🗞 Weekly Market Newsletter | Edition No. 43

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, June 11th, 2023

Hello Friends,

Years ago, I was asked my thoughts on a particular hypothetical situation:

Q: What would happen if governments shut down the fiat on/off ramps into crypto or, worse, litigated the primary exchanges where the vast majority of cryptocurrencies are traded into oblivion?

Q: How would we be able to convert our cryptos in the event they appreciated in value?

Back in 2020, I offered two (2) perspectives to consider.

Perspective #1: Without any doubt in my mind, we are undergoing the transformational merger of our traditional financial system with a distributed ledger-based financial system that will change the global economy as we know it.

For this event to come to fruition (and for the capital we have invested in owning portions of these data-based blockchain networks to appreciate), mass adoption must occur.

For mass adoption to occur on a meaningful scale, legislation and taxation laws must be instituted globally to ensure governments can both take their share (fair or otherwise) while maintaining a degree of control so that the digital economy doesn’t become lawless and underground. I wrote about this in a July 2022 edition that is worthy of a re-read.

It has been a fun ride observing the infancy stages of crypto, where 10,000x ROI were the norm and shitcoins popped off every cycle, making millionaires by the hour. It should surprise no one that eventually the party inside this pseudo-online casino would end with a whipping from Uncle Sam.

To be quite frank, I’m grateful that we may have arrived at our destination in time. More on this will be covered shortly below where I'll discuss the major news events from last week.

So, my first perspective on the hypothetical question of what if exchanges and fiat ramps get shut down can be summarized as follows: "That situation would mean we are moving closer to mass adoption and integration than we want to believe, and it should be considered to be a catalyst, not a detriment to the space."

When the "non-compliant exchanges, scam artists, fraudsters, and hucksters" (a paraphrased quote from SEC Chairman Gary Gensler last week) - all which currently act as the unwanted weeds & insects of the crypto space, pack their bags and leave, it will allow for greener pastures to grow.

Therefore, in the short term, we would expect in the event of this occuring that the liquidity from illegitimate sources that have been funding these exchanges and protocols will dry up as the exit gates begin closing, causing more fear and panic and a cascade of sell-offs to occur.

That event somewhat began last week with Operation Chokehold executing in full swingas the SEC launched two ground-shaking lawsuits against Coinbase & Binance, two of the most prominent centralized exchanges in the industry.

The U.S appears to be grooming the landscape and rolling out the red carpet for their major institutions to pummel their way into crypto, purchasing wholesale digital assets at cents on the dollar and setting up shop under the new framework of laws likely to be introduced simultaneously to these actions.

All of this is part of the plan. Likely, when that happens, crypto investors will be funneled through these institutions that have implemented proper KYC and Anti-Money Laundering procedures to ensure everything is tracked, recorded, and taxed in a proper manner.

If you’re a criminal, this sucks and you’re angry.

If you’re a serious long-term investor, you somewhat welcome this wave of change, despite the short-term pain it will inflict on your portfolio.

Perspective #2: My second perspective on this question is a mind-boggling concept to grasp, and although it is still foggy in probability, it must be examined nevertheless.

Reminding you of the initial question, “In the event that ‘X’ Government shuts down fiat on/off ramps and exchanges, how may we convert our cryptos?”

I believe it's fair to say that most people calculate wealth and capital in terms of fiat, i.e., dollars - don’t you?

We think this way because we are accustomed to an economy in which we measure monetary value based on a traditional financial system, somewhat similar to how parts of the world measure distance in imperial terms and others in the metric system.

But have you explored the possibility that by the time these data networks appreciate in value, it may be long after laws are legislated governing the creation, operation, and taxation of digital assets, and therefore a conversion into fiat may not be necessary in the same context as previously thought?

Many believe that the collapse of one system will bring forth a new one. Thus, metaphorically, it's like assuming that if you were lost at sea after your boat capsized, once the ship arrives to save you, you decide to jump back on the sinking ship because it's familiar.

Most are waiting for this crypto revolution to unfold, only to jump back into fiat currency when the networks appreciate in value and ride off into the sunset.

Can you spot the issue with this paradox?

I’m not saying I have never speculated on how dollar-rich I may one day be if crypto goes to the moon 🚀. Naturally, it’s how I measure value too. But I’m also open to the possibility that this operation chokepoint by the government may throttle the liquidity bandwidth (or even close the bridge) to fiat land permanently. My positioned capital into crypto may take the form of a new system of value we cannot quantify in its current state.

In conclusion to my opening words for you this week, I’ll leave you with my ultimate opinion on what happens next before we jump into the news from last week and the charts.

I do believe that in the short term (less than 2 years), there will be another expansion cycle in the crypto market where legitimately developed digital assets with real use cases experience a tremendous influx of liquidity. Meanwhile, the remaining 99% will be deemed either securities or somewhat illegal to possess or unable to convert.

I do believe that a wave of regulations across the globe will usher in legitimate on/off ramps including exchanges and banks that operate under the law (such as we see now here in Canada with Newton, BitBuy, etc.). These players will take over the market share of trading with a featured list of cryptocurrencies deemed ‘legal’ to possess, invest, transact, and utilize. Thus, ensuring your portfolio is comprised of fundamentally rock-solid cryptos is imperative should you wish to convert into fiat during an expansion cycle of value (i.e., bull run).

I do believe in the long run, 2-5 years from now, many financial assets will be denominated in non-fiat terms for value measurement. It’s a hard concept to grasp, but I do see this becoming a reality in some way, shape, or form. However, whether by that time we still hold the same digital assets as we do now is something I cannot forecast as we must be dynamic in our approach to investing in this space and not marry a bias if confronted with overwhelming evidence when the time comes. There is a difference between logically differentiating an underlying narrative and being naive, falling in love with a bias that no longer serves you.

I do believe it’s possible that in the short term, a very small number of digital assets are given legal clarity, meanwhile, the rest of the space remains in legal purgatory for months if not years to clear their name. This is why, from the beginning, I’ve advocated for extremely diligent research on whitepapers, the founding teams and developers, and roadmaps of any digital assets you have invested in your portfolio. If a very small batch of assets (such as XRP, BTC, ETH, etc.) is given legal clarity, I can only imagine the amount of liquidity that will be transferred into these select few in the interim.

These are some thoughts for you to consider on the backs of an explosive last 10-14 days in the markets. Enjoy my rundown of the news headlines below and be sure to check the charts for my forecast on the direction of the markets this week heading into an incredibly important week that features both FOMC on June 14th and a slew of impactful events in the early week.

- Matthew Fox

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 The SEC formally announces lawsuit vs. Binance (View Tweet / Article)

This week Binance, the world's largest crypto asset trading platform, along with its U.S. affiliate BAM Trading (which operates Binance.US) and founder Changpeng Zhao, have been charged by the Securities and Exchange Commission (SEC) for multiple securities law violations.

According to the SEC, Zhao and Binance allegedly sidestepped their own restrictions to allow high-value U.S. customers to trade on Binance.com, despite public claims that U.S. customers were barred from the platform. It's also alleged that Binance.US, promoted as a separate, independent trading platform for U.S. investors, was in fact secretly controlled by Zhao and Binance.

The SEC further claims that customer assets were managed and manipulated by Zhao and Binance, even allowing these assets to be mixed or diverted to Zhao's entity, Sigma Chain. Additionally, BAM Trading and BAM Management are accused of misleading investors about non-existent trading controls over the Binance.US platform, and Sigma Chain is said to have engaged in manipulative trading that falsely inflated the platform's trading volume.

The lawsuit also accuses Binance and BAM Trading of operating as unregistered national securities exchanges, broker-dealers, and clearing agencies, and alleges that they illegally offered and sold Binance's own crypto assets such as BNB, BUSD, certain crypto-lending products, and a staking-as-a-service program.

SEC Chair Gary Gensler accused Zhao and Binance of deception, conflict of interest, lack of disclosure, and calculated evasion of the law, stating that investors were misled about their risk controls, manipulated trading volumes, and custodial details.

In conclusion, the SEC alleges that, since at least July 2017, Binance.com and Binance.US, while under Zhao's control, functioned as exchanges, brokers, dealers, and clearing agencies and earned at least $11.6 billion in revenue from U.S. customers, while allegedly violating numerous registration requirements.

This legal action by the SEC is indeed a pivotal moment for the cryptocurrency industry. If we view this case through the lens of the SEC's potential agenda, it can be seen as a strategic move to regulate what it perceives as uncontrolled on- and off-ramps to the world of cryptocurrencies. Binance, being the world's largest crypto exchange, is a perfect target for such an intervention.

The SEC's allegations against Binance and Binance.US go beyond mere operational violations. The very assets they have been trading, including BNB and BUSD and many others are being classified as securities in the case, a classification that has long been a point of contention within the crypto sphere. If Binance admits fault, it could potentially set a precedent for the SEC to classify similar assets as securities, leading to a domino effect that could have far-reaching consequences for the entire industry.

This places exchanges like Binance in a precarious catch-22 situation. They can either fight the charges, a battle that would involve millions, if not billions, in legal fees and considerable delays. Given the intricate nature of securities laws and the novelty of cryptocurrencies, such a case could stretch on for years, draining resources and causing potential reputational damage.

On the other hand, admitting fault would have immediate, industry-wide repercussions. It would provide the SEC a key foothold to categorize cryptocurrencies as securities. This would subject them to a far stricter set of rules than they are currently subject to, potentially stifling innovation and throttling the burgeoning DeFi sector.

Moreover, such an admission could create a chilling effect on exchanges and crypto businesses. This could lead to a reduction in services provided, at least in the short term, as exchanges grapple with the complexity of securities regulations. The net effect would be a contraction of the space and a significant setback for the adoption of crypto.

It's worth noting that this very event is what I was discussing in my intro where it becomes a catalyst for regulated exchanges to step in and now take over the market share.

It’s valuable to take the highroad perspective and see that proper regulation is necessary for cryptocurrencies to gain mainstream acceptance and to eliminate scams and fraud, which are issues that currently plague the industry.

Still, the question remains as to whether the existing securities framework is the right fit for such a new and disruptive asset class.

As such, the industry now sits on a precipice, waiting for the outcome of this case, which could either lead to a period of uncertainty and potential decline or possibly pave the way for a new era of regulatory clarity and acceptance.=

🗞 1 Day Later - The SEC formally announces lawsuit vs. Coinbase (View Tweet #1 / View Tweet #2)

Then, in a stunning move the SEC announced a lawsuit against Coinbase just a day after unveiling charges against Binance, sending shockwaves through the crypto industry.

This back-to-back legal action against two of the world's largest crypto exchanges is a thunderous crackdown that has rattled the market's confidence and potentially posed a threat to the perceived value of crypto investments.

The charges against Coinbase echo those against Binance, accusing the platform of operating as an unregistered national securities exchange, broker, and clearing agency, as well as failing to register its staking-as-a-service program.

While similarities exist between the cases, the context is strikingly different. Unlike Binance, Coinbase is a publicly traded entity in the U.S. subject to intense scrutiny and transparency. The SEC's decision to launch a lawsuit against such a high-profile and compliant company amplifies the gravity of its intentions to redefine and control the crypto space.

The implications of these legal actions are far-reaching and profoundly alarming for the crypto industry. The regulatory offensive could trigger a dangerous ripple effect across the sector. The sudden and simultaneous legal attacks on Binance and Coinbase could damage investor confidence and destabilize market value. Potential investors may shy away, and existing ones may retreat, driving down the value of crypto assets.

If public companies like Coinbase lose their value during a prolonged legal battle, they might become ripe targets for acquisition by larger corporations or traditional financial institutions, integrating them into the legacy financial system.

These shocking developments suggest that no crypto company, no matter how large or compliant, is immune from regulatory scrutiny.

While these lawsuits are ostensibly about bringing crypto operations under securities laws, they also hint at a broader narrative: a power play to tame the decentralized crypto space and embed it more deeply into the regulated financial system. In light of these events, the crypto community must brace itself for potential turbulence and consider strategies to maintain market confidence amid this aggressive regulatory onslaught.

🗞 Gary Gensler’s Agenda vs. Crypto + Binance Job Rejection (View Tweet / Article)

Can you believe it?

In 2019 Gary Gensler was rejected for an advisory position at Binance, what a turn of events brought to light last week.

If proven true, the assertion that Gary Gensler sought an advisory role at Binance in 2019 is highly significant. It raises several pressing questions about conflicts of interest, regulatory impartiality, and potential abuses of power.

The key implication here is whether Gensler's prior interest in working with Binance could affect the fairness and objectivity of the SEC's actions. Did his potential previous interest in the company influence the decision to press charges against Binance, and if so, how? Was it a move borne out of rejected ambitions or simply strict regulatory enforcement?

Moreover, such a connection could taint the SEC's image. Accusations of corruption and protecting big banks and major financial players have long surrounded the SEC. This news might further fuel speculations about the agency's potential bias towards legacy institutions over disruptive technology companies like Binance and Coinbase.

The news also casts doubt on the credibility of the SEC's crypto enforcement actions. The crypto community could perceive the lawsuits as personal vendettas rather than legitimate regulatory oversight, especially given the drastic measures taken against two major crypto entities in quick succession.

While these allegations are currently speculative, they underscore the importance of transparency and impartiality in the regulation of emerging financial technologies. If trust in regulatory fairness is lost, it could exacerbate the destabilizing effect the recent lawsuits have had on the crypto market. As the situation evolves, it's crucial for all parties to strive for clarity, fairness, and above all, to maintain the integrity of the burgeoning crypto space.

🗞 Most Important Date in History for Crypto - June 13th

You couldn’t even script this type of week if you tried; it’s as action-packed as one can get and June 13th specifically is shaping up to be the most important date for crypto of the year - here’s why;

On June 13th:

Binance.US will officially halt all USD withdrawals effectively closing the door on its USD liquidity for on/off ramps.

The Hinman E-Mails are scheduled to be released to the public from the Ripple vs. SEC Lawsuit.

Remember this tweet from CEO Brad Garlinghouse?

Is a settlement in the works or is this case going to trial?

How damaging are these documents to the credibility of the SEC?

We will find out this week.

The House Financial Services Committee will host a committee hearing titled ‘The Future of Digital Assets: Providing Clarity for the Digital Asset Ecosystem’.

Now what are the chances all of these events are happening all at once coincidently one day before the June FOMC meeting in which nearly all asset classes are frothy with liquidity and on the edge of their seats awaiting the explosive reaction from the FED on whether to raise or halt interest rates?

Hodl’ on to your seats.

🗞 Important Economic Data Events This Week; All Eyes on June 14th (Federal Reserve FOMC)

These events will all be drivers of liquidity events in the markets, expect volatility.

🗞 Bank of Canada’s Surprise Interest Rate Hike (View Tweet / Article)

The Bank of Canada (BoC) took markets by surprise last week with a surprise hike in its target for the overnight rate to 4¾ %.

The significant increase is a clear response to stubbornly high inflation and stronger than expected economic performance, with GDP growth reported at 3.1% for Q1 2023.

In short, the Canadian economy is running hot.

Here are the key implications for various markets:

Forex Markets: The rate hike is likely to boost the Canadian Dollar, given that interest rates are a significant determinant of currency value. A higher interest rate tends to attract foreign capital looking for stronger returns, leading to currency appreciation. However, this strength might be offset somewhat if other central banks also tighten their monetary policy in response to global inflationary pressures. We’ll now watch for the U.S Counterpart FED on June 14th for their next chess move.

Housing Markets: Higher interest rates typically make borrowing more expensive. This could slow down the recently picked up housing market activity as mortgages become costlier. Additionally, increased rates might also cool off any potential housing bubbles by making speculative buying less attractive.

Risk Assets: The higher cost of borrowing can make riskier assets like equities less attractive as well, as companies' borrowing costs increase and profitability can be impacted. Additionally, the higher return on safer assets could shift investor preference towards lower-risk assets, leading to a potential sell-off in riskier assets.

General Economy: While the BoC's move is a response to strong economic performance and inflationary pressures, there is a risk that a sharper than expected slowdown could occur due to the higher borrowing costs. A balance will need to be maintained to avoid stifling growth while managing inflation.

Inflation remains a primary concern, with the CPI hitting 4.4% in April - the first increase in ten months. The BoC anticipates this will ease to around 3% in the summer, but persistent excess demand raises the concern that inflation may become entrenched above the 2% target.

The BoC's resolute commitment to restoring price stability could mean further rate hikes in the future. This potential scenario adds to the level of uncertainty and volatility in the markets and I’ll have to pay closer attention than normal to Canadian based economic data moving forward.

🗞 The Exponential Age Upon Us (View Tweet / Article)

Peter Diamandis succinctly summarized the key factors contributing to the current explosion in AI: Moore's Law, the doubling of global data every two years, increasingly efficient algorithms, and the massive influx of capital into AI technologies. This represents a profound shift, signalling that we are on the cusp of what many are calling the 'Exponential Age' of technology, a period of unprecedented and rapid technological growth that has the potential to reshape every aspect of our society.

The 'Exponential Age' marks a departure from the previous era of linear technological progress, where advancements were made at a consistent, predictable pace. Instead, we are entering an age where technology is evolving at an accelerating rate. As Diamandis points out, the cost of training AI systems has decreased by 99.5%, and global data is doubling every two years, which means AI's potential for innovation and disruption is growing at an exponential pace.

What does this mean for investors and industries? It represents an extraordinary opportunity. The industries at the forefront of this exponential growth - AI, quantum computing, biotech, nanotechnology, blockchain, and more - are ripe for investment. The massive inflow of capital, as evidenced by the $160 billion invested in AI in 2021, is already indicative of the perceived opportunities in these industries.

However, investing in the Exponential Age also brings unique challenges. As technology advances at an ever-increasing pace, the landscape becomes more complex and harder to predict. This means that investors need to be well-informed, adaptable, and ready to navigate a rapidly changing landscape.

In terms of industries, the rapid advancements in technology will drive innovation and disruption. Companies will need to adapt quickly, integrating these new technologies to stay competitive, or risk being left behind. The Exponential Age will also spawn entirely new industries and business models that we can't even imagine yet.

In essence, the Exponential Age represents both enormous opportunity and significant risk. It calls for a new mindset, one that embraces rapid change, fosters innovation, and is prepared to navigate the unprecedented growth and uncertainty that will define this exciting new era of technological progress.

🗞 Credit Card Debt vs. Savings (View Tweet / Article)

What does this chart tell you about the current state of our economy?

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

My projection for this week's markets hinges primarily on the key liquidity event - the Federal Open Market Committee (FOMC) meeting scheduled for June 14th.

While market players currently exhibit higher optimism regarding the possibility of a pause in rates compared to the rest of the year, I'm somewhat skeptical about this being the final decision on Wednesday. I predict that the Federal Reserve (Fed) may decide to raise rates by 0.25 basis points (bps) one last time, a move likely to generate significant volatility across most markets, including treasuries, stocks, cryptocurrencies, and metals. This rate hike would offer the Fed control over markets in anticipation of July’s FOMC, without providing either bulls or bears significant influence to excessively influence the financial markets.

Switching our attention to forex pairs, the Bank of Canada (BoC) surprised markets last week with a 0.25 bps rate hike. This development instigates considerations regarding how it may influence Chairman Powell and the Committee's decision on Wednesday. The BoC prematurely halted rates, and I doubt the Fed would want to emulate this and risk overheating the economy prematurely.

I expect the Canadian Dollar to break above resistance and target the median of the yearly range, approximately 0.75 to 0.76. I also forecast that the Euro will gain ground on the Dollar Index (DXY), despite maintaining a bearish stance due to the potential formation of a head and shoulders (H&S) pattern on higher timeframes.

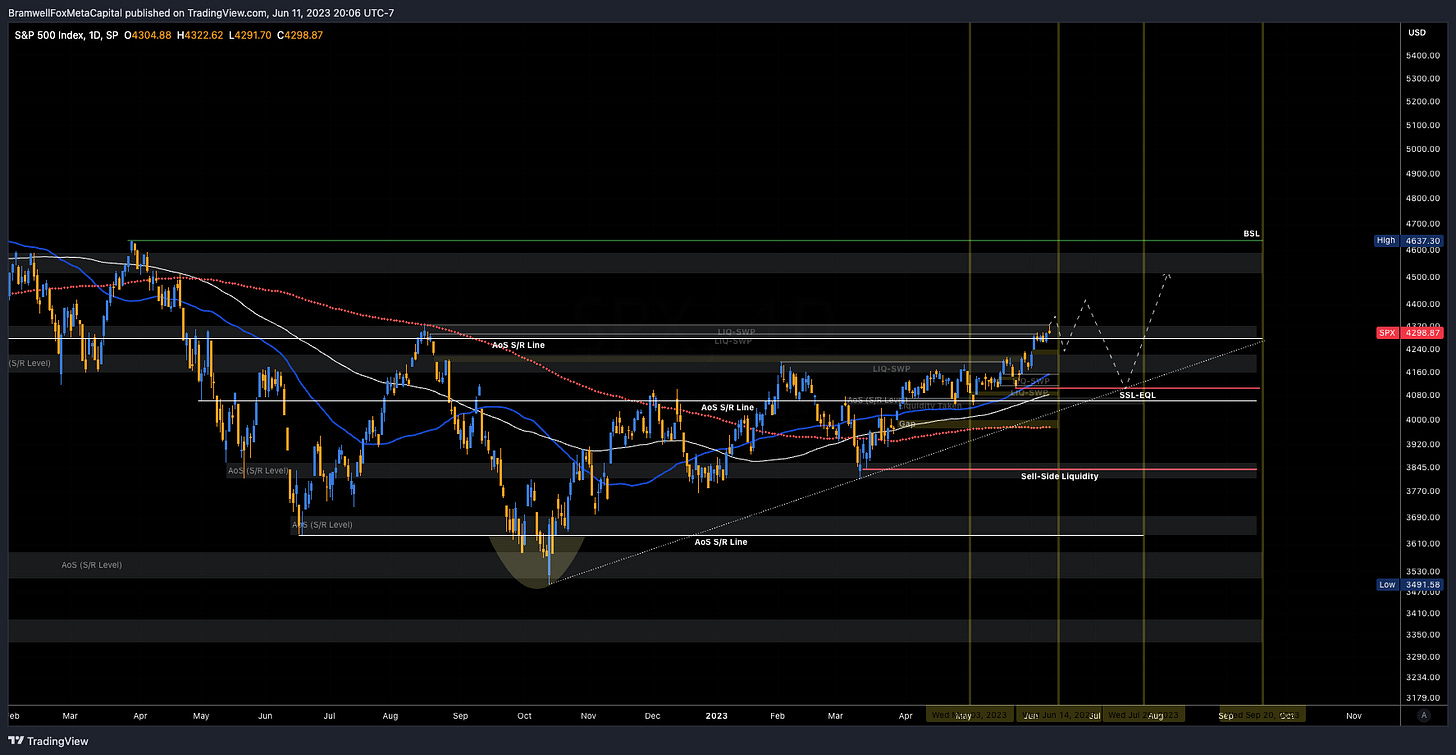

The S&P 500 has experienced a remarkable rally over the past two weeks. Given its current position atop my buy-side liquidity zone, combined with a nearly bottomed-out VIX, I predict a volatility spike this week. However, I remain bullish on risk assets in the longer-term, towards Q3 and Q4, though I foresee some aggressive intraday and intraweek movements.

I'm less optimistic about the Toronto Stock Exchange (TSX) due to my prediction of declining oil prices, which could significantly impact the earnings of many blue-chip TSX companies. Coupling this with recent interest rate hikes, I anticipate that investors may begin to doubt the earnings reports of numerous top Canadian firms, leading to a drop in prices over the next few weeks. My downside target for the TSX is 19,150.

The potential for the DXY to continue its descent hints at a possible bond price rebound, which is why I suspect Treasury yields will drop sharply post-FOMC this week. The Fed has been unable to meet their 2% inflation targets and has consistently shown a cautious approach in recent meetings. If we couple this with the short-term increase in the debt ceiling, it seems likely that inflation will not hit 2% in the near future. This should allow inflation hedge assets like Gold and Silver to appreciate slowly.

In terms of market rotations, I believe capital will shift from stocks to the currently lagging crypto industry, which currently offers the highest return on investment (ROI) from a risk-to-reward standpoint. Crypto sentiment remains fear-stricken, even though equity markets are frothy. I'm anticipating a volatile week that flushes leverage from both sides of the crypto market, followed by a swift price uptick.

Of course, only time will reveal the accuracy of these market predictions.

FOREX

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 DXY(U.S Dollar) + 📈 CAD + 📈 EUR

Featured Chart DXY 1D (click to enlarge photo)

Featured Chart CAD 1D (click to enlarge photo)

Featured Chart EUR 1D (click to enlarge photo)

Equities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🐂 S&P500 + 🧸TSX + 📈 VIX

Featured Chart S&P500 1D (click to enlarge photo)

Featured Chart TSX 1D (click to enlarge photo)

Featured Chart VIX 1D (click to enlarge photo)

Treasuries (Yeilds)

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 US2YR & 🧸 US10YR

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🐂 Bitcoin & + 🐂 XRP + 🐂 Total Crypto Market Cap + 📈 Total Altcoin Market Cap

Featured Chart BTC 1D (click to enlarge photo)

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart TOTAL 1D (click to enlarge photo)

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 Oil + 📈Gold & 📈 Silver

Featured Chart Oil 1D (click to enlarge photo)

Featured Chart Gold 1D (click to enlarge photo)

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 43

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!

Best intro to date! 🙌🏻