between Ripple v. SEC as many outside supporters of the XRP ecosystem (including the Digital Chamber of Commerce + A Luxury Airliner) wrote into the court filing multiple documents on behalf of / to support the defendants Ripple Labs.

In addition, Judge Torres scored a win for Ripple by overturning the SEC’s objections to producing the highly anticipated Hinman e-mails.

These turn of events have been speculated to possibly lead into a settlement on the case as the probability of a Ripple win has skyrocketed.

We’re going jump into the technicals shortly on the $XRP price and its reaction to the news.

🗞 Bramwell’s Must-Read Crypto Stories

📈 BramwellFox MetaCapital’s Technical Analysis

📈 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative

The U.S Dollar + U.S Treasuries

💬 📉 🐻 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The Federal Reserve is holding an emergency meeting to start the week, and it’s a closed door meeting.

Federal Reserve #FED holding Emergency Closed-Door Meeting, Monday Oct 3, 22 11:30am EDT Meltdown Monday coming? Volatile September - rumors Major International Bank Default - Credit Suisse ? Banks indicating there IS a problem ? federalreserve.gov/aboutthefed/bo… reddit.com/r/stocks/comme…This emergency meeting comes at a critical time as just last week central banks around the world launched intervening measures to prevent a systemic currency collapse as markets reacted haywire to the soaring U.S Dollar.

I’m leaning bearish on the dollar in the short term to correct back into the 109.5 range allowing room for risk-assets sitting on support to breathe.

As a result, we should see US 2&10YR yields drop in unison as charted below.

If this path is NOT taken, we’re looking at severe implications for the world if the DXY reaches the 115 to 120 range.

All eyes on macro this week.

Featured Chart DXY 12HR

Featured Chart US10YR 1D

Featured Chart US02YR 1D

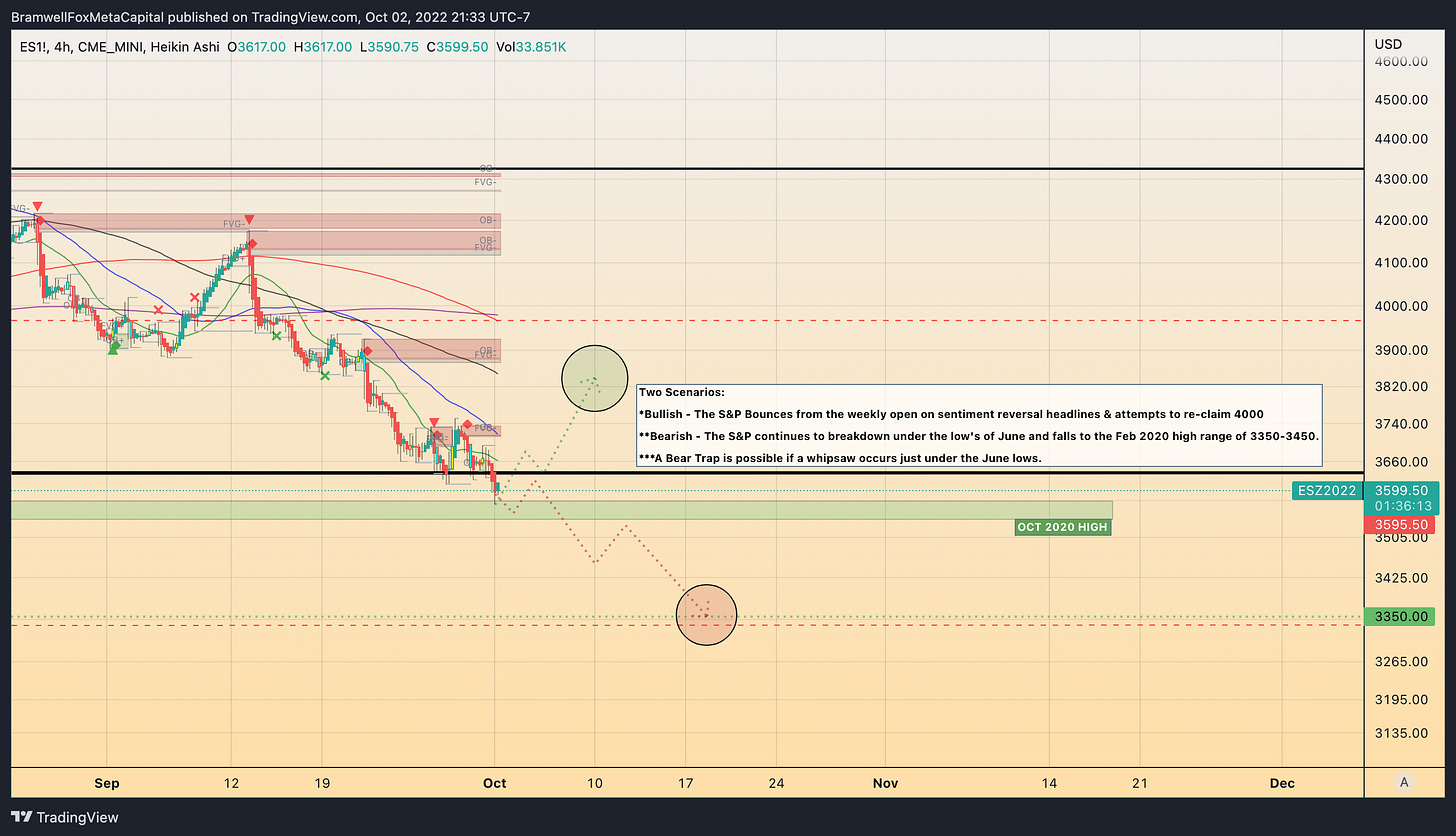

The S&P500 + VIX

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

It’s do or die time for the S&P500.

We need a bounce early in the week due as we’re dangerously close to seeing a support breakdown into the 3350 range.

Despite the volatility in the past quarter, I’ve been long risk assets playing the contrarian bias as I’m hedging that those in power will not allow further downside to the financial markets heading into an election mid-terms for the U.S.

What is equally as nauseating is the VIX (volatility index for the S&P) being in a danger zone ~30 (see chart below) as 32.5 rings the doorbell to the dot-com era crash and 2008 financial crisis.

Luckily as of the time of writing, it appears the VIX is getting rejected from a key area. The next few days will be important to monitor the markets.

I’m bullish on a small rally this week that may lead to a reversal.

Featured Chart S&P500 1W (Bullish Bias, both scenarios projected.)

Featured Chart VIX 1D (Possible top forming, reversal could be expected.)

BITCOIN

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

While the week may start rocky for crypto asset prices, I’m not expecting Bitcoin to follow the path in red which would take us into the mid 15.5K range and further drop altcoins <20%.

It may still occur in time, but I’m not convinced this would be the week.

Given where the dollar is sitting at the time of writing I’m expecting a small BTC selloff as markets open on money for U.S equities, followed by strength through the week as Bitcoin potentially breaks out of a short term downtrend with sights on 22K.

Featured Chart Bitcoin 6HR (Leaning Bullish)

Featured Chart Bitcoin 1W (If Bearish on a High Timeframe)

XRP

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The bullish fundamentals continue to pour into the XRP ecosystem.

On chain activity and wallet addresses have been soaring, whale activity notifications have shown hundreds of millions of dollars pouring into the network and headlines are breaking every week as the Ripple v. SEC lawsuit comes to an inflection point.

After a small wave impulse, XRP tested its daily 200MA and was rejected as expected. Its next move may be to finalize a short correction into the low 40 cent range and gather momentum to produce a bullish break to the targeted 60 cent range.

On a weekly timeframe, should XRP bulls fail to hold the line, or should any macroeconomic events further deteriorate, a possible drop to 25 cents isn’t out of the question - have cash ready on the side in the event this asset is in your portfolio.

Featured Chart XRP 12HR (If Bullish on Q4 Risk)

Featured Chart XRP 1D (If Bearish on High Time Frame)

GOLD

💬 📈 🐂 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I remain sneakily bullish on Gold and nothing has changed on my prediction that Gold experiences a bull-run through Q4 2022 into 2023.

Many are projecting a Gold bear market as high time frame support was recently lost, however I attribute much of this sell-off to a soaring DXY.

As the Dollar loses strength we should see investors rotate back into metals.

Featured Chart Gold 1W (Bullish Bias on Gold High Time Frame)

Oil

💬 📉 🐻 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I’ve been correct on Oil all summer into Fall with my call on a $75 dollar barrel in Q4, and we nailed the target.

I feel Oil is potentially forming a bottom on its corrective wave and should be gaining strength for a reversal to the upside.

All eyes on Russia and the energy crisis looming to give hints on the strength of Oils next move.

Featured Chart Oil 1D (Corrective bottom forming - possible reversal incoming.)

👋🏼 Hey!

Thanks for reading this week's Market Update Edition No. 013

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!