🗞 Weekly Market Newsletter | Edition No. 24

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

Sunday, December 18th,

Hello Friends,

Shh, but it may be time to call up Frosty, text Rudolph and facetime Santa because we might need a Christmas miracle to see a market rally before year end 😂

Welcome to the 24th edition of BFMC’s Weekly Newsletter.

First and foremost, I’d like to wish all of you the very best in health, wealth and unity as we enter into the festive holiday countdown week to Christmas.

It’s the perfect time to step away from the charts, the headline news and the hustle & bustle of life while enjoying some well deserved rest with family and loved ones.

So I encourage you to pour up a mug of hot cocoa and put on your ugliest xmas sweater as the markets will be here ready for your return after the holidays - and you can rest assured that I’ll keep you in-the-know as we close out 2022.

(hopefully with no coal in our stockings and a little joy infused into our portfolios as we rock around the Christmas tree.)

Enjoy the read everyone and Merry Christmas,

- Bramwell

📰 BramwellFox MetaCapital’s Weekly News Recap

You may press the 🗞 to read more about each headline.

Major News + Crypto Headlines

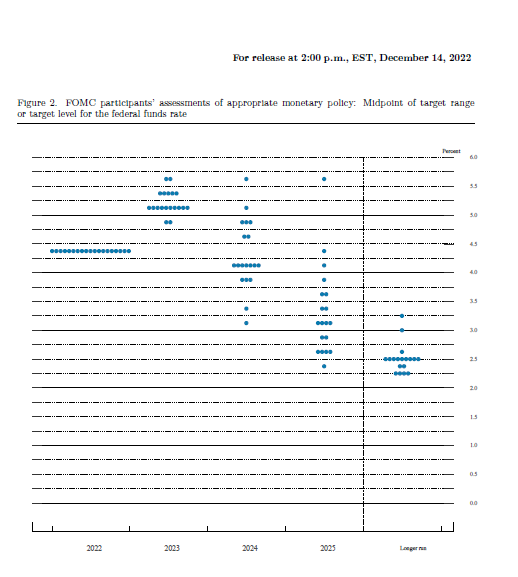

🗞 +50 bps, copy. | FOMC Rate Increase

💭 Bramwell’s Thoughts…

The most anticipated event of the week was the last FOMC of 2022.

The FED chose violence approved a 50 basis points hike bringing the effective target rate to 4.25% - 4.50%. Markets reacted bearish fading the news and any chance at a rally on risk were short lived as the week closed red.

Was this reaction surprising? Not really.

See, fundamentally, the macroeconomic landscape hasn’t changed much in terms of sentiment. Many market players are still fearful of the uncertainty that lies ahead. As we can expect, more time will be needed to truly unravel on-going economic indicators that favor a return of liquidity back into risk assets such as stocks and cryptocurrencies.

Second to the meh macro sentiment is the obvious realization that capital extraction from the markets is expected right now due to seasonal holiday expenses for both consumers and corporations.

tl;dr ppl be selling > ppl be buying and fed ppl say market still too hot.

It’s a catch 22 as the true tale of financial health lies ahead in Q1 2023 as we anticipate corporate earnings from holiday season. If retail sectors are wildly profitable it may lead the FED to assume market is still hot and demand high - yet if results are terrible and earnings poor, investors will begin pulling their capital from failing stocks - it appears selling pressure may be inevitable in Q1 2023 - hence the whole apocalyptic recession mantra from the elites economists.

What may be the best possible situation is for;

Retail and tech sectors to experience more layoffs and poor earnings from Q4 22’, driving management to trim labour (unemployment levels go up) and showcasing slower consumer demand and overall economic activity.

Consumer Credit to dry-up and housing prices + rents fall thus decreasing Q1 & Q2 CPI readings while also contributing to economic contraction.

The U.S Dollar to lose it’s relative strength across the globe and for other leading economies to regain their footing post-pandemic.

The FED to monitor all of these events and make a public announcement on a sooner rather than later expected pivot on rates.

The bottom of all markets will be in just slightly before that last point occurs as smart money will have a heads up on this outlook before retail investors know about it and we should begin to see volume increases on capitulated stock and crypto assets.

🗞 Costs may be down, yet Recession fears loom. | #CPIData

💭 Bramwell’s Thoughts…

Even with a positive CPI reading from earlier this week as the print was 0.2 points lower than expected, the bulls couldn’t sustain their most recent rally due to the fears of the recession monster.

Market participants have now found themselves asking, where should we put our capital given the current circumstances, maybe metals like gold?

But if we look at the business cycle theory,

…it points us finding ourselves close to the trough of Stage II, where bond prices become attractive as stocks are at their near lowest point in the cycle.

We truly are close.

🗞 Is another stock market crash imminent? | #StockMarketCrash

💭 Bramwell’s Thoughts…

We truly are close - but could ‘close’ still be painful? It’s possible.

Take a look at the correlation between the S&P500 in 2008 vs. today.

Eerie.

But remember as an investor your timeline is long term, not short.

Whether the market goes up, down, left, right it doesn’t matter as long as you’ve researched your portfolio, confident in your positions and not overexposed with funds needed for short term expenses.

This is where our dollar cost averaging strategy comes into practice.

🗞 If Binance fails, is crypto doomed? #BinanceProofofReserves

💭 Bramwell’s Thoughts…

Where there’s fear, there’s FUD.

On the backs of the FTX collapse, all attention has turned to the remaining major players in the market to prove their solvency innocence by producing an audited and public proof of reserves to restore user confidence and to appease the industry as a whole.

The problem is, no one truly understands blockchain assets throughly enough to stamp their approval on a proof of reserves audit as it’s a disruptive sector that hasn’t stood the test of time to develop sound practices and procedures.

All of the FUD has now found its way to Binance and the pressure is mounting.

It’s of my opinion that Binance will be fine and that their CEO ‘CZ’ has invested sufficient energy and time into ensuring his exchange becomes the market leader for transparency as the push for crypto adoption trenches forward.

I can’t say I’m a prophet on this call, but CZ hasn’t faulted my intuition or raised any signals that set off my bullshit alarms.

🗞 President Trump NFT Trading Cards | #NFTs

💭 Bramwell’s Thoughts…

It’s truly worth it to follow the rabbit hole on this story and click the tweet below.

I’m not sure if we deserve another market crash because of this headline, or if it signals a market bottom in itself.

Nevertheless, it’s both funny, ironic and par for the course of events headlining 2022.

🗞 Fusion Ignition, an energy revolution. | #Geopolitics

💭 Bramwell’s Thoughts…

Arguably the most under reported and under rated story of the week / month / year is this major announcement from the U.S Department of Energy declaring nuclear fission to have been achieved.

On the eve of climate change narratives, oil protestors and soaring energy costs comes a timely achievement by the brightest minds in the world.

Is this the pocket aces the U.S has been waiting to play as the geopolitical poker game continues?

How may this shift political power away from oil producing nations and how close is the US to capturing this technology and deploying its utility.

It’s worth paying close attention to the energy wars that may follow.

BramwellFox MetaCapital’s Weekly Market Review & Technical Analysis

📈📉 The Week Ahead in Charts

Symbols 📈 or 🐂 = Bullish / Positive | 📉 or 🧸 = Bearish or Negative | ⚖️ Ranging or Low Volatility

FOREX

📈 DXY(U.S Dollar) + 📉 CAD

💬 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The DXY has been falling for weeks with little to no significant rallies occurring.

One of my great friends and exceptional analysts Wolf pointed out to me that in near all DXY corrections there typically arrives a time for a dead cat bounce.

A dead cat bounce is a temporary recovery in the price of a declining security or market.

The term is used to describe a situation where the price of a security or market experiences a small, short-lived recovery after a significant decline.

It is called a "dead cat bounce" because even a dead cat will bounce if it falls from a great height, but the bounce is not indicative of any lasting improvement.

In other words, a dead cat bounce is a false or misleading signal that suggests a reversal of the underlying downward trend, when in fact the trend is likely to continue.

*thanks chatGPT

In looking at the technicals of the DXY that dead cat bounce could come at any point in time - but it’s of my opinion that the time isn’t right now and closer to late January early February 2023.

I’m expecting this week to be one of continued selling pressure across most markets and the DXY to cross the channel before getting rejected between 105.5 to 106.25.

Should this occur and the DXY to show signs of weakness at the yearly close, we may be able to hedge our bets on risk assets having room breathe at the yearly open.

Featured Chart DXY 12HR (click to enlarge photo)

It’s worth noting that each time the DXY has shown a monthly bearish RSI crossover (blue candle), the following month BTC and the crypto markets have been in the green.

Featured Chart DXY 1M + BTC (click to enlarge photo)

I’m expecting for the $CAD to dip ever so slightly due to the oversold U.S dollar rallying into the weekly open; however, short term I remain bullish on the maple leaf coin to rebound to it’s range highs.

Featured Chart CAD 1D (click to enlarge photo)

Equities

📉 S&P500 + 📉 TSX

💬 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

The weekly close was red for the S&P 500 and bears came out of the wood works to scare everyone away.

The first line of support was breached and the 3750 zone becomes the last stand for the bulls to hold strong.

Featured Chart SPX 12HR (click to enlarge photo)

On the 2-Day chart below you’ll notice the S&P resting atop the 400 MA in purple, directly in our bullish order block.

Lose this zone it may be lights out for the stock market and that ‘imminent crash’ I referenced above becoming a reality.

All eyes on equities this week.

Featured Chart SPX 2D (click to enlarge photo)

Treasuries

📉 US2YR & 📉 US10YR

💬 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

Sometimes down means good, and that’s the case to be made for treasury yields plummeting.

Both the 2YR and 10YR are in descending channels and both have breached major moving averages and support lines.

I’m hedging long on government debt and bearish on yields which may be a leading indicator of how the U.S Dollar performs at the yearly open.

Featured Chart US2YR 12HR (click to enlarge photo)

Featured Chart US10YR 1D (click to enlarge photo)

Cryptocurrencies

📉 Bitcoin + 📉 XRP

💬 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

With the DXY having room to breathe in its descending channel and the majority of crypto assets on lifeline support, it’s very possible we see capitulation occur which may trigger an onslaught of prices heading into the yearly close.

We also must pay attention the FUD surrounding Binance and any liquidity or sentiment events that could break while prices rest at support.

Featured Chart BTC 12HR (click to enlarge photo)

For Bitcoin, our last area of significant demand will be for bulls to defend 16.4K (above) - lose this region and the 1W bearish timeframe below shows capitulation support at 13.8K, a very steep drop.

Featured Chart BTC 1W (click to enlarge photo)

The price action on XRP isn’t looking any prettier as a H&S formation has completed on the daily and a breach of the neckline may trigger the freefall into 1/4 dollar (.25) to end the year.

The bulls must defend ~.33 and aim for a whipsaw or swing failure pattern on the daily to see reversal momentum and a short squeeze to the upside.

Featured Chart XRP 1D (click to enlarge photo)

Featured Chart XRP 5D (click to enlarge photo)

Commodities

📉 Oil + 📉 Gold & 📉 Silver

💬 Bramwell’s Commentary, Analysis & Prediction for the Week Ahead:

I’m not expecting commodities to finish the year with tremendous buying pressure.

In fact, I remain bearish on Oil into the $65 region.

Featured Chart Oil 1D (click to enlarge photo)

I’m short term bearish on Gold until a recharge of liquidity resets the RSI, expecting a drop into the low 1.7K region (green)

Featured Chart Gold 1D (click to enlarge photo)

And likewise looking for Silver to flip high timeframe resistance into support with a return to the low 21’s as we crossover into 23’.

Featured Chart Silver 1W (click to enlarge photo)

👋🏼 Hey!

Thanks for reading this week's Market Update Edition No. 024

If you have any comments, feedback or questions on any material written in this edition please share as I'd love to continue a dialogue below.

If you enjoyed the read, I’d really appreciate if you’d share our community with your network of friends, family & fellow investors!