🗞 Weekly Market Newsletter | Edition No. 10

News Update + A Full Analysis of Major Indices Including Stocks, Crypto, Commodities, Bonds & Forex

🎙 This week’s edition includes an audio narration - press play and enjoy.

Sunday, September 11th, 6:53 am

Hello Everyone,

All I can say is, buckle up - the next few weeks are going to be a wild ride.

Today I’ll be diving into (5) major headlines that are lighting the match for an explosive end to the worst financial year in history to an eventful year.

Following the news recap, move your eyes down to my technical analysis section as I’ve charted possible paths for the U.S. Dollar, Stocks, Bitcoin, Oil, Gold & Bonds.

Keep your eyes peeled for the news headlines breaking this month, especially the date September 21st for the Federal Reserve’s interest rate hikes - our portfolios are at the mercy of these macroeconomic events.

Hold on tight - we’re going to make it, but turbulent seas are on the horizon 🌊.

- Bramwell

BramwellFox MetaCapital’s Weekly News Recap

Major News Headlines

🗞 Historical Interest Rate Hikes; Bank of Canada & European Central Bank.

The European Central Bank raises interest rates by a historic 75 basis points to 1.25%, mimicking the 75 basis points hike by the Bank of Canada, bringing the maple leaf nation’s lending policy to 3.25%.

Combating historically high soaring inflation rates and increasing demand for both the Euro & Canadian Dollar while slowing the rate of growth of both economies were talking points of both the ECB & BOC.

💭 Bramwell’s Thoughts…

The international economy ‘pot’ has boiled over, and central banks are struggling to turn down the heat.

In 2022 we’ve experienced a series of unprecedented events.

The U.S. Dollar (DXY) is reaching 20-year highs.

Inflation is reaching 40-year to decade-long highs.

Supply chain disasters in the energy sector across the globe.

Democracy as we know it is being threatened by the civil uprising, prevalent not only on the Western Front but in many fragile nation economies in Asia, South America and Europe.

These events have exasperated the damage already created by a near 2-year economic pause button created by the

media hyped fluby #c19.My overarching opinion is that we are on the last days of a collapsing fiat-currency-backed monetary system, and the cracks are showing in the policy decisions of central banks everywhere.

As the U.S. Dollar continues its rage, foreign nations risk U.S. denominated debt default(s) at an ever-increasing rate, and to stop the bleeding, the ECB and BOC must do whatever they can to raise the parity of their currencies while fighting the soaring cost of living for its citizens.

The trade-off?

Higher interest rates add fuel to the risk of a scorching hot housing market collapse that is showing signs of toppling as I type these words.

The maple leaf bankers say that the end of quantitative tightening could come as soon as Q1 / Q2 2023 - but in my opinion, the statements of any central banks other than the U.S. should be taken with a grain of salt, as right now, the world is following the lead of U.S. politics and the U.S. FED.

🗞 Mayday, Mayday, We’re Going Down; Housing & Energy Crisis on the Horizon.

For the first time in decades, the western world is preparing for widespread and rolling energy shortages. The U.S., U.K., and E.U. have all been squeezed by Russia’s invasion of Ukraine, soaring costs for electricity and fuel, and record-breaking heat waves.

Gazprom (Russian Energy Exporter) is keeping the Nord Stream pipeline closed as Russian officials state the reason for the closure is sanctions which are fuelling a potential Energy bailout across the U.K.

Through the end of 2023, Goldman Sachs predicts a crash-like drop in home prices in New Zealand (–21%), Australia (–18%), and Canada (–13%).

💭 Bramwell’s Thoughts…

It was mid-2020 when I first heard the chatter begin to surface over the byproduct of global warming; a global energy crisis due to excess demand on power grids.

At the time, the citizens of the world had their first glimpse of what life was like, gridlocked in their homes due to #c19.

Was this a warm-up for what life will look like when it’s your neighbourhood’s turn to go dark for a day, week or month?

I remember walking up the street during summer 20,’ and the city was eerie, with no cars on the road and little movement of people - was this a warm-up for when energy costs skyrocket, fuel becomes too expensive for consumer vehicles and working from home becomes a necessity?

As fall rolls in and Winter begins to tie up its running shoes, should we expect a cold Winter for more reasons than one?

California is now rotating power grid blackouts in an attempt to prevent a catastrophic state-wide shut-down - but how long may it be until we hear from our local governments that these policies are put into place?

In fact, it’s the energy crisis that could be the new financial crisis bailout.

Where once banks begged for liquidity to continue their operations, perhaps utility empires and essential businesses may need stimulus cheques to combat their high cost of operations as supply chain shortages drive prices up globally.

(cue interest rate dig)

To make matters worse, Russia isn’t helping the situation as they spitefully slow the traffic of their exports to the U.K., which is lighting a match for the European economy to slow down to a mild frost pace as the cold months arrive.

If the European economy slows, that’s bad for the Euro. If the Euro falls, the almighty Dollar will likely see new highs, which creates a vicious cycle as Oil exports are priced in Dollar denominations.

…and if the Dollar continues to soar, risk assets will take a further beating to round out 2022.

Soaring energy & oil rates, rampant inflation, and high cost of debt - it’s no wonder the average joe is struggling to afford basic needs such as rent, let alone a Mortgage.

If the pockets of Average Maple Leaf Joe continue to slump, the liquidity crisis will spread to the housing market, creating home prices to plummet nationwide, which for most Canadians represents their collateral on home lines of credit and the majority of their net worth.

You can see how all of these macroeconomic factors are so tightly intertwined - one more Jenga block to fall could erupt a disaster.

Ps. keep in mind that Bitcoin mining requires an abundance of energy. Miners need profit to continue to keep the lights on. Should Miners face energy restrictions or turn insolvent, the whole network could crash.

🗞 One Stablecoin To Rule them All; Binance converts USDC, TUSD into BUSD.

CEO of Binance, Changpeng Zhao, shook the market this week by announcing that Binance, the world’s largest cryptocurrency exchange, will end support for a number of competing stablecoins, including USDC & TUSD and auto-convert them to Binance’s native stablecoin, BUSD.

The company stated that the move would improve the consumer experience by improving capital efficiency and liquidity.

💭 Bramwell’s Thoughts…

I have a tremendous amount of respect for Changpeng Zhao.

In an industry that can be filled with cheat, greed and fraud, ‘C.Z.’ as he goes by on Twitter, has been endlessly making moves around the world, forming strong relationships with major Governments, regulators and forming partnerships to solidify Binance as the lead crypto ‘bank’ worldwide.

This is a power move that appears to consolidate the majority of trading activity into their network native stablecoin BUSD, which will drive up its market share in addition to offsetting the going-concern risk that hosting competing stablecoins may present to their

monopolyAAA trusted status as a crypto empire.

🗞 “They’re all Securities!”- or are they? ; Gary Gensler Comments On Crypto.

Speaking this week, Gary Gensler, Chairman of the U.S. Securities & Exchange Commission, alluded to a more bureaucratic division of digital asset oversight between the SEC and CFTC.

“Let’s ensure that we don’t inadvertently undermine securities laws underlying $100 trillion capital markets. The securities laws have made our capital markets the envy of the world.” - Gary Gensler.

Gensler is famous for his opinion that despite blockchain being a modern technology, the same securities law written in 1933, known as the Howie Test, should mark precedence over the distribution of cryptocurrency network assets in 2022.

💭 Bramwell’s Thoughts…

In the ongoing regulatory turf war that has bled the U.S. dry of blockchain innovation, SEC Chairman Gary Gensler appears to be running out of ammo and reaching for his white flag.

His personal and professional reputation has been put on blast this year, marking a disastrous start of his tenure as incoming Chairman of the SEC after being given the salute by Brandon.

The ongoing litigation of the SEC vs. Ripple has nuked public confidence in the agency’s ability to regulate the digital asset space after details emerged of internal corruption concerning former officials William Hinman and Jay Clayton.

The two officials have been investigated to have a financial interest and personal vendetta to slow the pace of Ripple’s product On-Demand Liquidity using the XRP ledger.

It’s speculated that the underlying reasoning to sue Ripple was

a hit jobinfluenced by Hinman’s personal relationships with the Ethereum Alliance Foundation + gang of backdoor corporate banking buddies who understood that blockchain might mark the end of their multi-decade reign as the money mafia.I have a hunch that the white flag may be waved in weeks/months to come.

🗞 T-This Week; Flare.xyz Launch, XRP Lawsuit + ETH 2.0 Merge Countdown

The Flare Network is expected to exit observation mode this week and go live, coinciding perfectly with ETH 2.0 merge.

An SEC vs. XRP Lawsuit court docket shows that September 19th will be the most important date to watch for as both parties will ‘show their hands in the case with summary judgment filings submitted.

💭 Bramwell’s Thoughts…

The Flare network is, in my opinion, preparing to unleash the most advanced technology ever experienced in the blockchain.

Their network is the only multicurrency bridge network allowing for interoperability amongst the industry top layer one blockchains such as XRP, XLM, Litecoin, Dogecoin, BTC & Algorand.

Flare’s mission is to unleash the value of these networks by allowing smart contract capability guaranteed by the most advanced network security - a feature that is an industry first in the method that the Flare development team has invested years designing.

XRP holders will be amongst the privileged few to be airdropped the initial 15% of Flare network’s native Spark tokens upon the launch of the network.

Spark holders will then have the opportunity to vote on a very important proposal governing the future airdrop mechanism.

I’m fascinated by the coincidental timing of this week given that the Flare network may be in direct competition with Ethereum as the industries leading smart contract enabled blockchain; however, Flare being the superior underlying technology as a delegated proof of stake engine.

It appears a perfect storm may be brewing in the crypto space.

Should the regulatory turf war end with a Ripple victory, it may mark the warning shot of the smart contract ecosystem war between Flare & Ethereum.

All eyes are on how flawless the ETH 2.0 merge is executed this week.

BramwellFox MetaCapital’s Weekly Market Review & Technical Analysis

📈 The Week Ahead in Charts

DXY (U.S. Dollar)

✅ Last Weeks DXY Prediction:

As expected, the DXY showed signs of weakness at the ECB, and BOC raised interest rates by 75 basis points, respectively.

💬 📉 Bramwell’s Commentary & Analysis:

The chart below is arguably the most important setup I’ve ever forecasted in crypto.

After reaching a 20-year high last week, the Dollar broke its local trendline and appears to be deviating (black path) towards its secondary trendline originating from June.

This is the most important trendline for risk-asset markets for the remainder of 2022 - let me tell you why.

On September 21st, the Federal Reserve is expected to raise interest rates by 75 basis points, a hawkish policy move as they double down on

sending the world into chaos and destroying the middle class bycombating inflation.This date will confirm one of two possible scenarios;

🙏🏼 Scenario One: The market has already priced the 75 basis points interest rate hike into assets. The meeting is a short-term-volatile-nothing-burger and investors turn bullish on the discounted risk assets (stocks & crypto), sending the Dollar down towards the green circle ~100.00 for the remainder of 2022 - striking a bull run and the final leg up of the risk-asset cycle before the true bear market like we have not experienced since the great depression hits in 2024.

🔥 Apocalypse: The FED confirms its hawkish tone raising interest rates by 75 basis, and the markets completely capitulate their risk assets. Foreign debt holders prepare for potential sovereign defaults, a cascade of over-leveraged liquidations ensue, and the Dollar soars up to a channel high ~117-120 (red circle), creating a nostalgia of the 2001 dot-com boom crash.

🐻 Bramwell’s Prediction for the Week Ahead:

For the next two weeks, I’m expecting risk assets to potentially trap eager bulls as the Dollar falls to the trendline and 200MA (red). From there, our portfolios are in the hands of the FED free market.

As we have been in a bear market for so long and some of my greatest mentors (Ray Dalio, Michael Burry, Robert Kiyosaki) have endlessly been calling for a further 25% drop and the crash of all crashes, I’ll respect their bias and prepare everyone for the Dollar to lure hedged risk-takers into the stock market and crypto for the next week or so, only to send the Dollar through its local resistance supply (August 2001, region in red) up to channel top ~117-120 which will usher in a complete collapse in equities and crypto before we mark our true bottom.

My heart doesn’t love this call, but the evidence is piling up bearish as Europe potentially enters an energy crisis due to Russia’s lagging energy exports, interest rates creating fear of mortgage defaults, and mid-term elections for the most powerful economy in the world are looking disastrous for the current administration.

Featured Chart DXY 12 HR

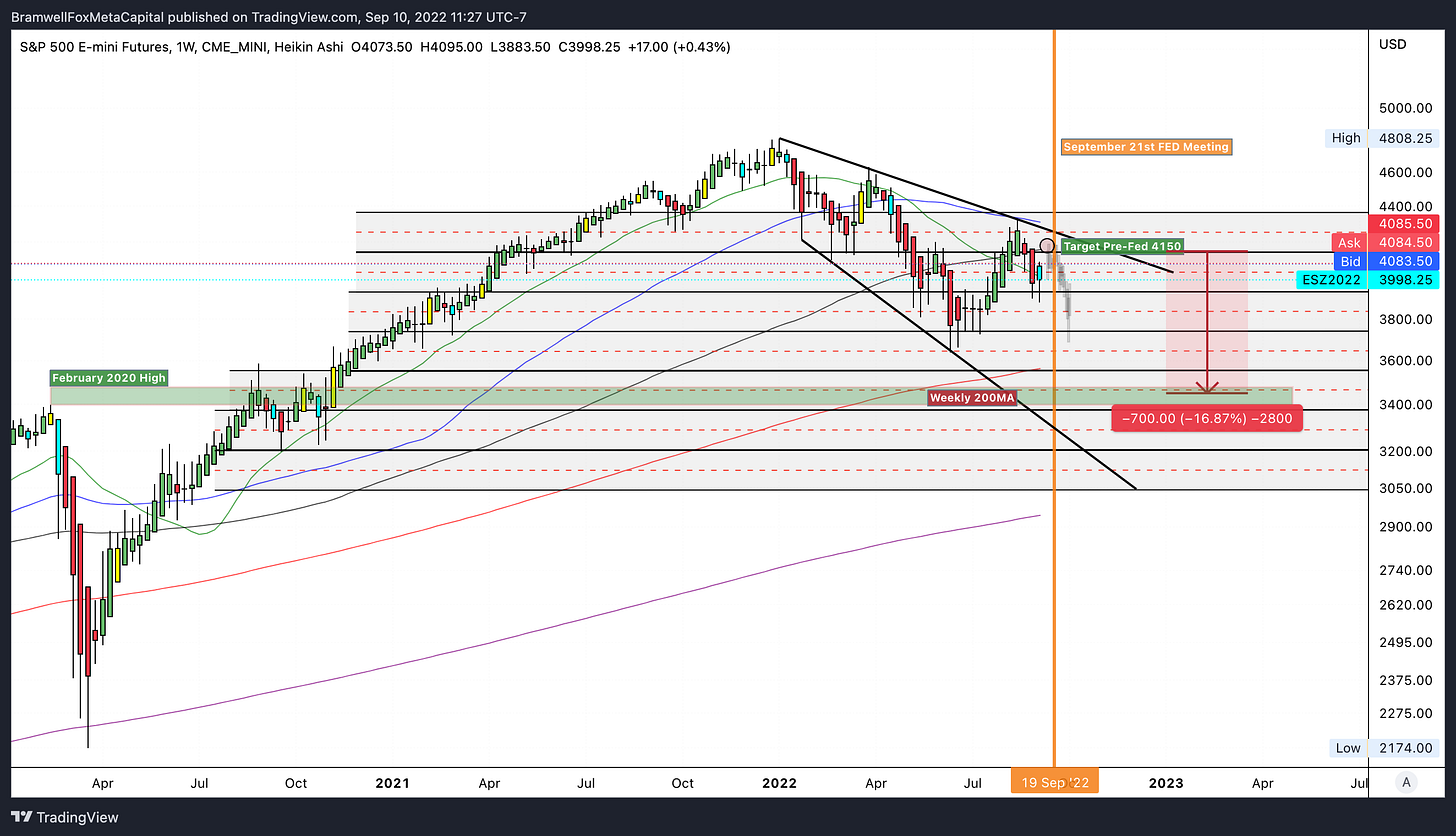

S&P500 (U.S. Equities)

❌ Last Week's S&P 500 Prediction: I expected the S&P 500 to remain in its short-term corrective channel and reach 3850 before a bounce to the upside; rather, the week turned bullish for equities as investors hedged the weakness in the DXY, anticipating rate hikes from the ECB and BOC.

💬 🔪 Bramwell’s Commentary & Analysis:

Every single analysis today will reflect the importance of the DXY analysis above.

Remember that all U.S. risk assets, in addition to crypto, are priced with the USD sitting underneath as the denominator, meaning as a fraction, strength in the Dollar dilutes the value of the nominator asset.

For market makers who love profits and liquidity, this scenario would be ideal.

Create a fomo rally this week and send the stock market to the 4150 region (green caption) and trap the bulls in their positions pending the remarks by Jerome Powell on 09.21.

Should this occur, the setup for a huge short opportunity would be present.

Referring to the S&P 12hr chart below, I’ve shown the bearish take on what I expect could be the scenario that unfolds.

The orange vertical line marks the FED meeting, should equities collapse, you can see the falling vertical channel depicts a possible 20-25% drop before reaching the heavy demand zone ~3350-3450 (green area) from the highs of February 2020.

🐂 Bramwell’s Prediction for the Week Ahead:

I’ll be watching as the S&P500 futures open this week and monitoring the volume in the early part of the week.

Should the futures markets open green, much to the delight of naive bulls, the first half of the week should be in the green as the DXY heads towards its June trendline.

The hint we will be looking for is a bearish divergence in the RSI indicators to begin to form at Friday’s closing, with investors closing positions in profit and setting up their short interest heading into the weekend.

Featured Chart S&P 500 12HR Timeframe

Featured Chart S&P 500 Weekly Timeframe

Bitcoin (Crypto)

✅ Last Week's Bitcoin Prediction:

I nailed it perfectly. I expected Bitcoin to start its week sweeping the lows of 18.8K before heading for upside liquidity in the 21.8 area, to which, at the time of writing, it’s trading slightly below - A+ on this call.

💬 🔪 Bramwell’s Commentary & Analysis:

Bitcoin broke down from its June trendline in August, re-testing the lows of 18.8K this past week and appears to be setting up for a bearish re-test of the 22-23K region.

Restating the DXY scenario, it would be ideal for market makers to push BTC into the ‘C’ region, trapping peak liquidity before the selling pressure commences.

The worst-case apocalypse scenario (see Bitcoin 2W chart below) would be that Bitcoin loses its support at 17.6K and heads down towards the .05 - .618 fib in the 13K - 15.5K region as the Dollar continues its strength into Q4.

Alternatively, should the Dollar break down, we could expect our current range to be the bottoming formation and eager bulls, the smart money and institutional funds to front run cash-deprived retail and send the crypto market into a full-fledged reversal 🤞🏼.

🐂 Bramwell’s Prediction for the Week Ahead:

I’m bullish on Bitcoin this week as I believe the market will set up the liquidity trap by squeezing short traders to the upside and creating fomo heading into the FED’s meeting. I’ve marked a short-term retracement possible for Bitcoin to re-test 19.8K (region B) before continuing its push-up into region ‘C’ ~$22.5 - 23K

Featured Chart BTC 12HR

Featured Chart BTC Bi-Weekly Timeframe

Oil

✅ Last Weeks Oil Prediction:

We have reached our destination. I’m unsure which came first, my notification that Oil hit $80 per barrel, which was my July prediction for September, or if local gas prices made me front run my community and get a full tank.

💬 📈 Bramwell’s Commentary & Analysis:

With an energy crisis on the horizon, one may assume that Oil is expected to skyrocket; however, that’s not necessarily the case - I’ll explain why.

As interest rates increase across the world’s most dominant economies, this creates a contraction effect or slower growth.

With slow growth comes lower earnings expectations.

With lower earnings expectations, corporations tend to lay off their workforce, have lower inventory turnover and create fewer products.

This means that the transport industries may lag, consumer travel to slow down and less demand for Oil.

It’s worth noting as well that China has recently locked down an additional 20M citizens as a part of their ‘Zero C’ policy, further contracting their economy, slowing exports and reducing the demand for Oil.

In the short term, I’m expecting Oil futures to rebound; however, heading deeper into Q4, it’s possible that Oil breaks down into the $60-$70 region.

🐂 Bramwell’s Prediction for the Week Ahead:

I’m bullish on a short-term correction in the price of Oil with a targeted region of $97.5 - $100 per barrel.

This scenario would essentially set Oil traders up for a massive shorting opportunity.

I’ll be focused on watching news headlines concerning OPEC+, Europes energy negotiations and how the petro-dollar performs in the last quarter.

Featured Chart Oil Daily Timeframe

GOLD

💬 📈 Bramwell’s Commentary & Analysis:

Gold appears to be the most manipulated asset in the world currently, as the chart makes no sense relative to the macroeconomic environment, with recession and depression fears everywhere we look.

You’ll see in the weekly timeframe chart below that Gold has been in a three-year-long horizontal trading range, making a series of very narrow higher lows (bullish structure) and trading at a large discount in that range as we speak.

In my opinion, on a high timeframe, the Dollar will eventually fall out of the sky, potentially marking the end of the U.S. dominance as the world’s reserve currency and potentially setting up for a basket of new currencies, or potentially CDBCs to be backed by Gold moving forward as the world evolves into the digital economy - it’s possible.

In my opinion, Gold marks one of the best investment opportunities as the end of quantitative tightening is near, and interest rates may begin to fall and potentially the strength of the U.S. dollar with it.

🦀 Bramwell’s Prediction for the Week Ahead:

I marked the weekly 200MA (red) as a potential tap region before an impulse to the upside for Gold, with the path I’m expecting to end the year marked in green.

I’m fully expecting Gold to reach $2K per ounce within 6-9 months.

But for this week, expect further chop (hence crab emoji) around these lows awaiting the FED monetary policy decision and further CPI data to be released.

Featured Chart Gold Weekly Timeframe

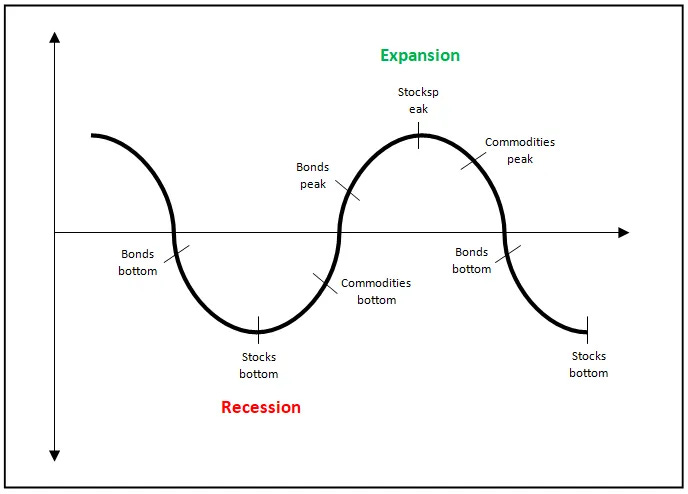

2YR & 10-YR U.S Bond + Yield Inversion Curve

💬 📉 Bramwell’s Commentary & Analysis:

Our last analysis is an important one; bonds.

Where would you guestimate that we are in this chart?

The correct answer is the mid-line towards where commodities begin to fall, and bonds begin to bottom.

In the news, economists everywhere are yelling at the top of their lungs that a recession looms due to the inverted yield curve - a fancy term for when the 2YR bonds yields are higher than the 10YR bonds yields - which makes no sense as who would want less of an ROI (return on investment) for locking their money away longer?

(the math = take the (10yr yield) - (2yr yield) and if the result is negative means the curve is inverted - see chart below)

Featured Chart 10YR - 2YR Yield Inversion Curve

If this is true, and we are about to see bonds bottom out, we should expect the yields to soon ‘top’ out and begin the reversal.

I’ve charted the 10YR below showing signs of weakness, and I’m expecting the 10YR to immediately begin reversing down towards the 2.95% - 3% region shortly after the announcement of the FED’s interest rates.

Featured Chart US10YR Daily Timeframe

To complement this scenario, let’s look at the US2YR.

The 2YR rates being higher than the 10YR indicates short-term panic in the markets as the Government attempts to source liquidity for uncertain times that may not be here to stay.

In other words, short term looks 💩, long term is all 🌞

It appears heading into this week that 2YR bond yields may be topping out around the 3.75% region before reversing back into the 3% region within Q4.

This would be a bullish scenario for risk assets as fears of a recession may cool should inflation come down, interest rates in 23’ reverse and the yield curve restore parity with the 10YR yield > 2YR before year-end.

Featured Chart US2YR Daily Timeframe

👋🏼 Hey!

Thanks for reading this week’s edition of the Weekly Recap + Looking Ahead.

If you have any comments, feedback or questions on any material written in this edition, please share, as I’d love to continue the dialogue below.

If you enjoyed the read, share it with your network of friends, family & fellow investors.