🗞 Weekly Market Newsletter | Edition No. 44

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, June 18th, 2023

Hello Friends,

Did you know that June 19th is now a Federal Holiday (‘Juneteenth’) in the U.S?

I must have missed the memo in 2021 when Joe Biden added this one to the calendar - nevertheless; stock market closed Monday.

Due to stock market futures not opening until Monday evening now, the price action in crypto over the weekend (and today specifically) was calmer than normal - but I expect this to change dramatically as the week unfolds.

Allow me to quickly recap the news events from last week as it was a fireworks show of explosive headlines one after another.

ps. I’ll add links & screenshots to the social posts from each headline below for you to click and explore further. Please pay special attention to the (2) videos from Stuart Alderoty and Brad Garlinghouse - watch them twice.

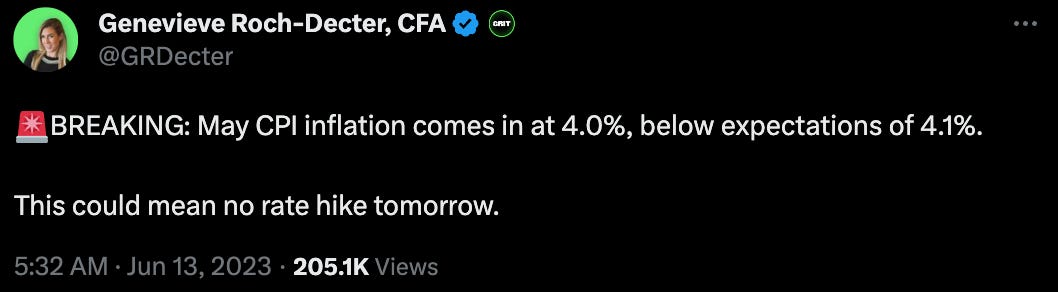

The week started off with CPI (inflation) data coming in slightly below expectations; 4% vs. 4.1%. This didn’t overly surprise me as i’ve been paying attention to the ‘narrative’ being painted by Government and this outcome fit the mold.

Immediately following the announcement the markets reacted (prematurely) bullish assuming that the much anticipated mid-week FOMC announcement would lead to a pause in rates (95% probability) or even a rate cut.

The stock market (equities) ripped higher off the news as the U.S Dollar (DXY) went into freefall - all while crypto stayed completely flat.

*yawn*

If you’re wondering why look no further than;

Binance being sued by the Securities Exchange Commission.

Coinbase being sued by the Securities & Exchange Commission.

Ripple being sued by the Securities & Exchange Commission.

Altcoins being called securities left, right and center by the Securities & Exchange Commission.

Fake Exchanges being created by the Securities & Exchange Commission to pretend to give credibility to their ‘Come In & Register’ trap.

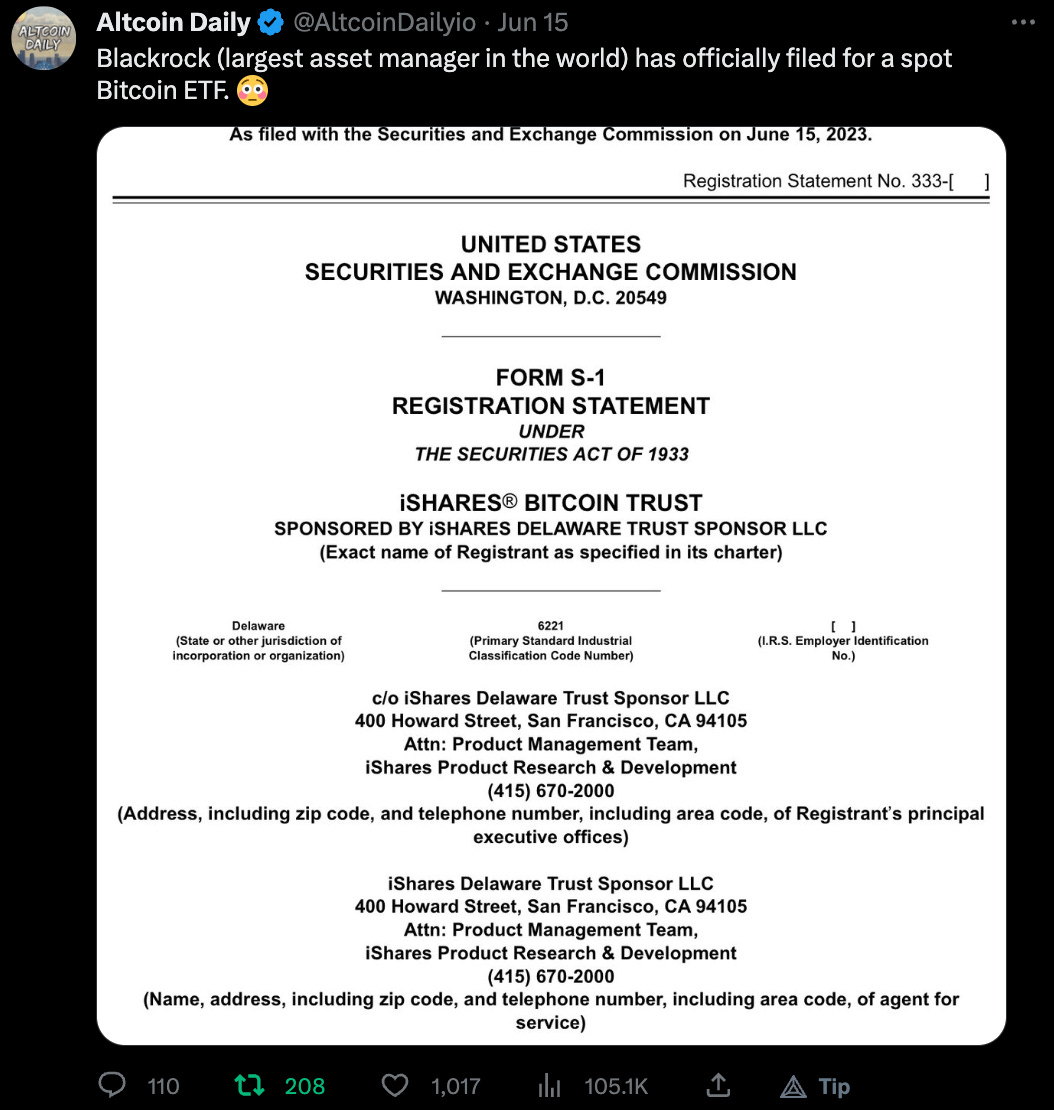

Thus it’s hard to get any capital flowing into crypto when at every corner the SEC is suppressing it’s adoption & maturity pending the big players such as BlackRock etc., taking their time to gobble up assets at wholesale prices.

(See in the news section below ‘BlackRock files for Bitcoin ETF’ this past week as evidence of this theory.)

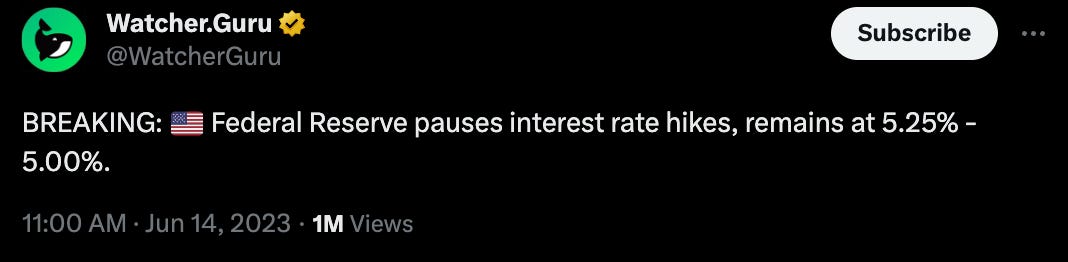

By the time Wednesday morning rolled around and the FOMC news broke that the FED would pause rates, market participants eagerly awaited Chairman Jay Powell to give his speech and answer questions to get a read on his tone and demeanour looking for telltale clues on how future FOMC events this year may play out.

In short let me summarize the press conference;

No rate hike increase this month (remains at 5.25%)

Rate cuts are unlikely in 2023

FED goal remains 2% inflation

FED signals possible rate increases this year

Two rate hikes with .25bps expected by FED this year

Overall, hawkish statement.

In typical Bitcoin fashion off of hawkish news, the price flash dumped to 24.8K followed by an immediate reversal within 24 hours back up to 26.8K, flushing out all over-leveraged speculators from their positions on both sides.

At the time of writing this Bitcoin is consolidating at 26.4K.

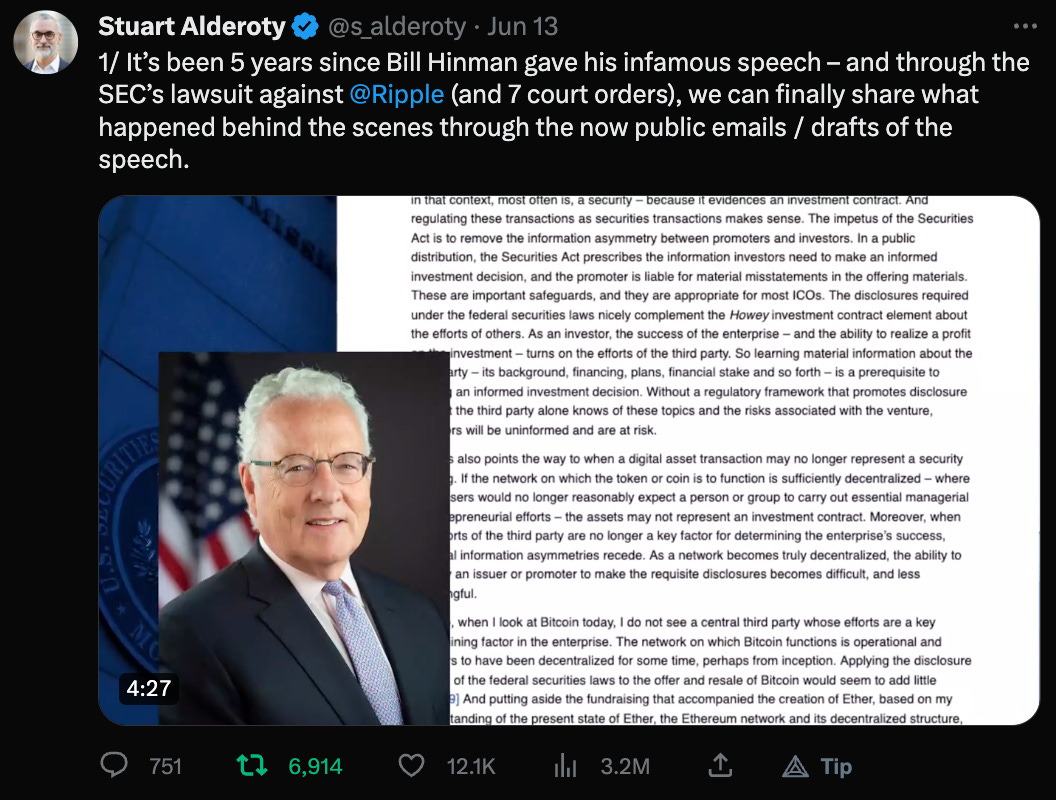

We can’t mention news events from last week without mentioning the most important crypto related headline that broke on the 13th - the infamous Hinman Documents release by Ripple.

It was expected that these documents would detail the internal corruption and hypocrisy on-going from within the agency designed to purposefully confuse and manipulate crypto companies and investors on the guidelines, rules and regulations surrounding digital asset clarity.

And they completely revealed just that.

The XRP price soared to .55 cents on the breaking news however retraced the full move as still the lawsuit awaits Judge Torres summary judgement ruling on the case.

This ruling may, and likely will, have far reaching impacts on the entire crypto space as should she grant in favor of Ripple, it may be a catalyst for digital asset clarity in the United States. In contrast, if the ruling is unfavourable this case may prolong another 1-2+ years as a trial or Supreme Court may need to be the final referee on the case outcome.

It’s for this reason that while overlooking the charts for this week it’s a challenging read for me to accurately get a firm stance on both XRP and Altcoins.

Bitcoin dominance is creeping up as $BTC is still the only asset nearly guaranteed to not and never be declared a security. As for the other 20,000 cryptos, the future is looking not so good in the short term.

No doubt this is going to create selling pressure on altcoins that have already taken a beating so far in this bear market with most being down 80-90% from their bull market highs. It wouldn’t surprise me if many either do not ever recover or fall another 80-90% should their fundamentals lack the merit to withstand the test of both time and resources to fight regulators as a going concern.

We require digital asset clarity immediately in the U.S and members of Congress are beginning to take action. Just this week an official bill was introduced to #FireGaryGensler, head of the SEC and restructure the agency to serve the people vs. protect the banks.

This is bullish - yet may still take time to see it through.

But my spidey senses are tingling that something big is around the corner.

The U.S Dollar is showing weakness at the same time that the S&P500 is pushing yearly highs. Treasury yields appear to be topping out (bond market recovering) and both Silver and Gold are consolidating at their highest levels in years.

Inflation is cooling yet U.S Debt is soaring to all time highs ($32T) which tells me that the U.S Government isn’t going to want to pay higher interest rates on this debt any time soon, meaning I’m not expecting any further hikes from the FED which would ultimately increase the cost of borrowing by the current administration, not a good look going into an election year.

So what does this all mean as we head into another week of action?

I’m still super bullish on risk assets especially crypto.

My intuition tells me that capital rotation will soon occur and profits from the stock market may flow into the best ROI asset class that remains at bear market lows, altcoins and crypto.

Perhaps a favorable ruling on the Ripple case sparks the rally we’re waiting on, or perhaps no news event occurs and retail investors get front run while waiting on the sidelines for God himself to say it’s okay to be bullish again.

Or, perhaps the Department of Justice criminally charges Binance and or Tether and the entire crypto market falls another 50% which would coincide with a Stock Market pullback from the highs - it’s anyone’s guess right now.

But again, my intuition says this is market manipulation and a purposeful suppression of this asset class until a major player has secured their positions and then we’ll experience the fastest mark-up in prices you’ve ever witnessed.

Time will unfold history in the making, and let me share a thought with you before you jump into the news headlines and charts this week.

A famous mentor of mind and world renowned investor Howard Marks once said that being ‘intuitively right on an outcome, but too early’ is the same feeling as being wrong in the short term.

If there is one lesson I’ve learned by investing in crypto is that the market moves when you least expect it and it requires more patience than you’ll ever deploy towards any other meaningful outcome of your life.

I’m sticking with my bias that there’s something too fishy going on behind the scenes for this industry and technology to not be monumentally game changing for the digital economy.

The big players will not shake me out.

Until next week.

- Matthew Fox

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 CPI Inflation below expectations, bullish.

🗞 Federal Reserve Pauses Interest Rates

🗞 The infamous Hinman Documents have been release (SEC vs. Ripple)

🗞 Ripple CEO Brad Garlinghouse Releases Powerful Video (3.2M Views)

🗞 Blackrock, the World’s Largest Asset Manager files for Bitcoin Spot ETF.

🗞 #FireGaryGensler (SEC Chairman) is a very real trend.

🗞 Canadian Regulators Cracking Down on Crypto Businesses.

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

FOREX

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 DXY(U.S Dollar) + 🐂 CAD + 🐂 EUR

Featured Chart DXY 1D (click to enlarge photo)

Featured Chart CAD 1D (click to enlarge photo)

Featured Chart EUR 1D (click to enlarge photo)

Equities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

📉 S&P500 + 📉 TSX + 🧸 VIX

Featured Chart S&P500 1D (click to enlarge photo)

Featured Chart TSX 1D (click to enlarge photo)

Featured Chart VIX 1W (click to enlarge photo)

Treasury Yields

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 US2YR & 🧸 US10YR

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

⚖️ Bitcoin + 📉 XRP + ⚖️ Total Crypto Market Cap + 📉 Total Altcoin Market Cap

Featured Chart BTC 1D (click to enlarge photo)

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart TOTAL 1D (click to enlarge photo)

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

🧸 Oil + 📈 Gold & 📈 Silver

Featured Chart Oil 1D (click to enlarge photo)

Featured Chart Gold 1D (click to enlarge photo)

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 44

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!