🗞 Weekly Market Newsletter | Edition No. 41

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, May 21st, 2023

Hello Friends,

It was a week dominated by (4) major headlines;

Judge makes favourable ruling in the Ripple vs. SEC lawsuit by DENYING the SEC’s request to seal the famous “Hinman Documents”

Ledger launches Ledger Recovery services prompting backlash from the crypto community citing security concerns.

The U.S is on the verge of a debt default and has nearly no money in their wallet to pay the bills - negotiations will continue this week.

The U.S Dollar sparked a rally which put risk assets on alert for further downside in the coming days and weeks.

I’ve added valuable context to these headlines below in the News Section with my commentary for you to read; however, I want to invest the short time I have your attention today into diving further into the significance of last weeks Ripple news.

Amongst all of crypto news and events from last week, including the famous Bitcoin Conference in Miami which took place this weekend, it was Ripple that dominated the social headlines with a plethora of bullish fundamental news breaks.

Ripple purchased Metaco, an institutional grade crypto custody company for $250M, added Warren Jenson (ex-Amazon CFO) to their Board of Directors, and were selected to showcase CBDC development for the e-HKD pilot program in Hong Kong.

These news bombshells, atop the already explosive Hinman Documents ruled to be unsealed by June 13th headline has prompted much speculation that the SEC may be forced to sit at the settlement table in the coming days to negotiate with Ripple a fair outcome to their 3-year ongoing legal battle to which Ripple has spent over $200M defending itself against.

If this is true, the very real situation may unfold that XRP is given in some way, shape or form a legal clarity of sorts meanwhile the remaining assets in the space still subjected to SEC scrutiny for time to come.

I’ve long speculated that XRP was an important asset to the U.S Government and financial system and that this entire litigation was moreso a delay tactic as a part of the problem, reaction, solution unraveling of a blockchain based financial system upgrade.

While I’m not counting my horses yet, there’s never been a time I’ve felt closer to this lawsuit being past us than now.

If this is true, I believe many XRP holders (including many of you) may be unprepared to capitalize on any value increase in token price as it’s been years of hodl’ing without substantial price action.

It would be wise now without delay to mentally prepare potential profit taking targets for your individual positions. This is important as a legal win for Ripple may also trickle down into bullish sentiment across the board for many other quality alt-coins that are waking up after a long crypto winter.

I cannot stress this point enough to ensure you have access to your wallets, exchanges and fiat on/off ramps and that you are fully KYC’d allowing you to transact without friction in the event a bull-run occurs for your crypto portfolios.

It’s important to prioritize taking action on these steps now without delay to prepare yourselves for any price action developments that occur in the short term or throughout 2023 into 2024.

If anyone requires assistance with this process, I’m available to help guide you through it and ask that you e-mail me to schedule a private session with me with discussion.

I felt it necessary to bring this up immediately given the time sensitive nature of the recent ruling this week and it’s possible implications. While it could be another nothing burger, I’d rather be an hour early than a minute too late after investing years into the patient process of watching this industry mature.

Now, let’s dive a little further into the news from this week and my projections on the charts which will follow.

Sending the best of viibes,

- Matthew Fox | 📧 bramwellfox@proton.me

📰 Fox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

🗞 U.S Economic Data Releases

I will be focused primarily on Manufacturing PMI, FED FOMC Minutes, Q1 GDP, Jobless Claims and Core PCE Price Index.

As a reminder, what do each of these mean?

Manufacturing PMI (Purchasing Managers' Index): The Manufacturing PMI is an economic indicator that measures the activity level of purchasing managers in the manufacturing sector. It provides insights into the health of the manufacturing industry, indicating whether it is expanding or contracting.

Investors and analysts closely monitor the Manufacturing PMI as it can impact stock prices, particularly for companies in the manufacturing sector. A higher PMI reading suggests economic expansion, while a lower reading indicates contraction, and this can influence investor sentiment and market trends.

FED FOMC Minutes: The Federal Open Market Committee (FOMC) is the monetary policy-making body of the U.S. Federal Reserve. The FOMC Minutes are the detailed record of their most recent meeting, where they discuss and decide on monetary policy, including interest rates.

These minutes provide insights into the Fed's thinking, including their outlook on the economy and potential policy changes. Investors watch these minutes closely as they provide clues about future interest rate decisions, which can impact various asset classes, including stocks, bonds, and currencies.

Q1 GDP (Gross Domestic Product): GDP is a measure of a country's economic activity and represents the total value of goods and services produced within a specific period. Q1 GDP refers to the first-quarter GDP growth rate. Investors monitor GDP data as it provides a broad overview of the overall health and growth of the economy.

Strong GDP growth can indicate a robust economy, potentially leading to increased business activity, consumer spending, and investment. Conversely, weaker-than-expected GDP growth can signal economic challenges, which may have implications for market sentiment and investment decisions.

Jobless Claims: Jobless claims refer to the number of individuals filing for unemployment benefits. It is an important indicator of the labor market's health and provides insights into employment trends.

Lower jobless claims suggest a strong job market and economic growth, while higher claims may indicate economic weakness and potential negative impacts on consumer spending.

We track jobless claims data to assess the overall economic health and gauge potential market impacts.

Core PCE Price Index: The Core Personal Consumption Expenditures (PCE) Price Index is a measure of inflation that tracks changes in the prices of goods and services.

The "core" PCE excludes volatile food and energy prices, providing a more stable measure of inflation trends.

The Federal Reserve closely monitors this index as it is one of their preferred measures of inflation. Changes in the Core PCE Price Index can influence the Fed's monetary policy decisions, including interest rate adjustments. Investors watch this index as it can impact bond yields, currency values, and stock prices, especially for sectors sensitive to inflation, such as consumer goods and services.

🗞 CEO of Ripple Brad Garlinghouse comments on a huge legal victory scored for the FinTech giant in their battle vs. the SEC

The Hinman documents and e-mail thread were the final boss to beat for Ripples Fair Notice Defense as they (Ripple) claimed in court that the SEC has been engaging in corrupt behaviour behind the scenes essentially hand-picking winners and losers at the expense of industry adoption.

The agency has lined their pockets with litigation proceeds over the past few years in an attempt to set legal precedent over the crypto industry at a pace that protects traditional finance players (ie. big banks) until their wholesale positions are secured pre-mark up phase of this new digital asset paradigm - the Hinman e-mails may prove evidence of these behind the scenes dialogues that took place.

The tentative date of the release will be June 13th, 2023 - perfect timing one day before the June FOMC when the markets will be frothy with liquidity.

🗞 The U.S is big trouble if they cannot successfully negotiate a debt ceiling increase in the coming days.

While I do not see a default as an outcome that’s on the table, I do believe the bureaucrats on both sides of the isle will milk this dilemma for all it’s worth of media attention and bargaining power for their own power agendas.

I’ve long called for a complete financial system collapse at the expense of the U.S Governments reputation and status as global reserve currency leader, but it’s of my opinion that it will not occur with an atomic bomb moment such as the U.S Government failing to pay bills as much as “problem, reaction, solution” moment that has already been pre-determined and now slowly unraveled in the interest of public psychological manipulation to accept a new way of life and commerce.

🗞 Ledger releases “Recovery” Service that sparks security controversy.

I’m not overly concerned about this headline despite the reactions of crypto twitter all week.

TL;DR: Ledger, the cold storage hardware wallet manufacturer launched a $9 per month subscription service which will send encrypted fragments of your seed phrase to various service providers in the event you accidentally lost or destroyed your recovery documents.

Users are upset as this triangulates the possibility that the Ledger Wallet firmware could be used to extract funds without authorization (i.e Government / Malicious Actors) and furthermore casted doubts on what other backdoor capabilities the firmware may already possess without users awareness.

I’m not overly concerned about this as I’m not going to be subscribing to the service nor updating the firmware and I do not see this as a fear worthy situation as much as maturation of the industry with cold storage capabilities improving at the demand of unsophisticated users adopting crypto.

Fox MetaCapital’s Weekly Asset Review + Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

FOREX

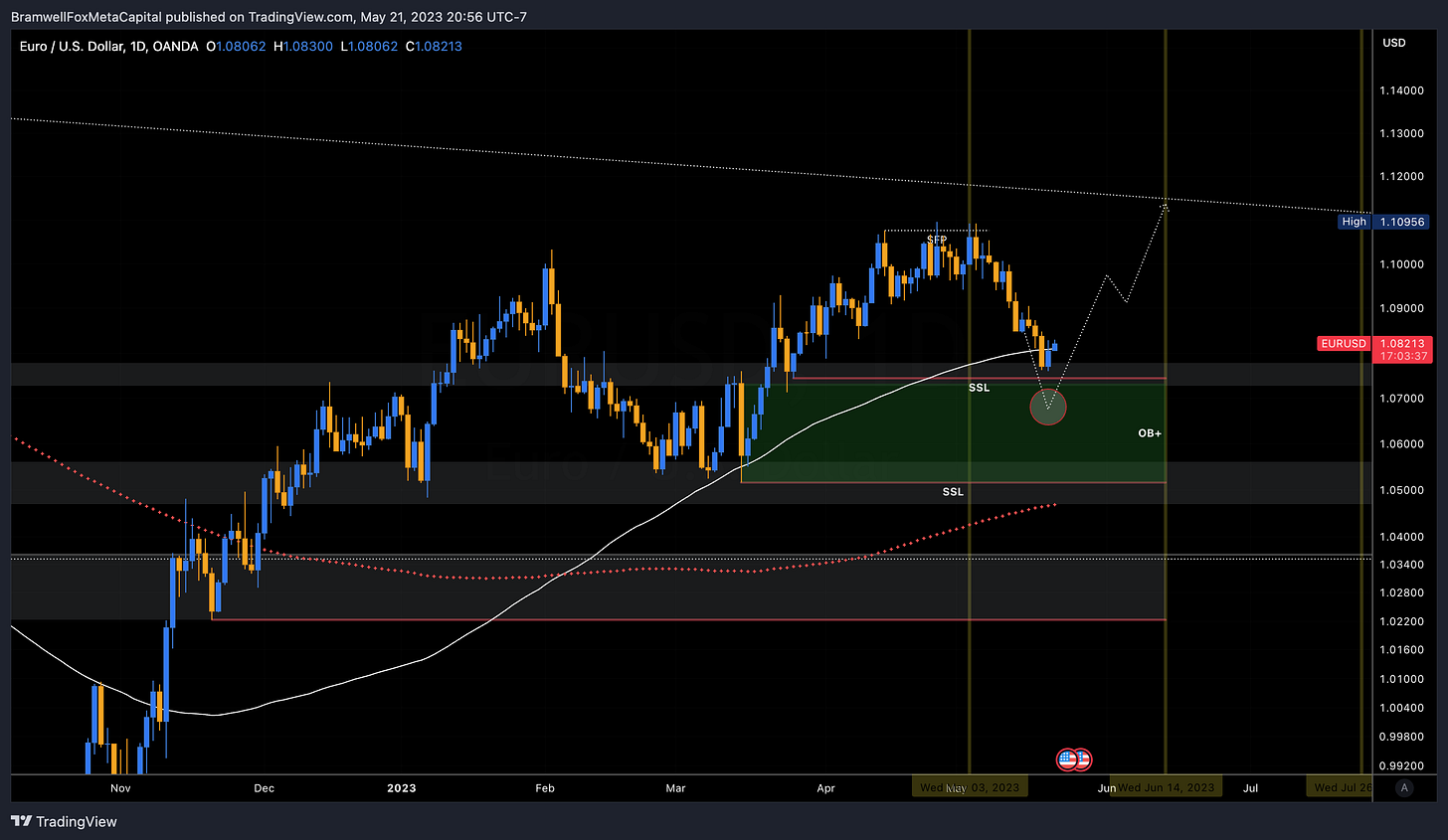

📈 DXY(U.S Dollar) + 📉 CAD + ⚖️ EURO

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

My outlook remains bearish on the higher timeframe DXY (U.S Dollar) technicals and I see last weeks rally as nothing more than a buy side liquidity hunt.

My targets for the DXY remains the same in the coming weeks and months to take out the sell side liquidity ~97-99 which ought to allow risk assets to run into Q3 / Q4; this bias is founded on the premise that with each passing FOMC market participants are anticipating a FED pause and pivot with increasing confidence.

Additional confluence to this bias;

The global narrative surrounding nations curtailing trade reliance on the USD appears to be gaining momentum.

The U.S debt default discussions are mounting as the deadline is approaching in June for a debt ceiling increase to fund operations of the U.S Government.

Featured Chart DXY 1D (click to enlarge photo)

The Bank of Canada may have more work to do as the Canadian inflation rate ticked upwards unexpectedly in April.

For this reason, I’m expecting a marginal interest rate hike from the BoC which may create a short term demand for the $CAD amidst a falling demand for the USD, for this reason I’m bullish on CAD / USD into the Q3.

Featured Chart CAD 1D (click to enlarge photo)

Featured Chart EUR 1D (click to enlarge photo)

Equities

🐂 S&P500 + 🐂 TSX + 🧸 VIX

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

It’s a big earnings week in the U.S and my bias remains strong for the S&P 500. Early week we may see a short term dip to collect liquidity generated from the monthly open but my sights remain strong that 4325 will be cleared very soon.

Featured Chart S&P500 1D (click to enlarge photo)

The performance of the TSX is heavily reliant on the financial and energy sectors. While I’m still bearish on Oil in the short term, the TSX ought to still get a push up from it’s tech and banking sector heading into late Q2 / Q3.

Featured Chart TSX 1D (click to enlarge photo)

Featured Chart VIX 1D (click to enlarge photo)

Treasuries

🧸 US2YR & 🧸 US10YR Yeilds

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

With uncertainty mounting regarding the U.S debt ceiling negotiations, treasuries had a sell off (higher yields) to finish the week as yields rose on both the 2 & 10 YR.

I’m expecting a possible further sell off to start the week as it’s of my opinion the yields may want to clear a few technical targets to the upside before their eventual collapse back down to support - likely this downside event on yields will be marked with successful U.S negotiation efforts on a short term bridge funding program in the coming week(s).

Featured Chart US2YR 1D (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

🐂 Bitcoin + 🐂 XRP + 🐂 Total Crypto Market Cap + 🐂 Total Altcoin Market Cap

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

Bitcoin has all but cleared most sell side liquidity and retail market sentiment is returning bearish after weak price action and consolidation at the range lows punctuated the Bitcoin Conference in Miami this past week.

It would be the perfect time for Bitcoin to pull a quick aggressive short squeeze to the upside and begin it’s path to clear the higher timeframe 32K target I’ve had my eyes on for months.

Should 26K lose support, this bias would be invalidated (in the short term) most likely driven by a bearish economic data pending release throughout the next week + a continued DXY rally.

I would expect no steeper of a re-tracement on price than Bitcoin to kiss the trending support line below ~24-25K - however altcoins may take a large hit if this were to occur.

Featured Chart BTC 1D (click to enlarge photo)

XRP has had an onslaught of bullish fundamentals hitting the news headlines over the past month and likely this will limit selling pressure as traders and investors hedge long on speculation of a < June 13th settlement between Ripple vs. SEC.

Therefore, any downside action may be the result of weakening retail market sentiment and any inverse DXY correlation placing pressure on risk assets across the board.

This bias would line up correct with how the technicals show low hanging fruit with sell side liquidity targets reaching as low as .42-43 cents; if there are cleared I’m expecting a bullish breakout to the upside of the channel clearing local highs and targeting a reclaim of .50 cents.

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart TOTAL 1D (click to enlarge photo)

Is this a trap?

It’s possible the altcoin market cap is flashing emergency warnings of a pending sell-off with TOTAL2 nearly falling out of its bullish channel; yet I’m going to take the contrarian position and say this is a bear trap and that altcoins will reclaim the channel and this price action was a simple fake out to the downside.

Featured Chart TOTAL2 1D (click to enlarge photo)

Commodities

💬 Matthew’s Commentary, Analysis & Prediction for the Week Ahead:

Both Gold and Silver are cooling off from their recent rallies yet I do not foresee their upside capped at current prices.

Both Metals are consolidating atop AoS (areas of significance) and it’s of my opinion these will move up at the first signs of a weakening or local top formed on the DXY.

Conversely, I remain bearish on Oil in the short term and seeking sell side liquidity targets to be cleared as low as $56 before a complete reversal takes place in Q3 and a strong rally sends Oil upwards of $100 a barrel in Q4.

📉 Oil + 🐂 Gold & 🐂 Silver

Featured Chart Oil 1D (click to enlarge photo)

Featured Chart Gold 1D (click to enlarge photo)

Featured Chart Silver 1D (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Weekly Market Update Edition No. 041

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

Leave a comment

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!

Share Fox MetaCapital