🗞 Weekly Market Newsletter | Edition No. 47

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, July 16th, 2023

Hello Friends,

It was almost three years ago (to the day) that I was driving down the road, listening to satellite radio, when I heard the show hosts, during a music break, discussing some gibberish about Elon Musk and some digital crypto money thing he was talking about called a Dog(e) Coin. I changed stations and didn't think much of it.

But the headline piqued my interest, and when I arrived home that day, I tried to YouTube the headline and was bombarded with video thumbnails that looked like this 👇🏼

There was so much for me to digest all at once but let me share with you my train of thought(s)

What are all of these digital ‘coins’ and why do those complicated charts in the background of all of these videos have rocket ships emoji’s going to the moon?

I vaguely remembered that one time, back in 2015, when a friend introduced me to this 'Bitcoin' thing. He was using it to send payments across the dark web for fitness supplements. But as he explained the process to me, I was completely overwhelmed.

I recall him showing me how to open a digital wallet with all these numbers and letters. He had to use encrypted computer software and rely on Russian third-party vendors to purchase Bitcoin before sending it to an anonymous seller, hoping that the payment would arrive and he would receive his goods.

Now, sitting in my office 5 years later, I was flabbergasted. I asked myself if all these digital coins were somehow related to that Bitcoin thing. I mean, I had a 5-year heads-up on this technology, and I won't lie, I was shocked that it had flown under my radar. Teenagers seemed to understand it well enough to make sound investment decisions and create YouTube videos about it.

I needed to know more.

/ short side note 👇🏼

It's worth highlighting that the important part of this story has to do with the fact that the world was now in month three of an international shutdown due to a foreign virus. People were dropping dead in the streets, and our entire economy was virtually shut down, including my primary source of income as an online lifestyle coach.

With plenty of time on my hands, I had already been on a 5-6 month binge of reading as many books as I could about the future of technology and economics. Some of the titles I delved into were:

'The Future is Faster than You Think' by Peter Diamandis

'21 Lessons for the 21st Century' by Yuval Harari

'Capital in the 21st Century' by Thomas Piketty

'Sapiens: A Brief History of Humankind'

These profound texts delivered powerful lessons on the history of money, the problems we currently face with our monetary system, the economy, and society as a whole. They also provided projections on what the future holds for money and the potential role of technology in creating a new financial system.

One could say that it was sheer fate or karma that my thirst for knowledge on these subjects had programmed my subconscious to listen more carefully that day to my radio. Who knows?

/ returning to me in my office looking up Dogecoin headline 👇🏼

So I needed to know more.

I spent the evening down rabbit hole after rabbit hole, watching video after video, reading article after article and at the end of the night I had made up my mind - I knew everything I needed to know about cryptocurrencies:

Cryptocurrencies are random 3 letter symbols that people try to guess using crazy charts which direction the price will go. It’s like a form of complex math using something called technical analysis mixed with degenerate gambling investing.

And as I mentioned, I had plenty of time on my hands and was looking for a new hobby.

Interestingly enough, it just so happened that my wife and I had a scheduled meeting at a local bank to open new accounts, which we had planned weeks in advance. Despite having lived in British Columbia for two years, we still dealt with branches on the East Coast for our primary business transactions. Opening new personal accounts locally seemed like a convenient choice for personal expenses.

During the meeting with the advisor, we opened a checking account, a savings account, and a tax-free savings account for each of us. I made a playful remark to the advisor, jokingly mentioning that I was opening a tax-free savings account to begin day trading stocks while the world was at a standstill.

Leaving the bank that day, I spontaneously decided to browse a local bookstore, searching for books on day trading, technical analysis guides, and even some books on this intriguing new technology called blockchain, also known as cryptocurrencies.

That night, I stayed up late at home and registered for a few cryptocurrency exchanges. I reasoned that while stocks were likely already overinflated, these cryptocurrencies were still relatively new and exciting, and perhaps many older generations lacked the expertise to trade them effectively.

Over the next two months, I isolated myself in my upstairs office, engrossed in reading no less than 10-11 books and completing around 15 Udemy courses on cryptocurrencies. I was determined to gain a comprehensive understanding of what they were and how to master the skill of trading them.

It should be noted that even after two months, I still didn't fully grasp the underlying value of cryptocurrencies in terms of representing real-world projects with dedicated development teams and practical use cases. Yes, it's not something I'm proud to admit, but at that point, I still saw them as three random symbol letters with fluctuating prices.

/ short side note 👇🏼

It's worth mentioning that I hold a Bachelor of Commerce Degree from Memorial University. During my time at university, I worked part-time at a call center, and interestingly, most of my shifts were spent printing off pages from the entire Investopedia website. I was deeply committed to studying everything I could about investing, portfolio management, stock trading, fundamental analysis, analyzing businesses, and the list goes on.

By the age of 22, I had amassed an impressive collection of hardcover books on these topics, written by some of the most respected authors of all time, including Robert Kiyosaki, Ben Graham, Warren Buffett, Christopher Browne, and John C. Bogle.

While I had always dreamed of becoming a stockbroker on Wall Street, my career path took a different turn. I was offered a job with the Royal Bank of Canada, and I climbed the ladder quickly, eventually becoming a Commercial Account Manager. However, on a whim, I decided to leave the financial industry and pursue building my own business in the wellness industry.

It's safe to say that finance, stocks, and investing have been lifelong passions of mine. Although there was a period of about 10 years where this passion went dormant, it has now been reignited with my recent foray into the world of cryptocurrencies.

/ returning to me in my office trading 3 letter symbols at midnight 👇🏼

It took me a few weeks of trying to trade before I realized I truly had no idea what I was doing and that I’d need to invest more time learning what this entire industry was all about.

By accident I came across a Udemy Course by the author The Bearable Bull, called Altcoin Ratings, Reviews & Price Analysis System.

‘Altcoins’, hey?

So, those three-letter symbols were actually referring to something?

I decided to purchase the course and dedicated an entire week to completing it without taking any breaks. I set it up on my large screen computer downstairs, which was connected to my sound system. I wanted to immerse myself fully in the learning about these mysterious alt-coins.

Within the first 15 seconds of the first video playing, I had a surreal moment.

It felt as if I had heard the voice of God himself, but in reality, it was an anonymous entity who called himself The Bearable Bull.

He claimed to have secrets about building wealth-generating portfolios of altcoins. I chuckled at the absurdity of it all.

I thought I must be going mad - perhaps the virus had affected my sanity.

It seemed impossible to believe that I had spent the past two months pursuing this hobby only to find myself listening to a deep-voiced cartoon bull sharing insights on analyzing digital currency symbols.

But unfortunately, that was my reality, and I had truly reached a new low point for sure.

You know, throughout our lives, we hear stories of serendipitous discoveries, like an apple falling on Newton's head or Alexander Fleming stumbling upon penicillin by accident. These tales always seemed mysterious and highly improbable, making you question their likelihood.

That same feeling washed over me when I began that Udemy course in August 2020. Half of me felt like I was losing my mind, while the other half believed it was destiny unfolding.

The course turned out to be incredibly impressive. It introduced me to the concept that altcoins are like software or apps built using modified versions of the original bitcoin code, offering alternative use cases for the underlying blockchain technology.

Suddenly, everything clicked into place for me. The entire blockchain industry became a realization akin to the gold rush, the industrial revolution, and the dot-com era combined. I realized that I had stumbled upon this burgeoning industry as an uninvited early adopter. I had arrived during a rough draft phase, where developers were experimenting and exploring new technologies, much like software and websites did in the '80s and '90s.

It all made perfect sense. Peter Diamandis discussed the promise of blockchain technology in "The Future is Faster Than You Think." Yuval Harari explored the history of money as a database that records resource sharing in "Sapiens." Thomas Piketty spoke of the need for global taxation reform and the potential collapse of society without a new financial system in "Capital in the 21st Century."

And now, I learned that in 2009, Bitcoin, a peer-to-peer payment system using a revolutionary invention called blockchain (or distributed ledger technology), was created by an enigmatic individual named Satoshi Nakamoto, who claimed no allegiance to any nation-state and then mysteriously vanished, leaving this technology as a solution to financial challenges for mankind.

The writing on the wall couldn't have been clearer to me. We are entering a digital-centric world where data networks hold greater value than gold. Blockchain technology represents the safest and most reliable data networks, enabling the exchange of various forms of data, including the data of money.

Like the diligent student I was, I printed out every single altcoin on The Bearable Bull's list. I made up my mind, saying to myself, "…f*ck trading these damn symbols. I want to buy up real estate on these networks before the masses catch on to what’s happening in this blockchain world."

I oriented my compass three degrees to the north and allocated my capital to the cryptocurrency that excelled in all aspects

It had a scalable and highly valuable use case, an advanced technology stack, a team of developers with credibility and expertise, and a network of investors and partnerships to facilitate the adoption of this technology.

The cryptocurrency I selected was XRP, created by Ripple Labs, a private company based out of the U.S.

I began connecting with other XRP investors across the world and to my surprise there was a small, but extremely intellectual online community on twitter who dedicated most waking hours to researching and somewhat speculating on what may one day be the the end game for this technology.

I ended up following my newfound mentor, The Bearable Bull on Twitter and YouTube as well as I began forming relationships with a much larger community called Crypto Twitter, or ‘CT’ for short.

In the fall of 2020 I experienced a surge of joy and passion that I had never felt before in my life.

Behind the scenes I was far more invested in learning everything about cryptocurrency’s and the industry than any of you, my readers, could ever imagine - it was all I thought about from morning until dawn.

While my T.V screen was blanketed with news about the pandemic and the U.S Presidential Election, I was underground with my C.T amigos diving into new and upcoming projects in the space, studying emerging segments of crypto called DeFi and NFT’s, Metaverses and DAO’s.

That fall I made more money investing and trading into digital data real estate, or crypto’s for short, than I could even believe.

I learned how the charts worked, also known as technical analysis and I learned how to grade the projects, known as fundamental analysis and began making a name for myself known as TheStoicSatoshi on Twitter.

Christmas (2020) was just weeks away and off the backs of the U.S election chaos, the markets surged and Bitcoin exploded over $20,000 per coin. The media was covering crypto on every channel with 90% of the coverage going to Bitcoin and maybe the remainder somewhat acknowledging Ethereum, but us insiders in the space knew the true value lay in the alt-coins, the technology that none of the media knew existed and the majority likely asking if they did happen to see other coins “…what do those 3 letters or symbols mean?”.

Every day, the crypto industry was attracting more and more capital, and every project coin seemed to be skyrocketing in value.

Prices were soaring for weeks on end.

The main concern wasn't whether one would make money but rather if the project you invested in would outperform the others on any given day.

The XRP community was eagerly anticipating XRP's moment to "go to the moon."

At the time, XRP was trading at $0.20, having previously reached an all-time high of $3.84 in 2017/18. Every day, we delved into research on XRP, scoured every headline and news release related to XRP, and closely analyzed the price charts.

However, XRP didn't show much movement.

There was a very small lingering concern in the back of all of our minds, a small asterisk that set XRP apart from most other cryptocurrencies—it was closely associated with the company Ripple, whereas many other projects had anonymous developers, adhering to the traditional spirit of decentralization.

This small little detail made many in the crypto space call XRP a ‘bankers coin’ and many even speculated that it was an illegal securities offering breaking U.S law due to how Ripple controlled the supply and would sell the asset to their partners, which was frowned upon in the crypto community at large for fear of price suppression and profiting off the backs of retail investors at Ripple’s will.

But we in the XRP community knew the difference.

We knew Ripple was a company with strong credible ties, a board of directors comprised of former SEC lawyers, a former U.S Treasury Secretary, top VP’s from the worlds largest banks and investment companies and many other high profile business people from across the globe - I mean it was impossible for the rumours to be true, right?

The week leading up to December 22th, 2020 I had my entire life savings poured into XRP and felt confident with the portfolio I was building. The price of XRP had risen from 20 cents to over 75 cents and the energy in the crypto space was incredibly exciting.

On December 22nd I woke up as I did every other morning that year, but by the time my head hit the pillow that night I felt my life had all but been destroyed.

I went to sleep that night confused, angry, embarrassed and all but paralyzed emotionally.

Jay Clayton, the outgoing chairman of the SEC, filed a $1.3 billion lawsuit against Ripple CEO Brad Garlinghouse, Founder Chris Larsen, and the company itself, alleging the sale of unregistered securities.

The entire XRP ecosystem's value plummeted, leaving me devastated. I had invested every dollar I had into XRP, and the news hit me hard. Christmas that year was a pretty somber affair, with no gifts and little joy.

Despite the setback, the XRP community remained united during the challenging weeks and months that followed, fueled by a determined energy as 2021 began. Ripple announced its intention to fight the lawsuit at any cost - which ultimately would amount to over $200 million in legal fees by the end.

Public figures like Lawyer John Deaton rallied together over 75,000 XRP investors for a class action lawsuit against the SEC. Lawyers James Filan and Jeremy Hogan provided updates and analysis through Twitter and YouTube, respectively, dedicating their efforts to helping the XRP community navigate the legal proceedings.

The Bearable Bull, through his daily YouTube videos, shared valuable research on XRP and Ripple, encouraging XRP investors to maintain a long-term perspective and not lose sight of the asset's overall potential despite the current setback.

As a global XRP community we tuned in to live audio court hearings, often breaking their phone systems as tens of thousands of us were eager to know every single detail to the case.

We would flock to twitter after to discuss.

We all felt that the case would last a few months before being thrown out or settled out of court.

Months turned into a year.

One year turned into a second year.

By this time Bitcoin had set all time high’s for price reaching over $69,000 per coin, meanwhile XRP was stuck in the 30 cent range.

*In 2021 XRP did experience a small bull run, reaching $2. At the peak my portfolio eclipsed over $1,000,000. Many investors were caught off guard with this rally given the circumstances surrounding the legal case. I would suspect many didn’t sell a single coin due to their loyalty to the network, which ended up being quite a mistake as it fell from $2 to 30 cents within a year as the entire industry was battered by scams, frauds and bankruptcies - and that $1,000,000 reached a low of just $50,000 at the market bottom.

At the turn of 2023 the crypto industry was sparked by a Bitcoin rally to $20,000.

On speculation that 23’ would be the year the FED pauses / pivots on interest rates and inflation had been cooling off towards the end of 2022, risk assets began their bull run.

Good news had been announced in the Ripple vs. SEC case that March 31st may be the final date that the Judge rules on case, but of course, that date came and went as a nothing burger.

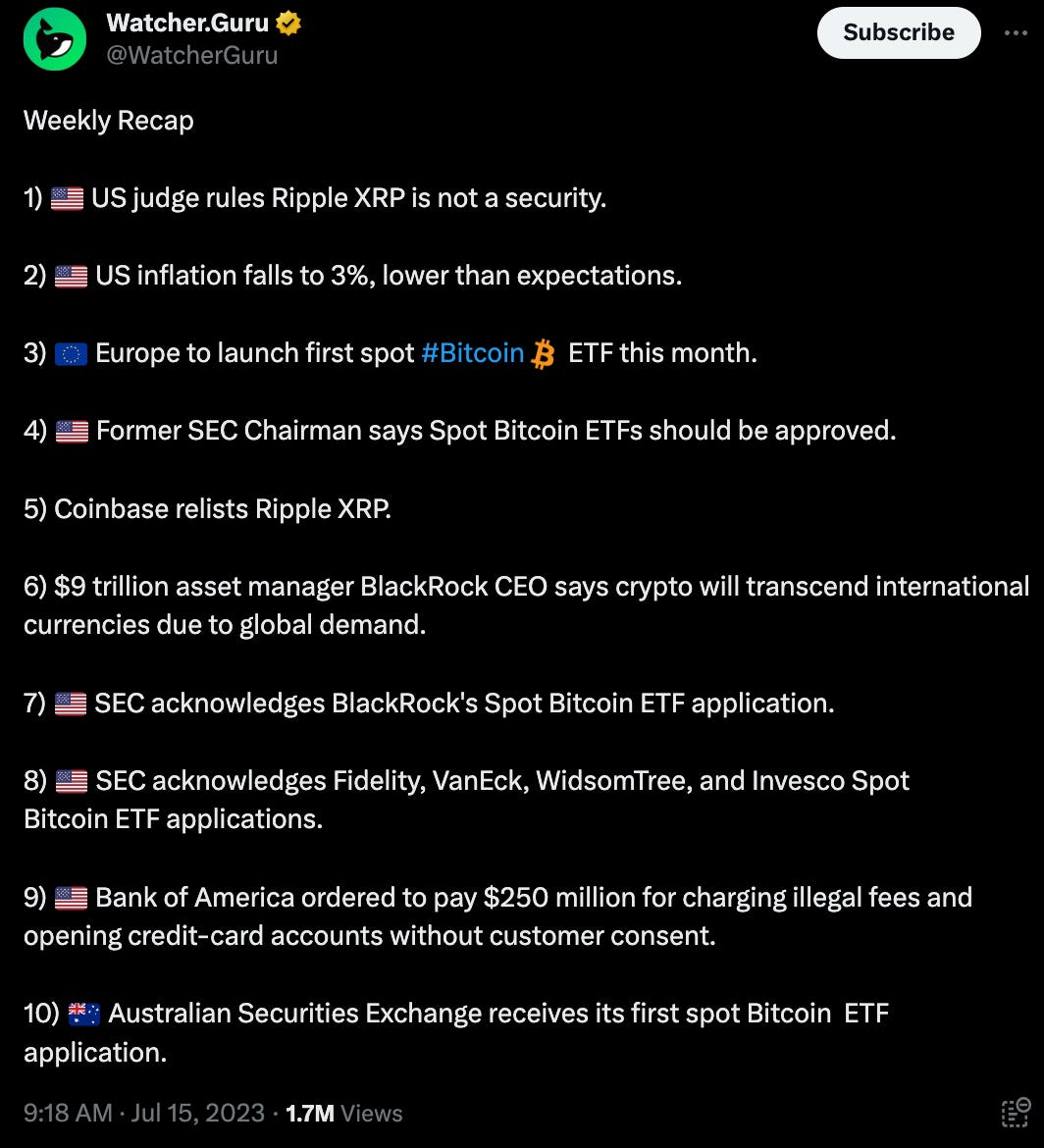

Then on July 13th, just a few days ago, on my wife’s late Father’s birthday, I opened my phone to this tweet.

And I sat there in bed paralyzed again, unable to react.

I wasn’t euphoric.

I wasn’t excited.

I didn’t jump around.

I didn’t even immediately check the price charts.

I just sat in bed, my heart rate barely jumped a beat.

I just said “Thank-you.”, as I pointed at the air and closed my eyes.

/ the end

My friends it has been over 900 days since the SEC filed it’s lawsuit against the company behind the most important digital asset ever created, XRP.

In that span of time I created Fox MetaCapital, my platform to educate and inform my clients and readers on developments in the crypto industry.

I was one of the original partners on the crypto project Unifund, a DeFi based mutual fund trading platform. We didn’t rug pull, the concept simply lost energy during the bear market and we shut it down.

I’ve built a 12-Part Course introducing my audience to the foundational aspects of the crypto industry, following in the footsteps of my mentor The Bearable Bull - whom I now consider a very good friend of mine and whom I thank with my entire heart for the energy he has invested into educating the masses with his content.

I’ve gathered a network of hundreds of the top personalities in crypto, the best of the best technical analysts and traders meanwhile I’m perfecting my own craft day in and day out, or should I say weekly, via our market newsletters that I write for each of you to read every Sunday.

I stayed true to my intuition and logic that cryptocurrencies and blockchain represent the most important technological and paradigm shifting event of our generation and never lost an ounce of hope during the vicious crypto bear market and 3 year attack from U.S regulators on this industry.

Thus you can now imagine how important to me this past week was waking up on July 13th to the news of XRP becoming the first digital crypto asset to have full blown legal clarity in the U.S.

Especially given the story I’ve shared with you today.

But I write to you today with much less looking into the past as much as preparing for the future ahead.

We are now on the precipice of waking up in unchartered waters.

We are now waking up to a world where, well, let me show you a graphic that sums it up great.

If there was ever a watershed moment for cryptocurrencies to shine, it's now evident that all the necessary ingredients are in place.

The value of the U.S. Dollar has been on a steady decline for the past two months.

The Federal Reserve's ability to continue raising interest rates is questionable, if not impossible.

U.S. Treasury Yields are decreasing, bringing stability to the economy as we emerge from a recession that was never formally acknowledged by our governments.

Trillion-dollar investment firms are recognizing cryptocurrencies as a global innovation and asset class.

Gold prices are reaching all-time highs, fueled by rumors of new gold-backed currencies that could challenge the dominance of the U.S. Dollar, particularly among the BRICS nations.

U.S. equity markets are experiencing a bull market, creating an opportunity for capital to shift towards undervalued asset classes and previously underperforming investments.

Congress now has the necessary ammunition to consider the Ripple vs. SEC case and engage in discussions about the future regulations and laws that should govern the crypto industry.

When I tell you that the morning news about XRP didn't prompt me to look at the price charts, I mean it. My initial thoughts took me back to the nostalgia of my early days investing in this asset class when it was still relatively unknown, when none of my family or friends understood anything about cryptocurrencies. It reminded me of the excitement I felt about the potential of this technology and my satisfaction at being part of it.

My immediate thoughts were that now the asset I had devoted years of mental energy to would finally have a fair chance to compete. Regardless of what unfolds from this point onward—whether crypto prices rise or fall, whether the SEC appeals the judge's decision, or whether external factors like interest rate hikes or disruptions from AI affect the financial landscape—it no longer matters to me.

This entire experience has taught me invaluable lessons in patience, faith, and discipline. During this time, I effectively earned a Ph.D. in economics through my extensive research and reporting, sharing real-time events with all of you for almost a full year, week after week.

I will be following up with a second edition in the next few days, discussing recent headlines and news events that I would typically cover in my weekly editions. I will also share my thoughts on what to expect leading up to the July 26th FOMC meeting.

But for today, I wanted to encapsulate in digital time my personal journey into the world of crypto and why this particular week holds such significance for me.

Stay tuned for the next edition, and keep an eye on your inbox.

- Matthew Fox

*ps. I have included my technical analysis below on all major assets and indices - if your curious where I see the markets heading in the next few weeks, I strongly encourage you view my charts below, especially the DXY, S&P500, Bitcoin and XRP.

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

FOREX

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

DXY(U.S Dollar) + CAD + EUR

Featured Chart DXY 1D (click to enlarge photo

Featured Chart CAD 1D (click to enlarge photo)

Featured Chart EUR 1D (click to enlarge photo)

Equities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

S&P500 + TSX + VIX

Featured Chart S&P500 1D (click to enlarge photo)

Featured Chart TSX 1D (click to enlarge photo)

Featured Chart VIX 1D (click to enlarge photo)

Treasuries

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

US2YR & US10YR

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

Bitcoin & + XRP + Total Crypto Market Cap + Total Altcoin Market Cap

Featured Chart BTC 1D (click to enlarge photo)

Featured Chart BTC.D 1D (click to enlarge photo)

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart XRP 1W (click to enlarge photo)

Featured Chart TOTAL 1D (click to enlarge photo)

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

Oil + Gold & Silver

Featured Chart Oil 1D (click to enlarge photo)

Featured Chart Gold 1D (click to enlarge photo)

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 47

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!