🗞 Weekly Market Newsletter | Edition No. 45

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, June 25th, 2023

Thirty years ago to the day, it's likely I would have been spotted lying on the carpeted floor of my grandparents' living room, mere inches away from the TV screen, watching my favourite animated series, 'Inspector Gadget,' after school.

One of the funny, repetitive themes of the show is that in each episode, Inspector Gadget would receive top-secret memos outlining the details of his next mission. These memos would 'self-destruct' in 60 seconds.

I want each of you to know that this is the visual that comes to my mind when I think of you all reading our newsletter each week: a top-secret crypto memo, and you're all Investor Gadget.

While you can rest assured that this memo will not self-destruct in 60 seconds, my remarks and thoughts today will be short and to the point, given the nature of the headlines last week.

The most dominating news headlines last week oddly had very little to do with the markets, yet they commanded the full attention of the world:

'Group of Five Explorers Went Missing While on an Expedition to Visit the Titanic.'

'Within a 24-Hour Span Over the Weekend, Top Russian Military Leaders Staged a Coup to Overthrow the Government and then Retreated.'

Both of these headlines are as 'odd' as they come.

In fact, typing them out felt even stranger than experiencing them in real-time.

I want to make it clear that my heart goes out to the families of the individuals who fell victim to the catastrophic submarine implosion. However, the timing, scale, and intensity of this news event couldn't have been more suspicious in nature in how it altered the emotional state of the masses.

Following a week of utter collective global sympathy, we were flash-blasted with a little WW3 fear, as it appeared Russia, as we know it, was on the precipice of a collapse - only to have the military coup leaders get bored and decide to go home on Saturday. Putin forgave them for their bad behaviour, and everyone moved on as if nothing happened.

This all felt like one big distraction, but I just haven't figured out the puzzle yet.

While all eyes and minds were absorbed by these two major headlines, the crypto markets made big moves while no one was paying attention.

The SEC approved the first leveraged Bitcoin ETF.

The world's largest institutions and banks filed for Spot Bitcoin ETFs all at once.

Bitcoin erased months of downward price action in just six days, soaring to yearly highs of 31K.

If you didn't know that any of these events occurred, it's because they received hardly any media attention.

(Remember my monologue months ago on how large market participants purchase assets at wholesale prices and mark them up to retail prices? It seems that while no one is looking, that's what's occurring as we speak.)

While I don't want to jinx anything as we've waited long enough to see this market pivot to the upside, I'll be brutally honest that my spidey senses are tingling.

Typically, a crypto bull run is sparked by plenty of media attention, usually capped off when your grandmother is texting you asking what 'sh*tcoins' to invest in, while celebrities are tweeting out their favourite DeFi projects, and FOMO reaches insanely high levels of greed.

But again, if I am being honest, it's still pretty quiet in the space at the moment.

I find myself asking if this recent move is price manipulation preceding the launch of the leveraged Bitcoin ETF? Was Capo right, is this one big bull trap?

Or is it the polar opposite? Did these institutions truly buy the bottom of the bear market as they're supposed to, and now, as I've speculated, they're marking up prices while the majority of traders are calling bluff on the rally, and retail masses are too afraid to touch crypto with a ten-foot pole because of the media slandering over the past 2-3 years?

Again, my spidey senses are on high alert.

Typically when the headlines are fishy, I'll go to the charts to tell me the news and predict the future. But even the charts are a challenge to grasp a true bias right now. Here's my best articulation of what I'm seeing.

Starting with the U.S. Dollar, my bearish bias stands.

Why?

Well, the Fed has done their best job at keeping market participants fearful of 'another hike is possible' for months now, but truth be told, I am finally calling their bluff.

I can't see them looking the U.S. Government straight in the eyes and saying, 'We're going to charge you even more on the $32 trillion you owe.' It's not happening. I think the rate hikes might be over for now.

The CPI and Unemployment numbers have been trending in a deflationary manner for months, telling me that the economy has cooled off tremendously. Maybe not at the low targets of 2% the Fed wishes to reach, but cool enough to warrant a chill on interest rates for a while.

You'll notice in my analysis below that it's my opinion that treasury yields appear to have topped and are preparing for a sharp reversal, the forex markets are gaining traction on the U.S. Dollar, and equity markets are for the most part experiencing price expansion.

For this reason, I remain confident that risk assets continue to be the play for the remainder of '23 into '24.

However, this all hinges on U.S. Dollar weakness.

After a week like we've experienced last week, it's challenging to understand what effect the geopolitical ripple effects will be from the abandoned Russian coup.

Does this show weakness in Putin's leadership and the Communist Kremlin?

Will market participants view any suspected Russian weakness as bullishness on U.S. Dollar dominance?

How will this event impact commodity prices such as oil?

All it takes is one single event to change the course of an entire bias, so I'm careful this week not to over speculate or over analyze the charts and headlines. It feels premature to do so until the emotions from last week settle, which may take a few days.

Therefore, my last remarks on the week ahead are as follows: I truly do think that this recent push-up in Bitcoin's price is a rally sparked by wholesale buyers pushing price up in anticipation of a major adoption catalyst. I don't think that the rally has finished, and I'm expecting Bitcoin to reach 32-40K within weeks from now. In the meantime, altcoins remain the highest ROI play in the markets as they are still at rock-bottom entry prices and may remain low or sink further if Bitcoin steals the show for a few weeks/months.

My only caution comes from the fact that the S&P 500 appears very overbought, the TSX has been in freefall, and both Gold and Silver are looking a little heavy, especially while the VIX has reached multi-year lows and is primed for a short-term rally to spark volatility in the markets.

Plus, the U.S. Dollar could also be viewed as oversold and primed for an event catalyst to spark a larger bullish rally - especially if the Fed decides to add 1-2 more hikes in 2023. This we must watch closely.

Therefore, it's not super clear to me what move is next, which is why I could make a case for this recent Bitcoin move to appear slightly suspicious like a trap - but this week ahead will give us the evidence we need to support a more thorough projection on what’s to come.

I’ve mapped my predictions in my technical analysis below, take a look through the charts and you’ll see how I’m thinking the assets may move in the days and weeks to come.

Until next week, ‘Go Go Investor Gadget’.

- Matthew Fox

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 Bitcoin Erases Weeks of Downside Price Action in <6 Days

🗞 SEC Approves First Leveraged Bitcoin ETF

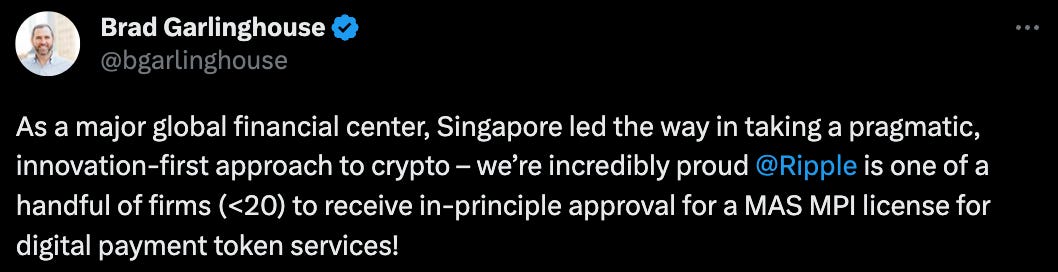

🗞 Ripple Receives Major Payment License in Singapore

🗞 Institutional Market Participants All-In on Crypto

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

FOREX

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 DXY(U.S Dollar) + 🐂 CAD + 🐂 EUR

Featured Chart DXY 1D (click to enlarge photo)

Featured Chart CAD 1D (click to enlarge photo)

Featured Chart EUR 1D (click to enlarge photo)

Equities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

📉 S&P500 + 📉 TSX + 🧸 VIX

Featured Chart S&P500 1D (click to enlarge photo)

Featured Chart TSX 1D (click to enlarge photo)

Featured Chart VIX 1D (click to enlarge photo)

Treasury Yields

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 US2YR & 🧸 US10YR

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🐂 Bitcoin + 🐂 XRP + 🐂 Total Crypto Market Cap + 🐂Total Altcoin Market Cap

Featured Chart BTC 1D (click to enlarge photo)

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart TOTAL 1D (click to enlarge photo)

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 Oil + 📈 Gold & 📈 Silver

Featured Chart Oil 1D (click to enlarge photo)

Featured Chart Gold 1D (click to enlarge photo)

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 45

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!